Buy the Dip: Why Novo Nordisk Looks Attractively Priced After 20% Selloff

That decline in share price could be a discount because the company may have room to run

- A disappointing drug trial for the CagriSema weight-loss treatment wiped out tens of billions in market value for Novo Nordisk.

- Despite the setback, the company’s strong Q3 earnings shows its continued dominance in the weight-loss market.

- The recent drop its stock has brought its valuation to a more reasonable levels, presenting a compelling entry point for bullish investors.

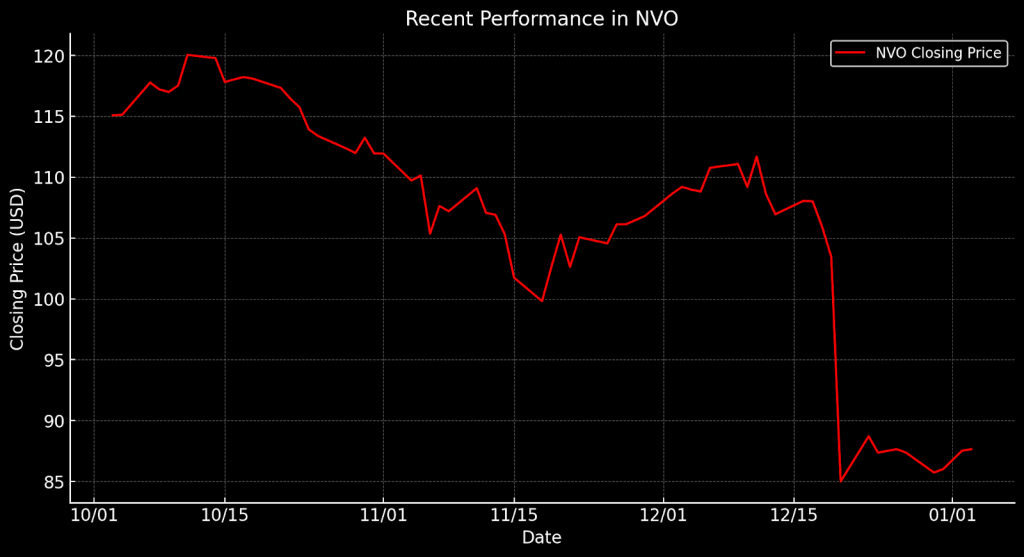

The path to dominance in the weight-loss drug market took an unexpected turn in December or Novo Nordisk (NVO. The company’s CagriSema, a highly anticipated experimental obesity treatment, fell short of lofty expectations in a drug trial, triggering a 20% drop in its stock price. This setback, coupled with the immediate market reaction, wiped out roughly $50 billion in market value. But a broader question lies beneath the surface of these results: Was this just a bump in the road for Novo Nordisk, or does it signal deeper concerns for the company’s future?

While the initial blow was hard to ignore, the long-term potential for Novo Nordisk arguably remains intact. The company’s flagship drugs, Wegovy and Ozempic, continue to generate significant demand. Plus, the company’s recent earnings performance demonstrates its ability to drive not only growth, but also profits. Today, we explore what’s next and how the current stock price may present a rare opportunity for those investors bullish on the company’s future.

Disappointing CagriSema drug trial results

Novo Nordisk, a global leader in diabetes care, has been making waves in recent years with its innovations in weight-loss treatments, such as Wegovy and Ozempic. These GLP-1-based drugs, which help patients manage both Type 2 diabetes and obesity, have become blockbuster successes, setting the stage for the company to expand its dominance in the obesity market. With a robust pipeline that includes treatments like CagriSema—an experimental combination therapy designed to further enhance weight loss—Novo Nordisk has positioned itself as a major player in a rapidly growing sector. However, as we saw in December, even the strongest market leaders face challenges.

In late December, CagriSema faced a surprising setback, resulting in a sharp decline in its stock price. Following the CagriSema Phase 3 trial results, the company revealed that patients treated with the drug lost an average of 22.7% of their body weight, falling short of the previously anticipated 25% target. This outcome was particularly disappointing because analysts had expected CagriSema to surpass the efficacy of Eli Lilly’s (LLY) weight-loss drug, Zepbound, which has already entered the market.

Notably, these trials featured flexibility in dosage—allowing patients to choose how much of the drug they received. Per the trial results, only 57.3% of participants involved in this study chose the highest dose. This, along with the fact that the drug combines semaglutide (the active ingredient in Ozempic and Wegovy) with cagrilintide, added complexity to the interpretation of the results. As a result, a new trial—aimed at improving the dosage escalatio n—is scheduled for the first half of this year. In the meantime, Novo Nordisk has indicated it will continue to pursue regulatory approval for CagriSema, with plans to submit the drug to the U.S. Food and Drug Administration for approval late this year.

Despite the high likelihood of FDA approval, the market’s immediate reaction was harsh. On Dec. 20, Novo Nordisk’s American depositary receipts plunged (illustrated below). In contrast, Eli Lilly’s stock surged by nearly 7% that day, indicating a belief among investors that the company had solidified its first-mover position in this niche. These events were catalyzed by a recalibration of CagriSeme’s sales projections, which were undoubtedly revised lower.

As though the CagriSema setback weren’t enough, Novo Nordisk and other GLP-1 manufacturers could face additional regulatory headwinds. Under Robert F. Kennedy Jr.’s (RFK) potential leadership, the FDA is poised to make some key changes, and it looks as though obesity treatments could be ensnared in this widening net. For starters, RFK has indicated he supports a ban on TV commercials for pharmaceuticals, which would negatively affect the promotional strategies of Novo Nordisk and its peers.

Robust earnings, and a promising outlook

Meanwhile, Novo Nordisk reported strong financial results in Q3, particularly in its weight-loss drug segment. The company posted a net profit of 27.3 billion Danish kroner ($3.92 billion), slightly above the consensus estimate of 26.95 billion Danish kroner. This marked a notable increase in profitability compared to the same period in 2023, reflecting the ongoing success of its overall weight-loss division.

Wegovy, in particular, showed impressive sales growth, increasing 79% year-over-year, totaling 17.3 billion kroner, well above analyst projections of 15.9 billion Danish kroner. The surge in Wegovy sales was a key driver of Q3 performance, illustrating the company’s strong position in its most important markets.

The latest results also showed Novo Nordisk’s share of the U.S. market remains robust. In the United States, it leads with 53.9% of total monthly prescriptions and 50.0% of new-to-brand prescriptions in the GLP-1 class. And despite some challenges in the supply chain—including periodic shortages of both Wegovy and Ozempic—the company’s efforts to ramp up production capacity have been fruitful, as indicated by the improving availability of Wegovy in North America.

Reinforcing the above, forward earnings guidance at Novo Nordisk remains strong. The company expects full year sales growth to clock in somewhere between 23% and 27%, which is robust. Moreover, the company’s operating profit growth forecast of 21% to 27% was also in range of what analysts hoped for, indicating that Novo Nordisk’s profitability potential remains attractive. Overall, the company’s most recent earnings results paint a picture of a growing and highly profitable company.

Why shares of NVO look undervalued at this time

After the recent stock drop, Novo Nordisk’s market capitalization has become much more palatable, now sitting at approximately $300 billion. That’s down from the 52-week high of closer to $480 billion, when the stock was trading at nearly $150/share. Today, shares of NVO trade for closer to $87/share.

This decline, driven in part by the recent results of the CagriSema drug trial, has undoubtedly created a more reasonable valuation for Novo Nordisk, especially for those bullish on the company’s long-term prospects. Considering the company’s most recent earnings report, which met or exceeded analyst expectations on key sales and profitability metrics, the current valuation looks highly compelling.

This outlook is supported by some key valuation metrics. For example, Novo Nordisk’s current Price-to-Earnings (P/E) ratio of 28.5, is below the sector median of 30, indicating the stock is trading at a slight discount relative to its peers. In comparison, Eli Lilly, a direct competitor in the weight-loss and diabetes space, has a stratospheric P/E—above 76. While Lilly’s premium valuation undoubtedly reflects investor confidence in its future growth prospects, Novo Nordisk’s position as the leader in GLP-1 treatments like Wegovy and Ozempic can’t be overlooked.

The company’s solid performance in Q3 only strengthens this case. Novo Nordisk reported a 79% increase in Wegovy sales year-over-year, showcasing continuing strong demand for its flagship treatment. Sales in North America grew 22%, and with Wegovy now approved for sale in China, Novo Nordiskis well-positioned to capture an increasing share of the global market.

These growth drivers, combined with Novo Nordisk’s efforts to expand its manufacturing capacity, create a solid foundation for investor optimism. Additionally, Ozempic has shown early promise in reducing the risk of Alzheimer’s disease, which could enhance the appeal of its weight-loss offerings and potentially open the door to a new class of treatments.

A strong investment case, despite the CagriSema setback

The recent selloff in Novo Nordisk’s stock has created a compelling opportunity for investors, especially those looking for an attractive entry point. While the disappointing CagriSema trial results have understandably raised some concerns, they’ve also led to a more reasonable valuation for the company. For investors already eyeing an entry into NVO, this dip offers an enticing chance to capitalize on near-term rebound, or a longer-term upward revaluation of the shares.

Wall Street analysts echo this positive sentiment. Of the 31 analysts covering the stock, 27 have rated Novo Nordisk a “buy,” “overweight” or “hold,” with only four analysts giving it a “sell” or “underweight” rating. The average price target from these analysts is about $129 per share, representing roughly 48% upside from the stock’s current price of $87 per share. This strong analyst consensus, paired with the company’s solid earnings performance and promising growth prospects, further strengthens the current investment case for shares of NVO.

For long-term investors, Novo’s dominance in the weight-loss market, its ongoing global expansion and efforts to scale production capacity provide a solid foundation for continued growth. Additionally, for those looking to capitalize on a potential short-term rebound, Novo may be an attractive option. The company’s P/E ratio has fallen below the industry average, and there’s still the potential for CagriSema efficacy to surprise to the upside in the next drug trial, offering a potential catalyst. Taken together, most of what we know suggests the recent dip in NVO presents an attractive buying opportunity in one of Europe’s largest companies.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.