Should America Forgive Student Debt?

Intelligence Squared has pitted some of the world’s brightest thinkers against each other in debates. It was founded in London in 2002 with the mission of promoting intellectual diversity by fostering respect for differing opinions.

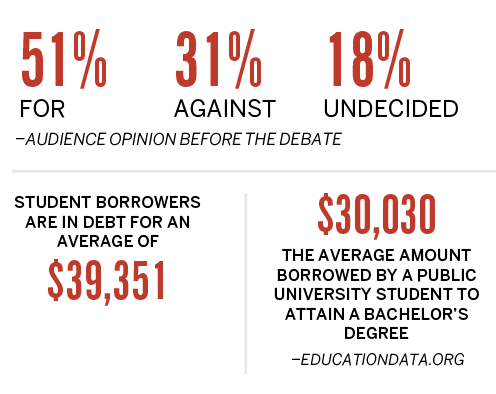

The debates are organized in the traditional Oxford style. The side that convinces more audience members to embrace its arguments wins.

The excerpts below came from a debate conducted in March on whether the United States should forgive student debt.

For:

Ashley Harrington, federal advocacy director and senior counsel,

Center for Responsible Lending

Dalié Jiménez, student loan law initiative director and professor,

University of California’s Irvine School of Law

Harrington: Congress has already given the president the authority to direct the secretary of education to cancel student debt. President Biden can cancel student debt on his own using the same authority that Donald Trump used last year when he canceled student debt payments and waived interest. And Joe Biden used that same authority this year when he extended that pause. But more is needed. We are at a place in this economy and in our country that is unprecedented. So, there has to be a solution

that is bold and meets the moment.

Jimenez: We want people with education. They’re less likely to be involved in criminal issues. They pay more in taxes. They’re more engaged in political and civic life. We need an educated public. But it’s wrong to support higher education by forcing students who couldn’t afford it to take out loans. We made a mistake. And as tuition has soared and we told young people they need to go get a degree or multiple degrees to succeed, that’s what they’ve done. And yet, here we are, with $1.7 trillion in student debt, and it’s continuing to rise with no end in sight.

Against:

Gillespie: About 56% of people who graduate with a B.A. have some student loans. At current interest rates for federal student loans, to pay back in 10 years, that works out to about $275 a month. What happens with that? When you go to college, you increase your lifetime earnings somewhere between $250,000 to $ 1 million. It is a smart move to go to college, and it is a smart move to take out $28,800 in order to do it because you’re going to be making so much more money.

Akers: More than half of the outstanding student loan balance in the economy today is held by people who are in the top 40% of the income distribution. What that means is that if we were to forgive this debt, this would be a hugely regressive policy. Yes, people with low income would benefit. But people with high income would actually benefit statistically much more. To me, that’s a very poor way of crafting a solution.

Nick Gillespie editor-at-large, Reason

Beth Akers, resident scholar, American Enterprise Institute