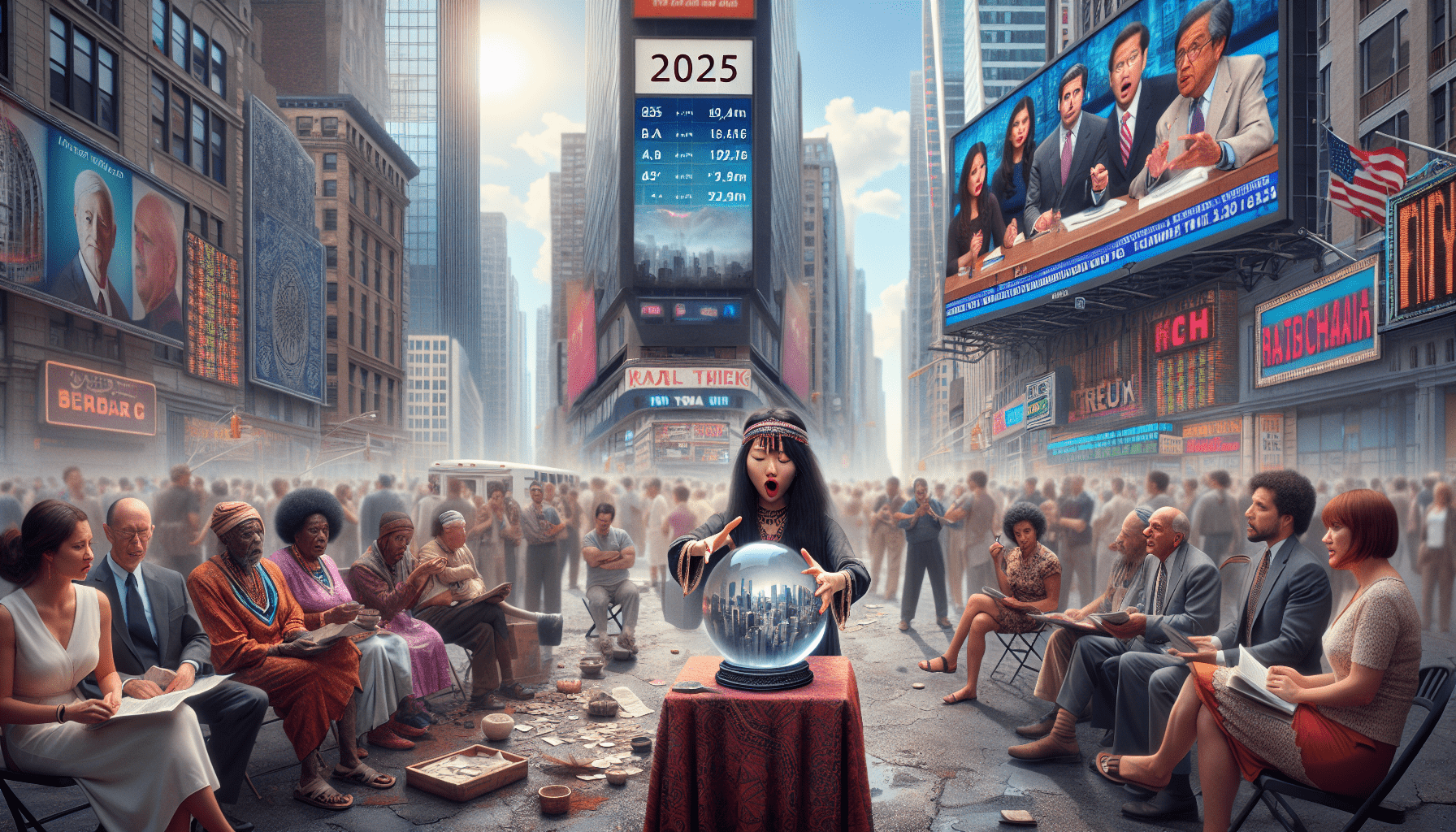

We Asked Market Pros Two Big Questions About 2025. Here’s What They Told Us.

From quantum computing to unidentified flying objects, they offer striking views of the risk, rewards and revelations ahead

A Luckbox panel of financial experts see plenty of reasons for optimism in 2025. One already calls it the year of quantum computing stocks. The others predict Q1 gains for QQQ, bitcoin, digital assets, Treasury bonds and just about any currency other than the U.S. dollar.

But opportunity seldom comes without risk, and our experts advise caution in the face of threats like tariffs, inflation, recession, misinformation, deep fakes and the COVID-era corporate loans just now coming due.

On the national, international and interstellar levels, our panelists predict the “divorce” of Donald Trump and Elon Musk, the fall of Iran’s theocracy and confirmation that UFOs are real.

But first, let’s meet the experts. They are:

Garrett Baldwin, an economist at Marketwise, who’s author of Postcards from the Republic on Substack.

Tony Battista, who co-hosts tastylive LIVE! and Last Callwith Tom Sosnoff. His podcast is Option Trades Today.

Sylvia Jablonski, chief investment officer at Defiance ETFs.

Dylan Ratigan, former global managing editor for corporate finance at Bloomberg News and current co-host of the Truth or Skepticismpodcast with Tom Sosnoff.

Anthony Scaramucci, founder of SkyBridge Capital, who served briefly as White House director of communications in the first Trump administration.

Tom Sosnoff, legendary options trader and co-host of tastylive LIVE!, who co-founded the tastytrade brokerage and helped develop the Thinkorswim trading platform.

Ilya Spivak, tastylive head of global macro, who’s on two tastylive shows: He hosts the Macro Money and co-hosts Overtime.

Ed Yardeni, president and chief investment strategist at Yardeni Research.

Best Bets

We asked our panelists to respond to two open-ended questions. Here’s the first: “Which publicly traded stock, sector, asset class or investment theme do you feel holds the most promise for appreciation?”

For Jablonski, the answer’s clear and her enthusiasm’s infectious. “Quantum computing stocks are absolutely on fire,” she says. “With names like IonQ (IONQ), Rigetti (RGTI) and others commanding massive returns going into the close of 2024, this is quantum’s ChatGPT moment.” (See our recent coverage on the sector here.)

Good can also arise from something bad. Sosnoff contends that investors can benefit from the U.S. dollar’s decline. “Go long on any currency in the world other than the USD,” he advises. “The U.S. dollar has had an incredible run dating back to when trading dinosaurs still roamed the exchange floors. At some point, though, gravity eventually takes over. I think 2025 will be the year of any currency other than the USD. You can pick your poison but for liquidity reasons, I like the euro and the yen. I think the pot odds, based on the extreme price levels, favor a four-to-one return vs. risk advantage.”

Yardeni likes the odds with Invesco QQQ ETF, which has a long record of outperformance. It’s heavily weighted toward tech stocks, and several tech CEOs are in the news these days for their efforts to enter the good graces of President-elect Donald Trump.

Trump’s return to the White House could benefit investors for a number of reasons, our panelists agree. Stock in fossil fuels companies, for example, appears likely to rise in price because of the incoming administration’s lust for drilling and aversion to regulatory restraints, notes Ratigan.

The administration’s passion for crypto and plans for a crypto reserve will almost certainly give bitcoin a boost. Battista confirms he’s bullish on bitcoin for other reasons, too. “It all started with demand associated with the spot bitcoin exchange-traded funds (ETFs) that began trading in January,” he says, “followed by the excitement of a halving that limited supply of new bitcoin and then the hope for crypto-supportive policies after the reelection of Donald Trump, reinforced by several of his appointments.”

Another commodity stands to gain from the administration’s fervor, Scaramucci says. “Digital assets hold the most promise for appreciation in 2025,” he reports. “Markets have not fully priced in the dramatic shift on regulatory policy relating to the asset class under President Trump.”

The return of Trump aside, Spivak sees potential in Treasuries. “Long-end Treasury bonds may finally turn higher as risk appetite sours and the global economy cools alongside that of the U.S., spurring haven demand and boosting Fed rate cut bets,” he maintains.

Mergers and acquisitions of small banks are on Baldwin’s mind. “Evercore hired banking experts from Goldman in 2024,” he points out. “There’s going to be a wave of M&A in the community banking space over the next year. Just buy anything under a price to tangible book value (PTBV) under 1. The uncorrelated asset class will benefit from simple valuation analysis.”

Despite all that upside, the panelists caution against what they view as potential Q1 pitfalls.

Battista offered these words of warning: “Technological disruptions, particularly in the field of artificial intelligence, have significantly contributed to a growing ‘misinformation gap’ on social media platforms, where the ability to generate highly realistic fake content, like deepfakes, has made it increasingly difficult for users to discern truth from fabricated information, leading to widespread confusion and manipulation of public opinion.”

Meanwhile, China’s unwillingness to devalue its currency compounds tariff worries, says Baldwin. “The downside for the S&P 500 is comparable to the 2015-2016 crisis, which resulted in the Shanghai Accord,” he suggests. “The devaluation of the yuan and quantitative easing efforts by the Federal Reserve is inevitable in 2025. That’s what will take the market down and then back up like a rocket ship.”

But just paying the bills will prove painful for some companies, Spivak declares. “Rollover of COVID-era corporate loans will finally squeeze U.S. companies and hurt growth at a time when Europe and China are weak, reviving global recession risk,” he says.

Black Swans

All of that said, our second question elicited a wide range of responses. This was what we asked: “What do you predict will be the next surprise, outlier or black swan to shake up financial markets, business, the economy, politics, geopolitics or culture between now and March 31?”

Answers ranged from the unsurprising to the extraordinary.

“The next outlier event may be a short-term uptick in inflation,” says Jablonski.

“Increased and unified pressure from Israel and the United States will cause the fragile Iranian regime to fall,” opines Scaramucci.

“Overthrow of the Iranian government,” agrees Yardeni.

“Trump and Elon will get divorced,” says Sosnoff.

“Confirmed UAP contact,” declares Ratigan, referring to the unidentified anomalous phenomena we used to call UFOs or unidentified flying objects. We suppose they’re no longer considered objects. But call them what one may, communicating with them would be a true outlier.

Ed McKinley is Luckbox editor-in-chief.