Fibonacci’s Arithmetic Revolution

A series of numbers known as the Fibonacci sequence revolutionized commerce and science. But can it help traders pick the right stocks?

A 13th-century Italian mathematician known these days as “Fibonacci” helped create the modern world of commerce and finance by introducing Hindu-Arabic numerals and mathematics to Western civilization.

The decimal-based system he popularized in Europe arose in India in the 6th or 7th century and uses the numerals 0, 1, 2, 3, 4, 5, 6, 7, 8 and 9, notes Keith Devlin, a Stanford professor emeritus of mathematics who’s devoted three of his 33 books to Fibonacci.

Before Fibonacci enlightened them, Westerners were still relying on clunky Roman numerals and counting on their fingers. That was holding them back in business, science and the arts, Devlin said.

But Fibonacci set out to change that. In 1202, he published the book Liber Abaci—which is now spelled several different ways—to teach modern math in the Late Middle Ages.

Yet the book’s revelations didn’t end there. Fibonacci wrote at length about how to run a business. That included the best practices for dividing profits, employing weights and measurements, dealing with foreign currency exchange rates, and assessing the value of the alloys contained in coins, Devlin said.

Within 20 to 30 years of its publication, Liber Abaci helped establish the banking and accounting principles that form the basis of commerce. Fibonacci lived until 1250—long enough to see the changes he had wrought.

“It was always assumed that [Fibonacci’s] Liber Abaci started that revolution,” Devlin noted. “That assumption was proved true in 2003 with the discovery of a manuscript in a library in Florence.”

He can testify from personal experience that it’s “awesome” to hold in one’s hands a hefty piece of parchment that launched such profound and lasting change. And don’t forget that the hand-written tome predated the invention of the printing press by more than two centuries.

But the modern ideas contained in the age-old volume continue to foster debate and spawn myths. The mythology begins with the man himself. For one thing, he wasn’t really named Fibonacci. That’s just the appellation a 19th-century historian gave him.

During his lifetime the man now known as Fibonacci was called Leonardo. When he became famous, people began referring to him as Leonardo of Pisa to distinguish him from others with the same name.

But let’s call him Fibonacci just the same. He was born in 1170 in Pisa, one of several

Italian cities that rode the crest of international trade in that era. His father was engaged in that commerce, which exposed the young Fibonacci to the business practices of merchants from the Muslim world.

Those practices remain relevant to this day, including a series of numbers now known as the Fibonacci sequence. (See “The Rabbit Problem,” below). Devlin calls the numbers “a simple little recursion that incorporates enormously interesting mathematical properties. “Numbers from the sequence appear often in mathematics—in the measurements of pentagrams and pentagons, for example. They pop up with an eerie frequency in nature, like the patterns in the seeds of sunflowers or the number of petals in a flower. Centuries ago, they provided the rhythm for Sanskrit poetry.

Instructors use the Fibonacci sequence to teach induction proofs in advanced high school math classes or in introductory college math courses. Students can use it in 40 to 50 exercises that prove “this or that,” Devlin noted.

“It’s a wonderful little piece of pure mathematics that’s quickly accessible and attractive and brings students in very early,” he says.

In fact, the sequence has been attractive enough to inspire a whole mythology. The mythologizers have convinced themselves and many others that the Fibonacci numbers correspond with the dimensions of the human body and influenced classical architecture and classical music—none of which is true, according to Devlin.

But now for the big question: Can traders use the Fibonacci sequence to make better investment decisions by accurately predicting the movement of equities prices?

Legions of investors have become unshakably convinced that charts tracing the movement of stock prices that reflect the Elliott Wave principle of recurring fractal patterns will pinpoint future prices and result in a better-than-average return.

Those traders often rely on Fibonacci retracement levels, the horizontal chart lines that indicate where support and resistance are likely, according to the Investopedia website.

Each level is associated with a percentage that shows how much of a previous move the price has retraced. The Fibonacci retracement levels of 23.6%, 38.2%, 61.8% and 78.6% are created. While 50% isn’t an official Fibonacci ratio, it’s also used.

Traders often find the indicator useful because they can draw it between any two significant prices. The indicator creates the levels between those two points.

But does it really work? Can it predict prices?

“I’m just going to say it’s bogus,” Devlin reluctantly concludes. “There’s no mathematical reason this would work.”

Still, that’s not his last word on the subject.

“If enough traders believe [the sequence can ferret out future prices], that imposes some structure on the market,” Devlin notes. “If you know how all of the other traders are going to go, that gives you an edge.”

What’s more, using technical chart patterns that reflect the Fibonacci numbers won’t cause traders any harm if they keep them in perspective. Savvy investors might use them as one of many pieces of evidence for taking a bullish or bearish position, he suggested.

“I’m fine with that, but that’s not mathematics,” Devlin maintained. “That’s just being very smart and using evidence in different ways.”

Another expert with broad experience of the Fibonacci numbers has reached a similar conclusion. He’s Tim Knight, a Luckbox columnist and tastytrade web show host who’s been using technical analysis to trade the markets for decades.

“In my experience with charting, I’ve found precious few instances in which anything Fibonacci-related was helpful,” Knight said.

Check out the next issue of Luckbox to see how the Fibonacci sequence—and the golden ratio and golden rectangle associated with it—have influenced humanity’s understanding of mathematics, nature, architecture, music and the visual arts.

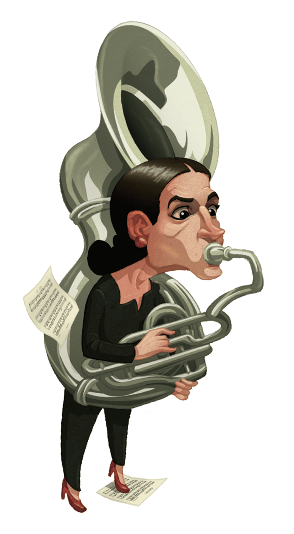

“The Math Guy”

Keith Devlin, the Stanford University mathematician who helped put the Fibonacci sequence into perspective for Luckbox, has a history of bringing math to the masses.

Devlin became known as “The Math Guy” during his tenure with National Public Radio, and he’s a co-founder and the president of BrainQuake, a company that creates video games that teach mathematics.

But he backed those expeditions into popular culture with impressive academic credentials that include directing a long list of university programs and projects and serving as a fellow for numerous institutions.

Besides designing information systems that analyze intelligence, he has studied mathematical cognition, models of reasoning, the theory of information and applications of mathematical techniques in the study of communication.

He’s written 33 books and earned the Carl Sagan Award and the Joint Policy Board for Mathematics Communications Award. The California State Assembly recognized him for his “innovative work and longtime service in the field of mathematics and its relation to logic and linguistics.”

The Rabbit Problem

Fibonacci, author of a lengthy 13th-century missive that revolutionized the way the Western world does business, used the example of rabbits to teach readers how to use the Fibonacci sequence of numbers.

The sequence generally starts with zero and then adds one. From there, users find the next number by adding the two numbers before it. The resulting sequence is: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34 …

The rabbit problem begins with a single pair of bunnies. The question is how many there will be if the original rabbits and their descendants keep reproducing for a year and none of them die.

Suppose it takes a month for the first two bunnies to reach maturity and have two offspring—one male and the other female. That makes for a total of four rabbits.

The second generation takes a month to mature, and then they have two offspring, once again a male and a female. And so it continues. Every month, all of the mature rabbits produce another male/female pair.

Can you figure out how many rabbits there would be at the end of the year?

Answer: The Fibonacci sequence would yield the number of pairs of rabbits at the end of each month this way: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144 and 233. So, at the end of a year, there would be 233 pairs or a total of 466 rabbits.