Big Oil, Big Pharma, Big Tech: Is Big Grocery Next?

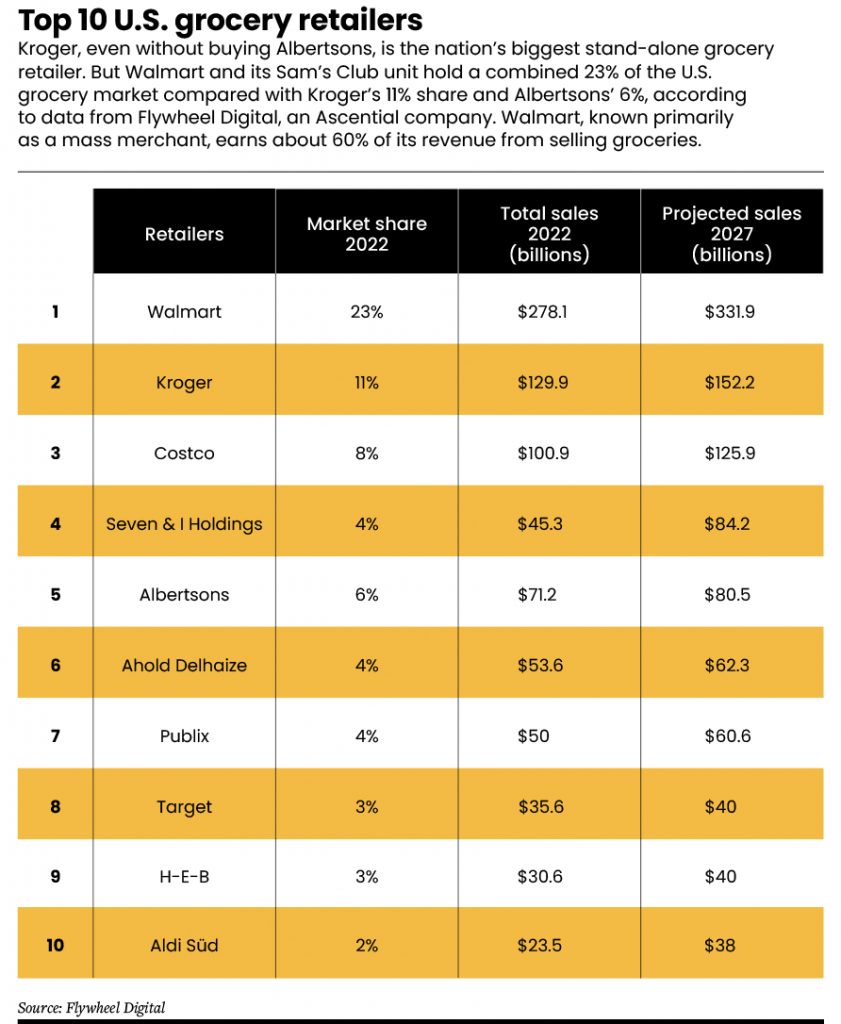

A Kroger-Albertsons merger would create a supermarket behemoth. But the grocery giant would still be No. 2 in the U.S. market, trailing Walmart.

The proposed merger of Kroger (KR) and Albertsons (ACI) would create a national powerhouse, but it wouldn’t dominate grocery retailing.

The deal would result in a conglomerate with stores in almost all 50 states. That scale would be great for Kroger and Albertsons shareholders, industry observers say. But even after the merger—assuming it’s approved by regulators—the grocery-selling crown will remain with Walmart (WMT).

“For the companies themselves, the biggest benefit is that it’s really going to give Kroger and Albertsons an opportunity to step back and take a look at their entire organizations,” retail and supply-chain consultant Brittain Ladd told Luckbox.

He said a Kroger-Albertsons mashup would enable the combined company to do things like divest manufacturing centers and older warehouses and make better use of Kroger’s network of robotic warehouses (see sidebar on page 24). He doesn’t expect the deal to re-make the grocery market, but the combined company would be much stronger than Kroger and Albertsons are separately, he said.

The combined operation would “have a lot of redundancies throughout the company,” Ladd said. The merged company would benefit from economies of scale and could cut costs by streamlining headcount, from senior levels down to workers in the distribution centers, he noted.

The merger requires approval by the Federal Trade Commission (FTC).

“The proposed Kroger-Albertsons merger faces heated opposition from unions, consumer advocates, liberal think tanks and progressive politicians.”

$24.6 billion deal

According to the merger agreement, Kroger would buy all outstanding Albertsons shares for an estimated $34.10 per share. That per-share price values Albertsons at about $24.6 billion, including the assumption of $4.7 billion of Albertsons’ debt.

Like most mega-mergers, this one would be complicated. One provision gives Kroger the right to reduce the cash part of the $34.10 per share by the value of a newly created standalone public company (SpinCo)—a subsidiary Albertsons would spin off to its shareholders at closing, in conjunction with the regulatory clearance process.

What’s SpinCo? Call it a back-up plan. To get the regulatory clearance necessary to close the transaction, Kroger and Albertsons expect to divest more than 650 stores. SpinCo would receive any stores not sold off to other grocery retailers. That, the companies say, would eliminate the need to close any stores or cut frontline jobs. In September, media reports said Kroger and Albertsons were working on a deal to sell more than 400 stores to C&S Wholesale Grocers for nearly $2 billion.

A no-layoffs pledge

Kroger and Albertsons say SpinCo could include between 100 and 375 of the divested stores. Names commonly mentioned as store buyers include Amazon (AMZN) and Netherlands-based Ahold Delhaize (ADRNY). Ahold Delhaize owns several regional U.S. grocery chains, including Food Lion, which runs supermarkets in 10 Mid-Atlantic and Southeastern states and Stop & Shop in the Northeast.

In a statement emailed to Luckbox, Kroger reinforced its no-layoff pledge. “Kroger will not lay off any frontline associates or close any stores, distribution centers or manufacturing facilities as a result of this merger.” The statement says Kroger is working with the FTC to “develop a thoughtful divesture plan—either through selling stores to strong buyers or by creating a standalone independent company.”

Pablo Garces, a director at S&P Global Ratings, says it’s more likely competitors will buy up all the divested stores, making the creation of SpinCo unnecessary.

“It’s not going to be one buyer, it’s going to be several,” Garces said. And he expects Amazon and Ahold Delhaize to be among the buyers.

As evidence, Garces pointed to Amazon CEO Andy Jassy’s April letter to shareholders in which he cited the need for “a broader physical store footprint” for Amazon’s grocery store business. Amazon owns the Whole Foods and Amazon Fresh chains.

In an interview published Aug. 6 in The Oregonian newspaper, Kroger CEO Rodney McMullen said the retailer was talking with several potential buyers for the divested stores but said it was too early to name them.

McMullen told The Oregonian that the grocery market has changed, and Kroger must change with it. Kroger’s main competitors, he said, aren’t other grocery chains, but retailers like Walmart, Costco (COST), discount stores like Dollar General (DG) and online retailers like Amazon.

Data backs that up. Supermarkets accounted for 66.6% of grocery sales in 2022, down from almost 70% in 2017, according to Coresight research. Meanwhile, the share of household spending going to grocery sales at “dollar” stores grew 89.7% between 2008-2020—making them the fastest-growing sales channel, the American Public Health Association says. Besides Dollar General, retailers in the segment include Dollar Tree, (DLTR) and Family Dollar (FDO).

Tech provider Mercatus and data firm Incisiv estimate online grocery sales will account for 21.5% of the market by 2025, up from less than 15% in 2022 and 3.4% in 2019. But research firm SymphonyAI Retail CPG, says the net number of online grocery shoppers in the U.S. and Europe declined 14% from Q1 2022 and Q1 2023. Online grocery revenue declined just 1% in the period, but inflation accounts for much of the smaller decrease, the firm says.

“We expected better”

For a variety of reasons, the merger faces stiff opposition. Among those calling for a halt are several unions; the Economic Policy Institute (EPI), a liberal-leaning think tank; the consumer advocacy group Center for Science in the Public Interest; and politicians that include Sens. Elizabeth Warren (D-Mass.), Bernie Sanders (D-Vt.) and Rep. Jan Schakowsky (D-Ill.) Each side has thrown around accusations and heated rhetoric.

For example, Sean M. O’Brien, general president of the Teamsters Union, issued a statement that said: “Kroger and Albertsons management likes to talk the talk on job security when they’re sitting in front of Congress but talk means little when it comes to protecting our members. We expected better from these two longtime Teamster employers.”

Kroger clapped back in an email to Supermarket News, calling the EPI findings “erroneous and based on a faulty, biased and poorly sourced analysis.” Ouch.

Approval might be highly conditional

Despite the opposition, Dan Wasiolek, senior equity analyst at Morningstar, told Luckbox he thinks the Kroger/Albertsons merger will happen—just not necessarily the way the retailers want it to. Wasiolek anticipates any approval to be conditional—probably requiring the combined company to sell more stores than they want to divest.

“Any part of Albertsons that [Kroger] can accumulate, I think over time gives them more scale, more customer data and a more national presence, and in some regional markets they will be stronger, too,” Wasiolek said.

The FTC is expected to make its decision by early 2024.

Subscribe for free at getluckbox.com.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.