Earnings Season and the Calendar Spread

Earnings for the first quarter of 2020 are only recently in the books, but savvy traders are already looking toward the second quarter, which don’t kick off until mid-July.

One reason for having a longer view at this time is because earnings this year have been especially unpredictable, and going by the first quarter, pretty dismal, too.

Based on earnings from companies included in the S&P 500, the blended earnings decline in the S&P 500 for Q1 2020 was 13%, which was the worst year-over-year decline since Q3 of 2009 (amidst the Great Recession). And expectations for the second quarter of 2020 are even worse, especially because economic lockdowns associated with the coronavirus epidemic didn’t really start to bite until Q2.

Recent protests over the death of George Floyd have arguably exacerbated economic pain in the United States, which could impact 2020 earnings, as well.

Looking ahead, the bulk of second-quarter 2020 earnings season will arrive during the August expiration period, meaning that’s an expiration month in particular traders may want to circle with a red pen and handle with care going forward as it relates to position deployment and management.

One thing to keep in mind is that the bar has been set fairly low for the next earnings quarter, as Q2 forecasts have been continuously revised lower.

At the start of 2020, expectations were that full-year corporate earnings could shrink by 2% this year. Based on current projections, that number is now closer to negative 20%. This means that a drastic cut in full-year 2020 earnings is now a broadly-accepted expectation.

How a trader positions his or her portfolio going forward is of course dependent on a wide range of factors, including his/her: existing positions, current outlook, unique trading style/approach, and risk profile. That said, one position structure traders may want to consider in the coming days and weeks is the calendar spread.

As a reminder, a calendar spread involves simultaneously buying and selling options with the same strike price, but different expiration months. When executed for a debit (i.e. cash comes out of the account), the position entails selling the near-month option, in favor of purchasing an out-month option.

Debit calendar spreads (a.k.a long calendar spreads or time spreads) are theoretically bullish volatility because after the near-term option rolls off, the position is left with only the long premium leg of the trade. If volatility expands, that remaining position wins.

Moreover, debit calendar spreads can be bullish or bearish, depending on whether one executes a debit calendar call spread (bullish) or a debit calendar put spread (bearish).

Calendar spreads perform optimally when the underlying hovers close to, or right on, the strike of the near-month short option. In this scenario, the premium from that short option bleeds off and funnels straight into the trader’s wallet.

Moreover, if the underlying makes a big unexpected move in either direction, the most a debit calendar spread trader can lose is the amount of premium paid to establish the position – meaning the debit calendar spread is a defined risk position.

Several of the most important considerations when trading calendars are highlighted below:

Looking at the current 2020 term structure, if a trader were to sell either June or July premium, against buying August or September premium, he/she could sell an option in an expiration month without earnings, in favor of buying an option in an expiration month that does include earnings.

One potential argument against this position structure is that first-quarter earnings season is now in the rear-view mirror, which means that implied volatility has theoretically dropped due to the “earnings crush.” The term “earnings crush” refers to the tendency of implied volatility to crash after an earnings announcement, particularly in the expiration month capturing the “event.”

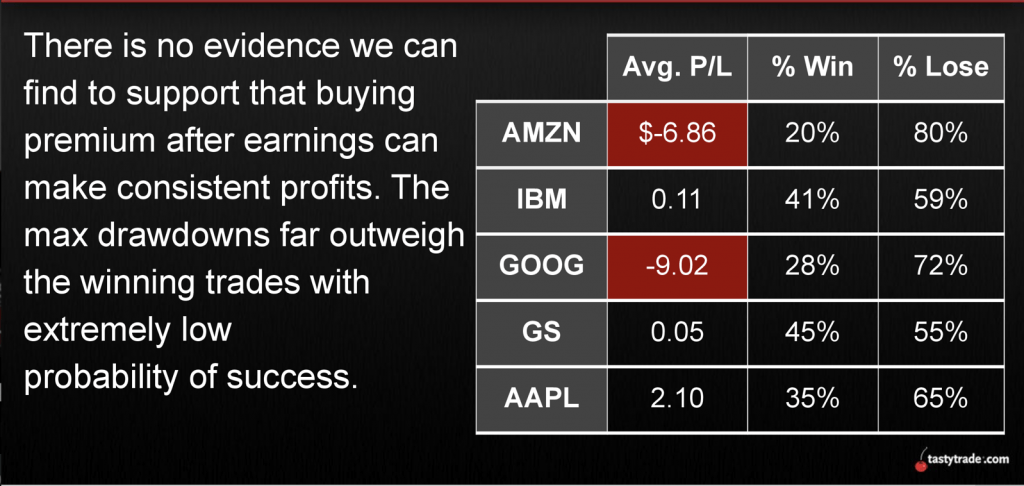

However, recent research conducted by tastytrade suggests that post-earnings implied volatility may not be as “cheap” as many think.

Based on a comprehensive market study of historical data, the aforementioned research revealed that buying premium after the “earnings crush” hasn’t been on average a profitable endeavor, as summarized below:

The above may suggest that there’s more opportunity selling premium after earnings than one might initially believe.

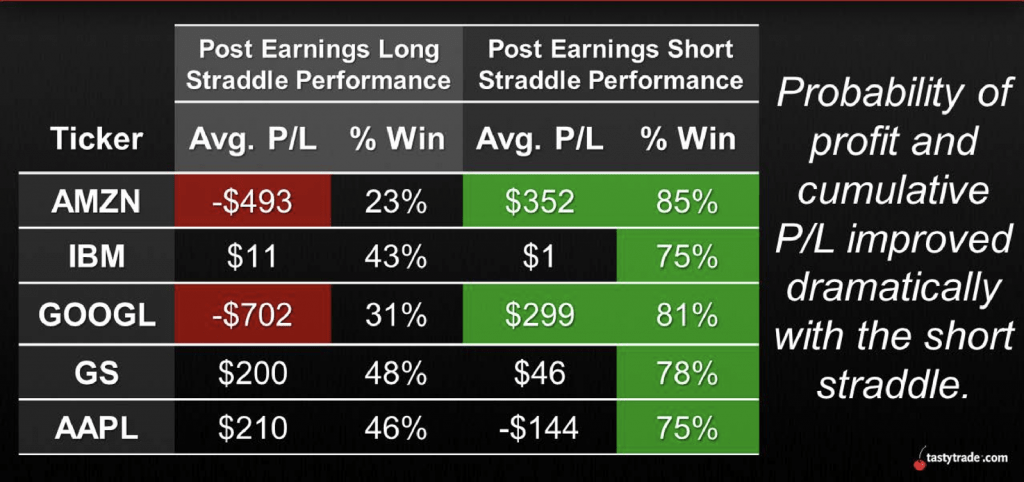

In fact, another study conducted by tastytrade illustrates that a short premium approach in the wake of earnings has been a lot more effective than buying premium, as pictured below:

One important thing to keep in mind is that the debit calendar spread depends muted movement in the underlying during the life of the short near-month option. With the coronavirus still raging, and widespread social justice protests on top of that, it’s possible investors and traders don’t view the coming weeks in the market as “quiet.”

Traders that do see volatile movement in the near term, should be careful, however, of reversing the debit calendar position structure–a so-called reverse calendar.

By selling long-dated options, and buying short-dated options, as dictated by the reverse calendar, traders can leave themselves open to far greater (and theoretically unlimited) risk if the position goes south.

If an investor/trader simply wants to deploy a position which is expected to benefit from rising implied volatility, he or she would likely be better served purchasing option premium in the expected expiration period, and skipping the second leg of the reverse calendar.

While long options positions are associated with lower expected probabilities of profit, they do represent a “defined risk structure,” meaning the worst case scenario is the loss of premium paid to establish the position, as opposed to the theoretically “unlimited” losses associated with naked short options.

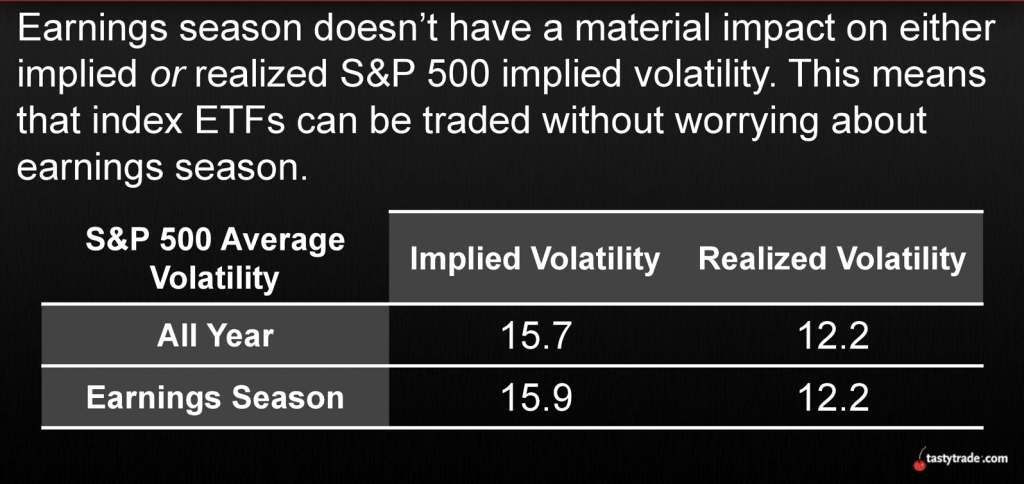

Another important consideration for any of the above position structures is whether to use single-stocks, ETFs, or index ETFs when entering a given options position.

As it relates to earnings, tastytrade has previously investigated this question, and found that index ETFs appear to trade largely agnostic of earnings. These findings are summarized below:

Based on the above, traders desiring reduced risk exposure to outlier movements related to earnings may want to stick to index ETFs when deploying debit calendar spreads, or any other structure involving short options.

To learn more about the topics covered in this post, readers may want to review associated tastytrade research in more detail when scheduling allows:

- Market Measures: The Effect of Earnings

- Market Measures: Is Premium Undervalued After Earnings?

- Market Measures: Selling “Cheap” Straddles After Earnings

- Market Measures: Optimal Calendar Spread Trading

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.