The Mullet Trade

Calendar spreads: short in front, long in back

Some investors hold off on trading until periods of high implied volatility. But if they consider volatility high only when the VIX “fear gauge” surpasses 20, they’ll be sitting on their hands 60% of the time. Using calendar spreads, traders can stay engaged during all market environments and profit from the passing of time.

Option contracts contain an embedded time component nonexistent in stocks. While investors can hold stock positions indefinitely, option contracts have a listed expiration date. This time component gives traders an edge that traditional stock traders don’t have.

Standard option contracts expire the third Friday of each month, and most liquid stocks list options expiring several months in advance.

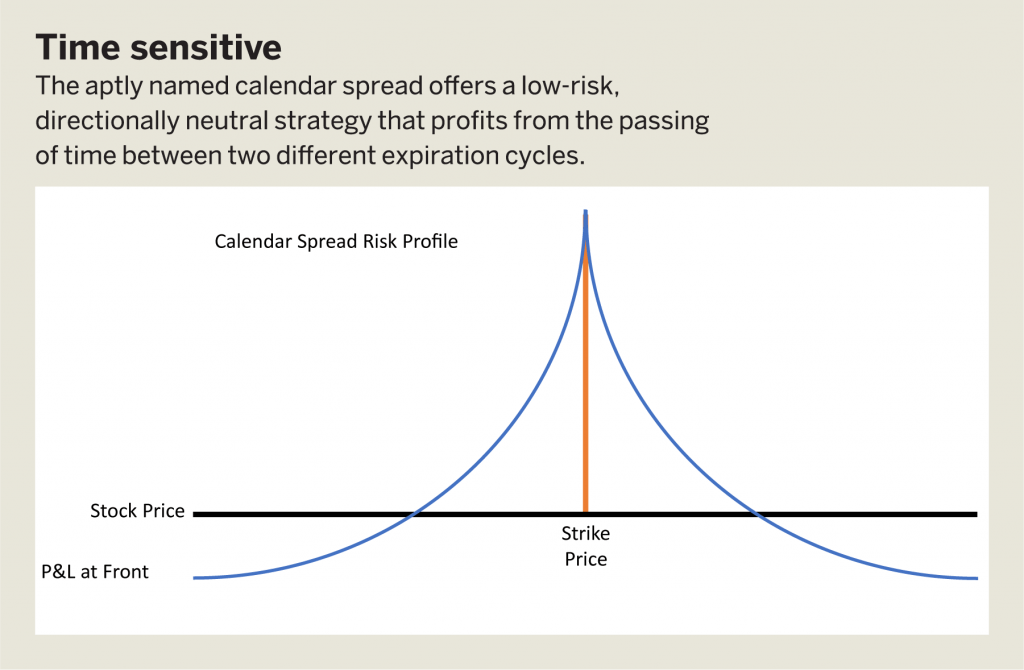

Traders can buy and sell around different expiration cycles. One such trade that benefits from different expiration dates, the aptly named calendar spread, offers a low-risk, directionally neutral strategy that profits from the passing of time between two different expiration cycles. When volatility’s low, it enables traders to stay engaged with a small capital outlay.

The goal of the calendar spread is for the stock or index to be at or close to the strike price of the calendar close to expiration. Then the short front-month option will be cheaper, while the long back month option retains value. That’s when the price of the calendar should be greater than the debit paid initially. Investors can place calendar spreads at a strike price below the current stock price for a slightly bearish strategy, above the current stock price for a slightly bullish strategy or at the current stock price for a neutral strategy.

Time sensitive

The aptly named calendar spread offers a low-risk, directionally neutral strategy that profits from the passing of time between two different expiration cycles.

A calendar spread, comprised of one long option and one short option, has the same strike price and different expiration dates. To construct one, sell a front month option and purchase a longer dated option. Like the mullet haircut, calendar spreads are short in front and long in back. Investors construct them using either puts or calls, but generally with the same type of option—both calls or both puts.

Calendar spreads are an inexpensive trade placed for a debit. Because they’re slow-moving and benefit from an increase in implied volatility, manage them at a profit of 10% to 25% of the debit paid. If, for example, it costs $100, manage at $125 for a 25% profit.

Tight markets and low implied volatility make SPY an excellent candidate for a calendar spread

When placing a calendar spread, look for an underlying with plenty of option liquidity and low implied volatility. Look at SPY, one of the most-liquid ETFs, which tracks the S&P 500 Index. Each day, investors trade more than 1 million option contracts on SPY, and most have strikes and expirations with penny-wide spreads. Tight markets and low implied volatility make SPY an excellent candidate for a calendar spread.

If the current expiration months for SPY are June and July, investors can initiate a put calendar spread by selling the at-the-money put expiring in June and buying the at-the-money put expiring in July. This trade uses only $150 in buying power, and if managed at 25% the trader nets a profit of roughly $38.

Michael Gough, a self-taught coder who became an options trader, serves as co-host of tastytrade’s Research Specials Live.