False Prophets Get It Wrong About Profits

New data suggests it pays to concentrate on managing stocks that are gaining value, not the ones in decline

For the last 100 years, Wall Street has been dispensing this advice to investors: “Cut your losses and let your winners run.” The adage formed the basis of trading discipline. The problem is that it’s not necessarily true.

To build wealth, in fact, the opposite may be a better strategic choice. The data backs that up—thanks to research tools that weren’t available even 10 years ago. So, don’t fault the old-timers for getting it wrong. It’s just that today, investors should base decisions on the latest information.

After all, it feels awful when a loss wipes out weeks, months or even years of gains. But the reason that happens has less to do with a lack of discipline and more to do with strategy. Luckily, in today’s world of largely democratized financial technology, individual investors can take advantage of strategies that enhance portfolio performance.

Pundits often dwell on ways to stop losses, but it’s more advantageous to enhance performance by managing existing winners. Why? Because the probabilities and historical backtests suggest that managing winners will more effectively boost overall portfolio returns and prevent profitable positions from slipping away and turning into losses.

The philosophy of managing winners instead of losses stems from the fact that losses, albeit undesirable, cannot be controlled. Managing losers will only lock in the loss and does nothing to prevent future losses. In other words, managing losers is a reactive strategy, and managing winners is a proactive strategy. Investors should remain proactive and thus give themselves the best chance of success while they can still control the outcome of a win.

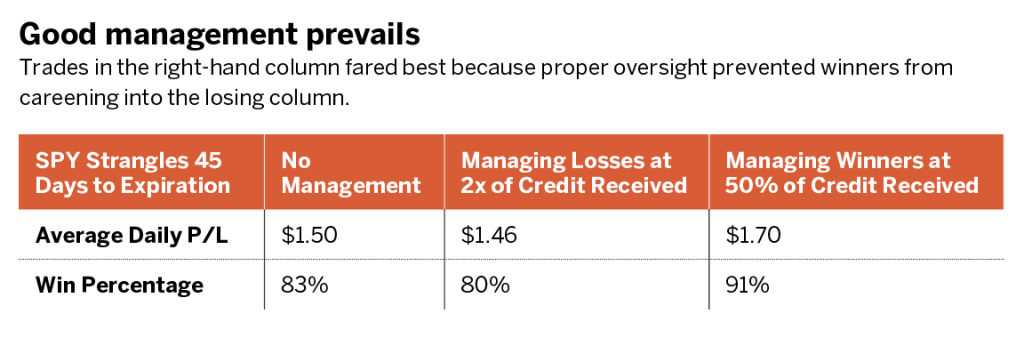

So, what do the numbers say? The table above shows a historical backtest of a strategy known as a short strangle in the S&P 500 ETF (SPY) going back 14 years. In the left column, the trade was placed 45 days to expiration and then held to expiration. In the middle column, the trade was placed 45 days to expiration and then taken off if and only if the loss reached two times the credit received for the strangle; otherwise, it was held to expiration. In the right column, the trade was placed 45 days to expiration and then taken off if and only if the trade reached a profit of 50% of the credit received; otherwise, it was held to expiration.

The rightmost column yielded the best results, not only in terms of daily profits, but also in terms of risk and win percentage.

The reason? Managing winners prevents those winners from turning into losses, while losses that already have happened did not get much worse. That means overall performance was improved, and the numbers demonstrate that.

The moral of the story is that taking a loss is largely unproductive compared to managing existing winners. To enhance a portfolio’s returns, increase the win percentage and reduce the risk, compared to managing losses.

Anton Kulikov is a trader, data scientist and research analyst at tastytrade. @antonkulikov97