Making the Leap to Futures

Understanding the differences and similarities between futures and equities

Even investors with plenty of experience trading equities and exchange-traded funds (ETFs) may find the leap to futures a bit daunting. Futures can be big, and they move fast enough to steamroll the unprepared.

But once an investor becomes familiar with the difference between stocks and futures—as well as some of the latter’s major advantages—futures can become manageable and fit into just about any portfolio.

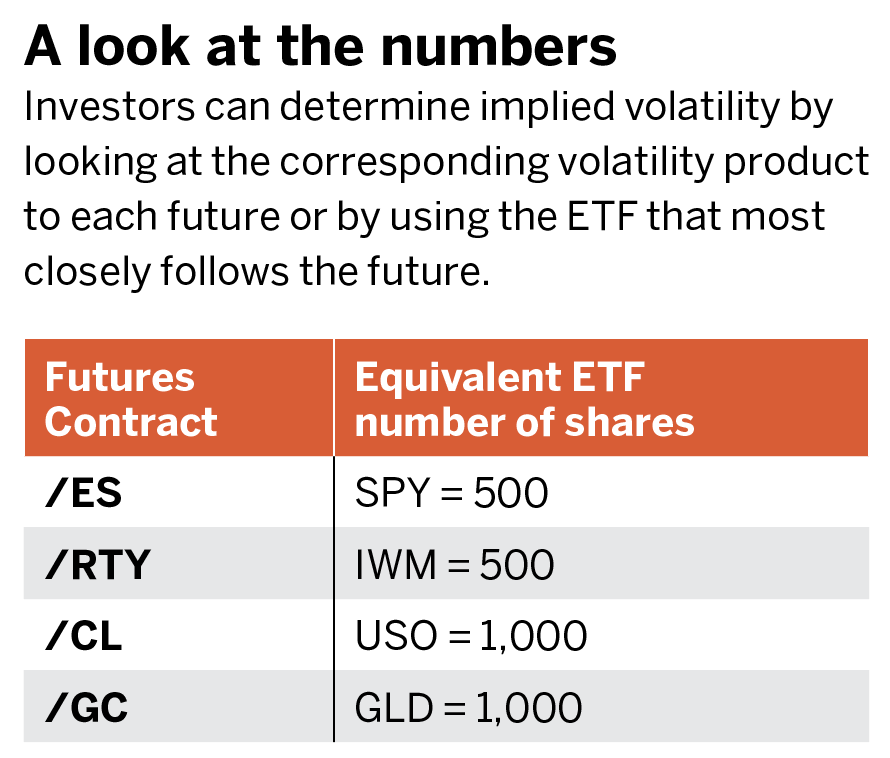

The mechanics of trading equities options also apply to futures options. Futures can have liquid and active option markets that provide choices for anyone looking for high-probability trading strategies. But first, the basics. Implied volatility is a key to any trading strategy, and the relationship between a futures contract’s implied vol and that of an ETF that is closely tied to that future can be instructive. Examples of ETFs that are closely related to futures include the S&P 500 (SPY), oil (USO) and gold (GLD).

One interesting difference regarding futures volatility is that volatility can expand if price is moving higher or price is moving lower. This can be compared to equity options where volatility typically expands only on down moves.

Worried about getting 300 tons of corn dumped in the driveway because of trading some futures options? Worry not. Options on futures expire into one long/short future, whereas options on equities expire into 100 shares of long/short shares. To avoid assignment, traders typically close out futures options before expiration. When closing out, aim for a specific profit target or when the option no longer trades as the front month contract. The front-month contract refers to the expiration month that has the highest number of contracts traded, as well as generally the most liquid markets. Sometimes the futures close to expiration are no longer the front-month contract.

A futures contract, like options, has an expiration date. That’s one primary difference from equities. Because of that, it’s important to stay vigilant in active management of positions when trading futures. Rarely are futures contracts held to expiration. Instead, we look to roll futures to the next cycle to add duration to the trade.

Futures require significantly less buying power than equities to obtain static deltas. That’s often viewed as a dangerous disadvantage because it’s easy for them to become too large. Still, knowing the deltas of a portfolio (beta-weighted delta) sometimes requires adjustments, and futures are a great choice for that because of the low buying power.

Futures can become scalping vehicles as well. Investors can scalp by trading outright contracts, looking for short-term profits. It’s also possible to trade multi-product spreads using another futures contract (pairs trade) or combining with options (covered trades).

An often overlooked advantage of futures is the favorable tax rate. Trades are marked-to-market and taxed at a rate of 40% for short term, which is ordinary income. Compare that with equities taxed at 100% at the short-term capital gains rate.

No pattern day trading rule is associated with futures contracts. That means multiple round-turn trades are possible in futures even if an account has less than $25,000. In equities, multiple daily scalp with less than a $25,000 balance will result in locking of the account.

Understanding the differences and similarities between futures and equities dispels the mystery and ameliorates fear. Remember the nervousness of trading that first stock option? Learning to view futures and futures options as just another product contributes to becoming a fully developed trader with a bigger toolkit. It’s part of making speculative trades or hedging a portfolio. Used correctly, futures can add a new dynamic to any trade strategy.

Mike Hart, a former floor trader at the Chicago Stock Exchange and proprietary futures trader, specializes in energy markets and interest rates. He’s a contributing member of the tastytrade research team.