Smart Inflation Hedges

Looking to take the sting out of an investment’s shrinking value? Ethereum and bitcoin have been anything but stable. Think gold.

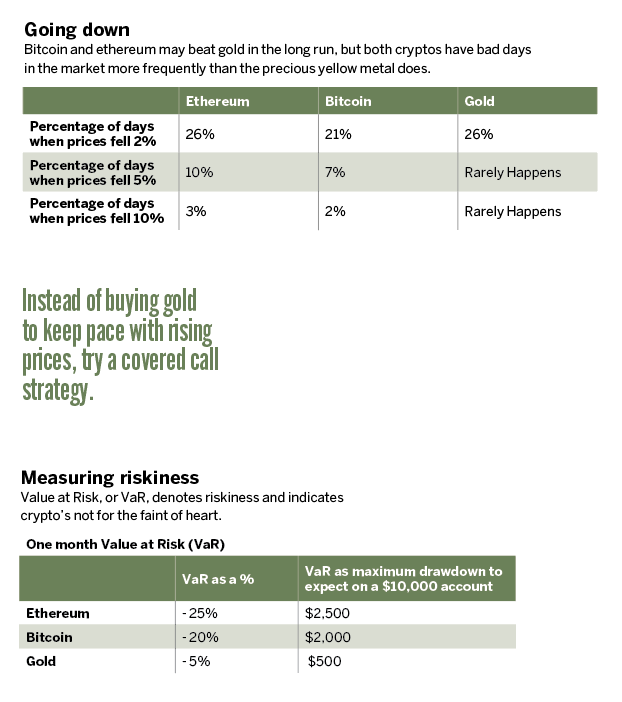

Is cryptocurrency the new inflationary hedge? Not for anyone who worries about a 5% drop in purchasing power. Ethereum has had losses that big roughly once every two weeks (or 10% of the time).

What’s more, hedging is supposed to reduce risk, and ethereum and bitcoin have been anything but stable.

See “Going down,” below, for more stats. The table shows the percentage of days ethereum, bitcoin and gold have fallen by a given amount during the past two years. Value at Risk (VaR), a statistical measure of the risk of financial instruments or asset portfolios, shows significantly more risk in the cryptos as well.

VaR is defined as the maximum dollar amount (or percentage) that investors can expect to lose during a one-month period with a high degree of confidence.

Looking at ethereum over the course of a month, a loss of $2,500 on a $10,000 investment would not be out of the ordinary. For gold, the VaR is only $500. See “Measuring riskiness,” below.

For those seeking relative stability or asset preservation during inflation, gold is the better bet.

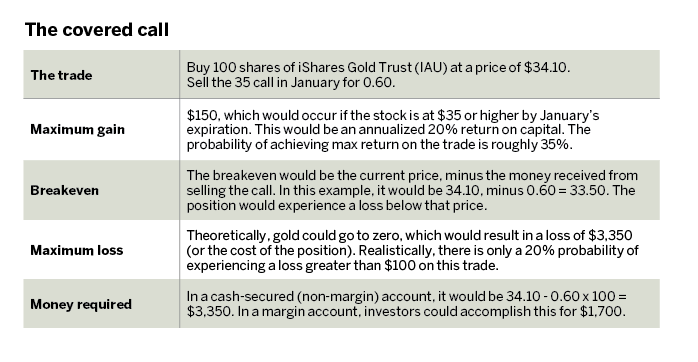

Investors have two popular choices: the SPDR Gold Trust ETF (GLD) or the slightly less popular iShares Gold Trust (IAU). They have similar constructions, and both are based on the price of gold. IAU’s lower price makes it a better choice for smaller investors.

But instead of just purchasing gold, try the following covered call strategy. It provides a high probability of success and the advantage of additional cash flow.

The cash received on the short call amounts to an annualized return of 13%, and that helps reduce any drawdowns gold may have.

Take a look at the trade and stats in “The covered call,” p. 63. For another view on hedging inflation, below.

Michael Rechenthin, Ph.D., aka “Dr. Data” is the head of research & development at tastytrade. @mrechenthin