The REIT Trade

Real estate investment trusts tend to pay dividends that can ease the pain of a bad trade

Got a bad trade? Tell everyone you bought the stock for the dividend. It’s an old joke among traders and provides cover for a mistake. But in all seriousness, dividends do add a nice buffer to lackluster stock returns. Half of the returns over the past 20 years in the S&P 500 have been dividends. Some industries tend to provide larger-than-average dividends, and Utilities (XLU) is one example. Another is real estate investment trusts, or REITs.

So, what’s a REIT and why is it important to have a basic understanding of them?

REITs have been around since President Eisenhower agreed to allow investors to amass large-scale portfolios of income-producing properties. Over time, rules have been established that create their designation as a REIT. They are as follows:

- 75% of its gross income must come from real estate holdings

2. 75% of its assets must be in real estate

3. 90% of its income must be paid to shareholders as a dividend

The REIT essentially trades like a stock, and it’s technically diversified because it’s made up of multiple properties with separate cash flows.

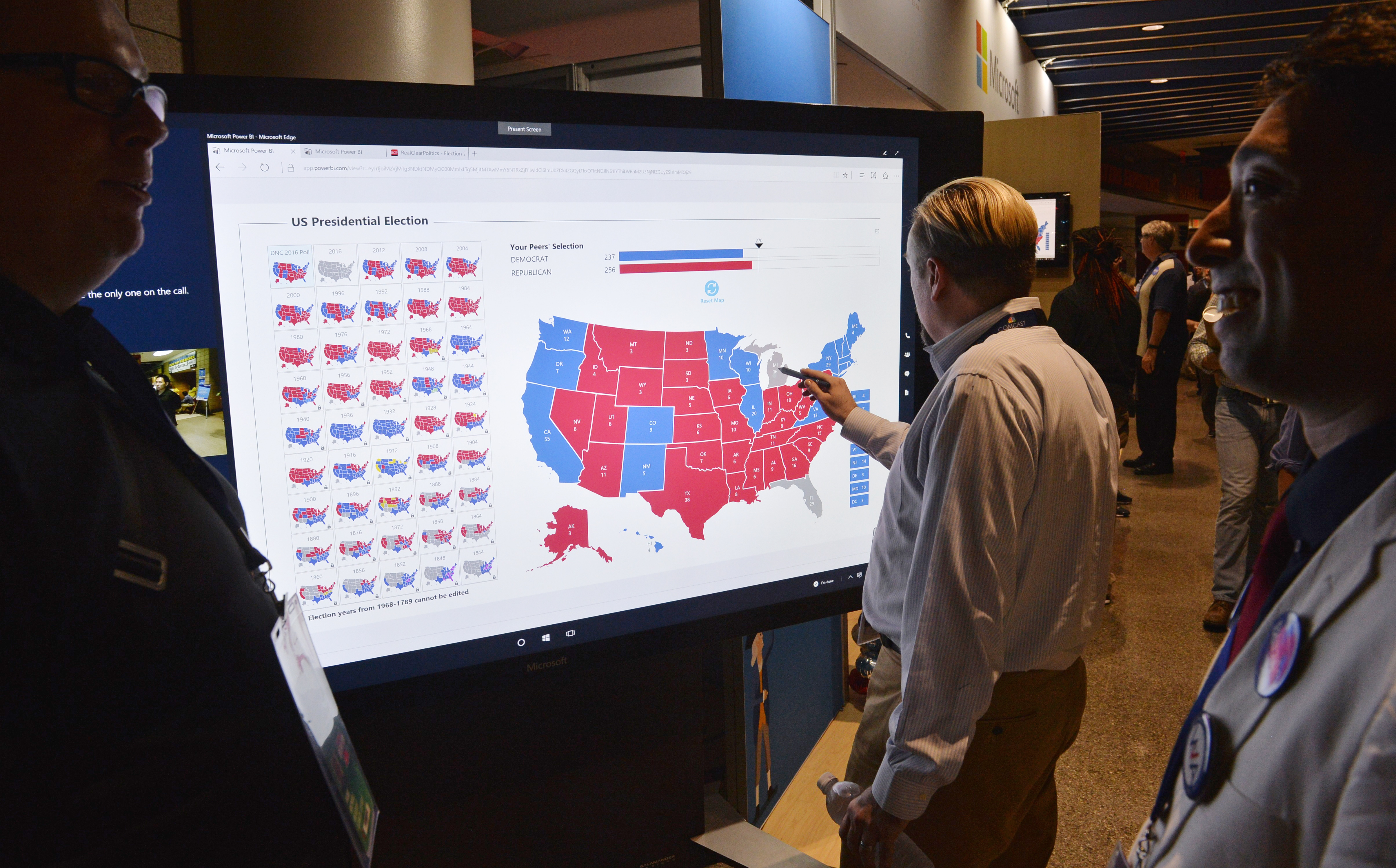

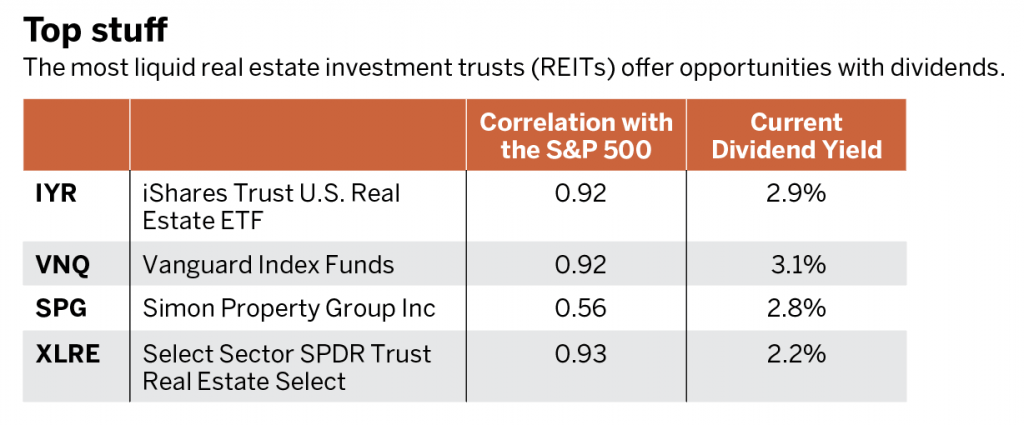

Rising rates hurt REITs, especially those with high levels of debt that need refinancing. The good news is there’s a low probability of that occurring. In fact, the futures market is pricing in a roughly 5% probability that rates will increase from their current levels over the next year—low rates provide a headwind for REITs. The table in “Top Stuff,” below, shows the most liquid REITs.

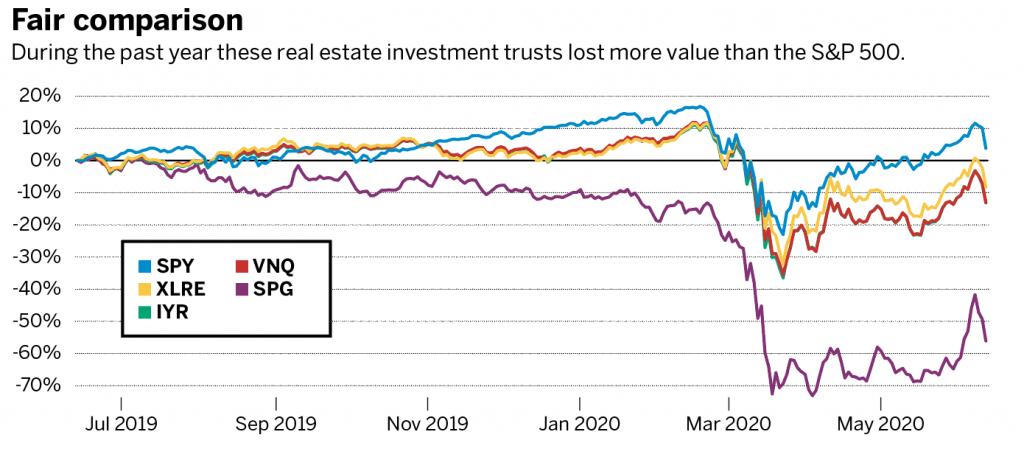

It also helps to look at the returns during the past year, compared with the S&P 500. See “Fair comparison,” below.

What are some trade ideas to help get those probabilities on your side? Reduce risk by lowering the trade’s breakeven. Consider a covered call in IYR—sell the second out-of-the-money call. Right now, with the stock at 83.32, traders can sell the 85 call for 1.60. That lowers the breakeven to 83.32 – 1.60 = 81.72, which is approximately 2% lower than the current stock price. Annualized, this is approximately 17% protection. And the dividend provides an additional cushion of 3%, which is nice for anyone who occasionally forgets to roll those calls.

Simon Property Group (SPG) is at lows from 10 years ago. Why? It’s the biggest mall operator in the U.S., and unpaid rents are stacking up because of COVID-19. Contracts are contracts, and Simon is suing many of its tenants for unpaid rent. Still, it has one of the stronger balance sheets of mall REITs. Traders who think Simon might have sold off too much could consider a cash-secured covered put. With the stock currently at 72.87, the first out-of-the-money put is 70 and can bring 3.25. By selling this put, the breakeven becomes 70 – 3.25 = 66.75 or 8% lower. That means the stock can drop by 8% over the next month and a half before a loss occurs.

Both strategies are worth considering when choosing a trade.

Click here for more trades from the research team.

Michael Rechenthin, Ph.D. (aka “Dr. Data”), heads research and data science at tastytrade. @mrechenthin