The Short Put

The moving parts of a short put have scared off many investors. Let's clear up misconceptions so traders can take advantage of the benefits

Sometimes investors feel certain a stock won’t go down but aren’t very bullish on it. That’s when it’s time for a short put.

A short put is a bullish strategy that profits if the underlying moves up. However, a stock’s movement isn’t the only variable that affects a short put. In fact, a short-put trader should pay attention to changes in implied volatility, changes in directional exposure, time decay and the date of expiration.

Keeping track of all of those metrics can seem daunting at first, but over time investors find that the short put becomes one of the most versatile strategies in the toolkit, especially in periods of high implied volatility.

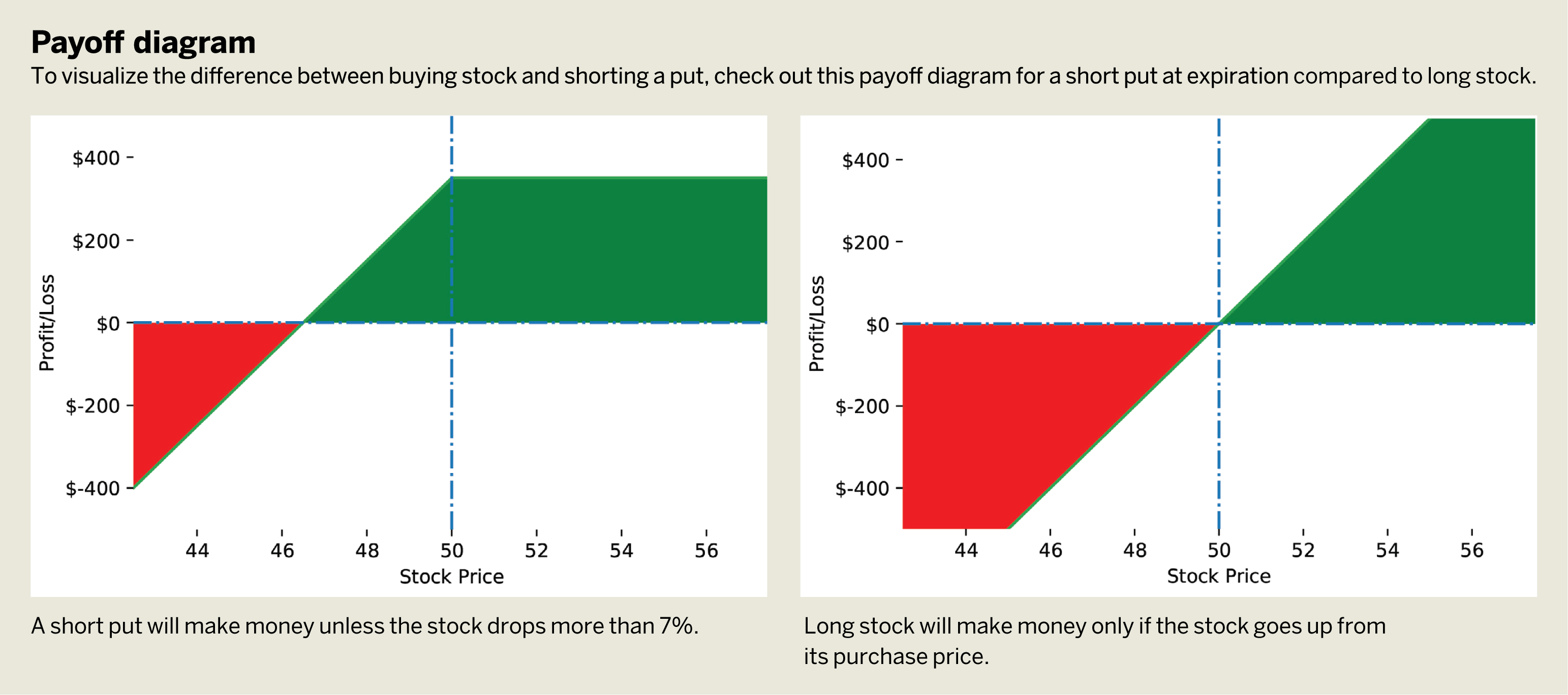

To visualize the difference between buying stock and shorting a put, take a look at “Payoff diagram,” below, which shows a diagram for a short put at expiration compared to long stock.

Take, for example, stock XYZ, which is trading at $50. An investor can sell a $50 put for $3.50, netting a total credit of $350. So, what happens then? Well, one of five things can occur by expiration: the stock goes up a lot, goes up a little, goes sideways, goes down a little or goes down a lot. Investors profit in four of the five ways. The only way they take a loss is if the stock goes below $46.50—that’s the scenario where the stock price goes down a lot (at least 7% in this case, which is the breakeven price for that put).

Stocks can gain a little, gain a lot, stay the same, lose a little or lose a lot. In four or those five scenarios, a short put makes money

How is that calculated? Just take the strike price of the put ($50) and subtract the price of the put ($3.50).

That provides the $46.50 breakeven price; below that price is where the short put loses money, while above that price is the point where it can make money. Compare that with 100 shares of stock that make money only if the stock goes up. That’s because the breakeven for the stock price is its purchase price of $50.

In this case, if the stock drops to $49, the long shares of XYZ lose $100. But the short $50 put can still be profitable with the stock at $49 at expiration because $49 is higher than the put’s $46.50 breakeven price. That illustrates a main advantage of a short put. There are more ways the stock could move and still make a profit.

But some readers might say a short put carries more risk than long stock! That’s just not true. Suppose the worst happens to XYZ, and it goes to $0. Kaput. The short put would lose its breakeven price, $4,650. The long 100 shares would lose $5,000. Both losses stink, but which is riskier? The long stock.

Remember all the other metrics that affect a short put? Investors can make all of them work to their advantage. Ideally, they would sell a short put when implied volatility (IV) is high. The reason? Because short puts have negative vega. That means that when the IV goes down, the price of the put also goes down (good for short puts!). So why wait until the IV is high to sell it? Volatility tends to be mean reverting, meaning that if it goes up a lot it has a pretty good chance of coming back down, such as reverting to its mean or average.

What about time decay?

Well, another advantage of the short put over long stock is the benefit of positive theta. Positive theta is how much profit investors realize at the end of each trading day on a short put (or any option, for that matter) if nothing else changes. All short puts come with some value of positive theta.

Another great aspect of this strategy is that even though an investor sold the put on 100 shares of stock, they start off with only 50 shares of exposure. That’s the delta of the short put. That reduces risk to the downside if the stock does move against the investor.

To recap the benefits:

- Investors lose only if the stock price goes down significantly by expiration.

- Investors can claim early profits if implied volatility declines.

- Investors have paid every day just for holding the position.

- Initially, there’s less exposure to the stock than being long 100 shares.

At this point, some readers will be thinking, “What’s the catch?” There are two. One, if the stock has a big move up, the profit on the short put is limited to the credit received when the investor shorts it. The stock can make more money if that happens. Two, the long stock is eligible to receive any dividends, while the short put is not. However, the price of the short put reflects the stock’s dividend and is higher because of it.

Finally, it can seem like there’s a lot to juggle with short puts. But don’t overthink it. It’s a less risky and more flexible alternative to a long stock position. So when feeling bullish on a stock, consider a short put instead of buying shares. It could become a mainstay of an investment strategy.

Anton Kulikov is a trader, data scientist and research analyst at tastytrade.