Three Ways to Play Long Odds

Options enable active investors to quantify and manage risk. But sometimes they may want

to try for a big score with low-probability, high-return strategies.

Investors want to see their portfolios grow in value—it’s why they generally steer a course toward higher-probability trading strategies. But they would do well to think in terms of repeatable “investable strategies” instead of “speculative strategies” over the long term.

Yet, what if someone has a hunch? There’s nothing wrong with placing speculative trades, as long as investors understand they have a low probability of success.

Here are some speculative strategies and the pros and cons of each.

- The Butterfly Spread

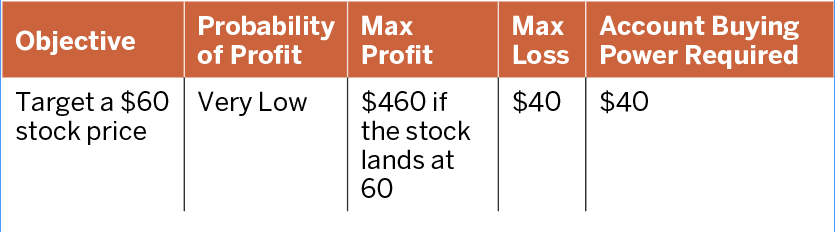

In the Advanced Tactics section of the last issue, Luckbox discussed speculation with butterflies. It’s a low-probability trade often accomplished for a small debit (i.e., cost). The cheaper the butterfly, the less capital is required and the more the max loss declines.

The idea is to have the two middle short strikes where the stock is expected to land.

For example, suppose a trader predicts that DraftKings (DKNG), at ~$48, will pinpoint 60 at expiration. (See the table below.)

Buy 1x 55 puts in August

Sell 2x 60 puts in August

Buy 1x 65 puts in August

Traders can accomplish this for a $40 debit.

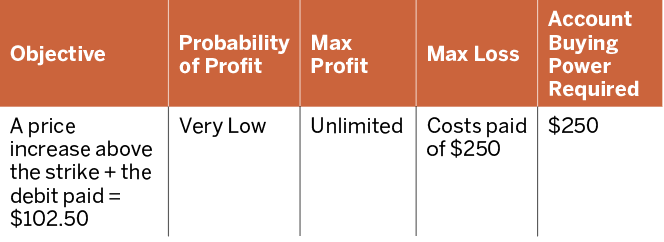

2. Long an OTM option

This is among the least favorite “speculative” trades because the probability of success is low and the costs can be substantial—especially for stocks with the highest volatilities. The higher the volatility, the higher the expected movement and the higher the costs. The higher the costs, generally the lower the probability of making money.

The good news is that it’s easy to determine the breakeven—it’s simply the strike bought with the cost of the option accounted for.

Suppose, for example, a trader predicts that Caesars Entertainment (CZR), at let’s say a price of $90, will increase above $102.50 by expiration (see the table below).

Buy 1x 100 calls in August

The trader accomplishes this for a $5 debit.

This is generally the least-preferred method of speculation, especially when stocks have higher levels of volatility.

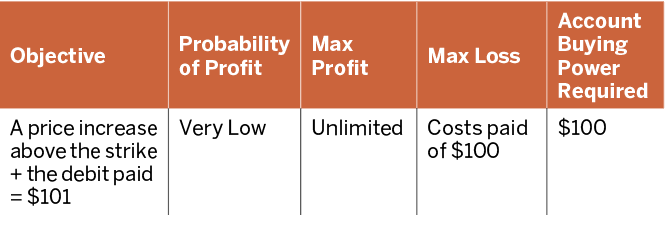

The table below for Activision Blizzard (ATVI) shows an example of the stock with much lower levels of volatility but a similar stock price. Notice that the price of the call is muchlower.

Buy 1 x 100 calls in August

This is done for a $1 debit.

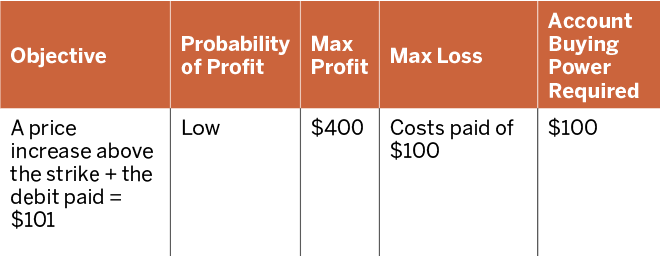

3. The OTM vertical spread

This strategy isn’t always discussed, but traders can use it to speculate. The costs are low because of the credit received from the short option. It’s still a low-probability event but higher than buying the long option by itself.

Suppose a trader predicts Caesars will increase above $101 by expiration. (See the table, below).

Buy 1 x 100 calls in August

Sell 1 x 105 calls in August

This is done for a $100 debit.

Michael Rechenthin, Ph.D., aka “Dr. Data,” is the head of research and development at tastytrade. @mrechenthin