2023: Expect A Trader’s Market

Chaos will roil the economy this year, but the Federal Reserve is creating market opportunities for active investors

Keeping active doesn’t just improve your health. It also bolsters financial well-being.

But it hasn’t always been that way. For years, the debate over active and passive investing has favored the latter. Capital has swung toward exchange-traded funds (ETFs) and mutual funds in an equities market driven by Federal Reserve policies.

Active investing requires a portfolio owner, manager or other “active participant” to make investment decisions and buy and sell equities frequently. Passive investing requires fewer trades and usually involves trying to replicate or outperform the performance of a stock index, such as the S&P 500.

Passive investing has been on a roll. In 2007, Warren Buffett inspired traders to pour more capital into passive funds by winning a $1 million wager against money manager Ted Seides.

Seides had bet his hedge fund could beat a passive S&P 500 fund, but it didn’t. And for years afterward, the performance of active managers continued to trail the relevant indexes.

It’s been difficult to beat the market because the Federal Reserve has been propping it up. Over the last 13 years, the Fed poured nearly $8 trillion into the economy by keeping interest rates at record lows. Unprofitable zombie stocks surged, and careers blossomed for fund managers hawking innovative ETFs and passive strategies—regardless of valuations or fundamentals.

But now the markets have shifted. The Fed is continuing its tightening, including higher interest rates and a planned balance sheet reduction of $1 trillion. In the first nine months of 2022, 60-40 portfolios containing 60% stocks and 40% bonds turned in their worst performance ever. Cryptocurrencies shed 90% or more of their value, and exchange-traded funds like the WisdomTree Cloud Computing Fund (WCLD) dropped in value roughly 50% in 11 months.

What’s more, the pain may not be over for the zombie stocks.

But this year will bring a stock picker’s paradise and an active trader’s market that will see momentum swings, bear rallies and short squeezes like in 2022. And if the Fed does pivot, expect even brighter skies.

So, let’s discuss the joy of active trading and seven reasons why investors can beat the market in 2023 and outperform the ever-growing crop of passive investment vehicles.

1) The Federal Reserve hasn’t pivoted yet, but the market will

Investors have hung on every word uttered by Federal Reserve Chairman Jerome Powell since the central bank began contemplating rate hikes and balance sheet reductions late in 2021.

Markets sank in January 2022 on the expectation of small rate hikes and surged on the promises of “no recession” in March, following a meeting of the interest-rate-setting Federal Open Markets Committee (FOMC). Wild swings defined the markets of 2022.

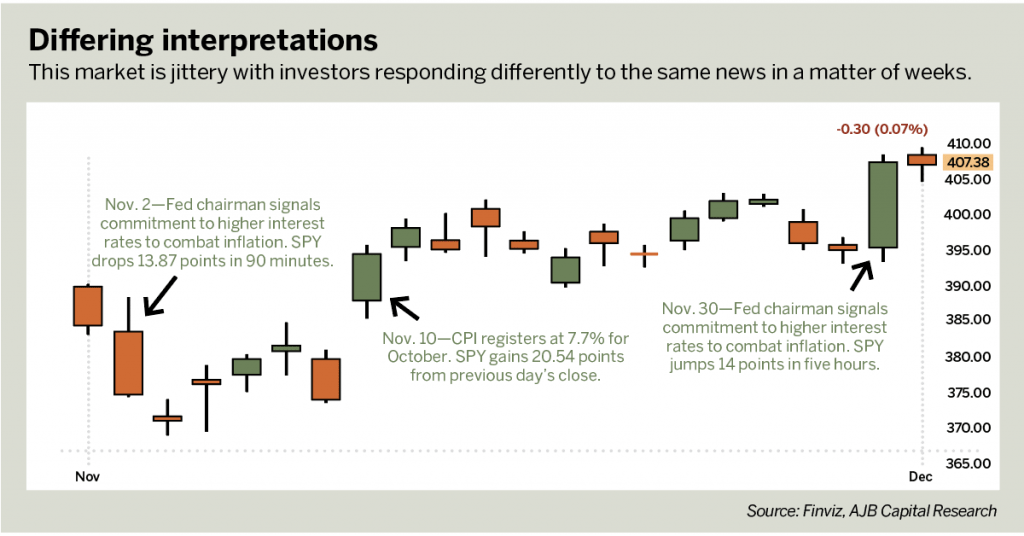

By the end of the year, the slightest change in what Powell said about inflation could trigger a slump or fuel a rally. In November, for example, markets experienced dramatic swings up and down based on his statements.

First, Powell reminded investors the central bank would continue to raise rates to combat inflation. His statement set off the worst one-day performance ever on the day of an FOMC meeting.

Then, Powell spoke at the Brookings Institution on Nov. 30 and again declared the Fed would raise rates with the goal of reaching 2% inflation—but at a slower pace. Speculation that the Fed might call for a 50-basis-point hike touched off a short-covering S&P 500 rally over the last two hours of the trading day.

Powell’s language had changed only a little, yet markets delivered two much different outcomes.

Given the dramatic short exposure in the market, a squeeze pressed the S&P 500 to a critical technical level of 4,100 in two days. It was a reminder of how contrarian approaches based on technical levels and never-ending speculation can cause dramatic rallies and breakdowns. It also showed differing interpretations of a Fed message can cause wild swings in equities in the months ahead.

As of December 2022, markets continued to price in odds of rate cuts by late 2023, suggesting the central bank has reached its goal of bringing inflation down to its 2% target. Such an achievement would have no historical precedent, and supply chain challenges and energy volatility may persist, creating inflation in the year ahead.

By May 2023, the market will likely start to anticipate that the Fed will begin discussing the timing of rate cuts. Instead of focusing on the size of rate hikes as in 2022, future speculation will center on the size and timing of moving the Fed funds rate lower to stimulate the economy.

Expect more volatility, more range-bound trading and more price swings through the duration of the Fed’s quantitative tightening. It makes for a more exciting market for active, disciplined traders who aren’t afraid of riding these waves.

2) Insider buying hasn’t called a longer-term bottom

November and December are typically strong months for executive insider buying, which occurs when corporate leaders buy stock in the companies they run.

However, insiders haven’t bought aggressively since January 2022, signaling they may believe the bottom isn’t in. The whipsawing markets have created chaos, squeezed out shorts and fueled dramatic reversals.

But executives appear keenly aware of potential recessionary pressure, the threat of earnings compression and more challenges for the macroeconomic outlook.

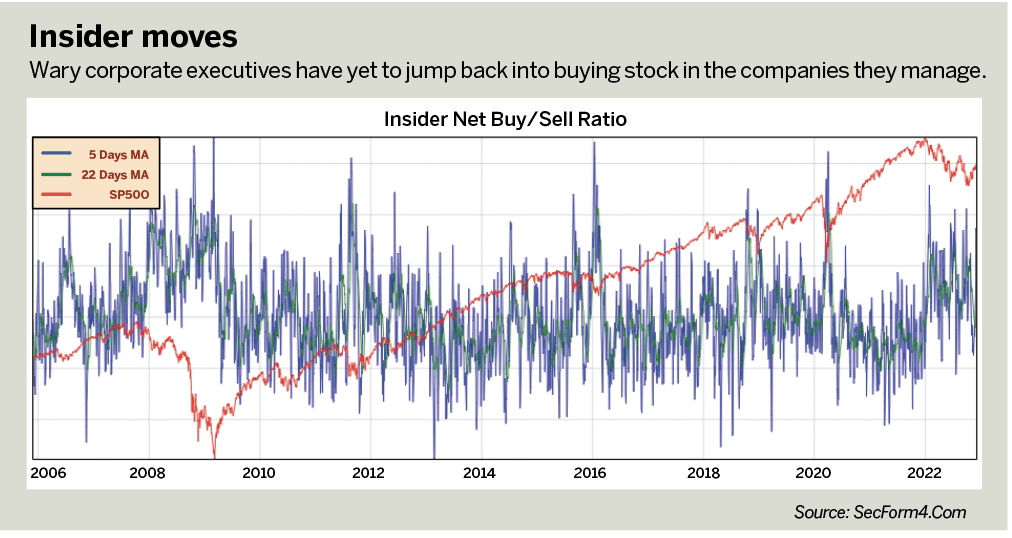

The chart above shows the five-day moving average of insider buying to insider selling over 17 years.

The higher the blue line on the chart, the higher the ratio of executive purchases to sales. In October 2008, executives were historically early in calling a bottom in the market but soon doubled down in March 2009 when the Fed expanded its quantitative easing.

The chart suggests executives collectively called the bottom in the market in the 2011 European debt/U.S. debt ceiling crises, the 2015 China tantrum, the 2018 Fed rate hike cycle pivot and the March 2020 crisis after the Fed’s stimulus program.

Insiders were early again in January 2022, with the most robust buying ratio since the beginning of COVID. However, we haven’t seen a purchasing period that resembles the previous crisis, which means executives remain wary of the economy and await more direction from monetary leaders.

That suggests more pressure may come for this economy and the market.

3) Blame the herd mentality on Apple

Last year was challenging for managers at ETFs as valuation compression and speculation about Fed policy pushed asset prices lower.

ETF managers have engaged in more crowded trades to align with their benchmarks. A fine example is widespread adoption of Apple (AAPL) shares to both active and passive ETF portfolios.

In January 2021, 289 ETFs owned Apple shares, according to ETF.com. By December 2021, the figure had increased to 320. By the end of 2022, the tally grew to 403. The proliferation of ETFs is undoubtedly driving the trend.

Still, the significant increase explains an ongoing adoption of technology stocks to align with the performance of benchmarks—largely the S&P 500 ETF (SPY) and the Invesco Nasdaq-100 ETF (QQQ). Apple represents 6.5% of the weight on the SPY and 13.2% of the QQQ.

Such decisions may have violated the original investment thesis of the ETF itself. For example, the Global X S&P 500 Catholic Values ETF (CATH) reputedly aims “to provide an efficient solution for investors looking to invest by Catholic beliefs.” So, what does a 6.6% weight in Apple, 5.6% stake in Microsoft (MSFT), 2.5% stake in Amazon (AMZN), and 1.7% stake in Alphabet (GOOGL) have to do with Catholic values? The Fund’s net asset value has a nearly identical performance to the S&P 500 Index fund and carries a 26.4% stake in information technology stocks. Again, someone should explain the investment thesis. While those funds may continue to hold a large swath of technology stocks, there’s the threat of forced selling, capitulation or capital rotation among funds to other assets.

If thematic ETFs start to sell assets like Apple and move back to their investment thesis, it could create interesting price action.

4) Value exists in this market

For 13 years, it’s been easy to believe fundamentals no longer matter.

The post-COVID rally of 2020 helped power a remarkable equity rally that started to deflate in February 2021 in tech stocks and compounded with a decline in January 2022.

As geopolitical tensions have grown worse, supply-side challenges remain in critical sectors like energy, agriculture, real estate and materials. Even in the face of China’s increasing demand for oil, uncertainty about Russia’s supply and domestic upticks in production, several companies are trading in U.S. energy markets at attractive valuations.

For example, Marathon Oil (MRO) and Epsilon Energy (EPSN) operate in oil production and exploration. Both companies have strong balance sheets and low buyout multiples. Their enterprise value compared with earnings before interest, taxes depreciation and amortization (EV/EBITDA) is under eight.

Instead of purchasing these stocks at current prices, active investors can sell put spreads to maximize long-term gains. For Marathon Oil, consider selling the $23 put for April 2023. Buying the $21 put for protection requires $145 in buying power to generate $55 in credit. That represents a 38% possible return by April and gives traders a breakeven price of $22.45. That breakeven represents a 16% drop from December and has a probability of profit above 65%. Consider doing it if the implied volatility rank is above 30.

5) Are buybacks dead?

Next year could create some unstudied liquidity tension for the markets.

The Federal Reserve will still be cutting its trillion-dollar balance sheet.

Meanwhile, corporate buybacks—companies using excess cash to repurchase and retire stock—may have peaked. Last year, Goldman Sachs (GS) noted that buybacks totaled nearly $1 trillion with companies like Apple leading the way. But in October, Goldman slashed its outlook for S&P 500 buybacks by 10% because of concerns about future earnings.

Any pullback in buybacks could create additional liquidity pressure, while the January implementation of the 1% buyback rule mandated in the Inflation Reduction Act of 2022 may deter the practice.

In 2019, Larry Light at Fortune magazine noted that financed debt funded more than 50% of corporate buybacks that year. The practice is common, but with interest rates rising and concern about recession, more pressure could come to bear on companies to stay calm but be ready for problems.

6) Volatility is an investor’s friend

Tastylive, the online television network for active options traders, continues to expand its coverage of implied volatility rank (IVR). It focuses on active trading strategies that use IVR to gain advantage.

IVR on a 52-week scale compares the current ranking of a stock’s implied volatility to all other days over the past year. Understanding IVR can help traders identify what to trade and what strategy to use.

An IVR of 25 would mean implied volatility sits 25% of the way between last year’s highs and lows. An IVR of 60 indicates implied volatility sits at the 60% level in that range.

Tastylive hosts Tom Sosnoff and Tony Battista typically look for stocks with an IVR over 30 to sell options to generate income at a high probability of success. When stocks are trading under 30 it’s a potential opportunity to go long premium and buy calls and spreads.

Look for stocks with high liquidity scores indicating tight liquid markets. Combine them with high IVR to sell premium. Look for high liquidity scores and low implied volatility to buy premium.

7) MOMENTUM MATTERS

Decades of research have established that investors can’t time the market.

But would-be traders would do well to learn about market momentum gauges, an active tool created by J.D. Henning, an academic, active trader at Seeking Alpha, and editor of Value and Momentum Breakouts, a service for investors.

Henning uses a variety of technical trading strategies to manage 12 portfolios, including an active ETF portfolio and a leveraged/inverse leveraged ETF portfolio. As of Dec. 1, 2022, all his portfolios had beaten the S&P 500.

His automated momentum gauges that actively track capital flows in the market have been even more impressive. There are lots of momentum switches, but Henning’s versions had remarkable success in 2022.

He bases his extensive research on his doctoral dissertation, and he follows S&P 500 and Russell 2000 momentum by tracking breakout and breakdown conditions in an entire universe of stocks. He brings it down to one positive or negative number and actively trades stocks, index funds and leveraged funds based on his proprietary momentum gauges.

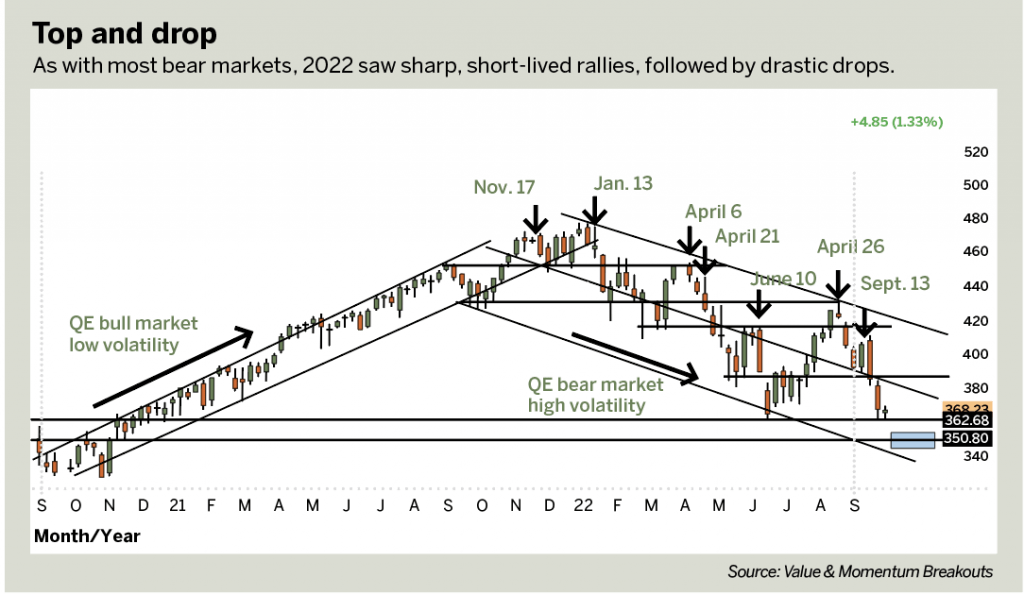

Henning’s record of avoiding dramatic selloffs in 2022 is complemented by his service’s historical performance dating back to 2019. His model has measured 22 topping signals that preset short-term selloffs and correctly tracked large inflows that fueled positive momentum swings and moved higher on the SPDR S&P 500 ETF and the iShares Russell 2000 ETF.

Through September 2022, four major topping events occurred in the market, which predated more significant selloffs. They were on Jan. 13, April 6, June 10 and Aug. 26.

In April, a furious selloff complemented the most substantial outflows of capital from ETFs since 2018. Following the June 8 selloff that pushed the market from overbought to oversold in seven days, the gauge was correct in the early stages of the sharpest hedge fund selloff in more than a decade.

The system creates another tool for active S&P 500 and Russell 2000 traders. Active traders are better at managing options strategies—like put selling and covered calls.

So, what does it all mean? In 2023, markets will continue to parse every word Powell utters, algorithms will still account for 80% of the trading and options will continue to explode in popularity.

The macroeconomic climate, technical setups, and fundamental opportunities create a very active environment.

Don’t buy and hold. Trade smart…and actively.

Garrett Baldwin, a commodity and trade economist, serves as Luckbox editor-at-large. He actively trades value and momentum stocks and wagers on sports and prediction markets.