A New Player in Products for All Ages

No longer part of Johnson & Johnson, Kenvue blazes a new trail for its brands like Band-Aid and Listerine

The name is not as familiar as that of its former parent company, the venerable Johnson & Johnson. But in its segment, Kenvue, spun off from Johnson & Johnson in 2023, is a giant aimed at serving the lifetime needs of customers, from baby care to anti-aging skincare products.

Breaking up into two independent companies, Johnson & Johnson (JNJ), founded in 1886, is to focus on its larger pharmaceutical and medical devices business. Likewise, Kenvue (KVUE) is free to pursue opportunities in what it calls “everyday care” with a roster of familiar consumer brands.

While Kenvue has been an independent company since August 2023, Johnson & Johnson retained a 9.5% stake in Kenvue until March 2024. At that time, JNJ exchanged its final shares for debt held by Goldman Sachs (GS) and J.P. Morgan Securities (JPM).

Pure play

Now that it’s no longer a division of a pharmaceutical company, Kenvue bills itself as “the world’s largest pure-play consumer health company by revenue,” and its products come with iconic names like Band-Aid, Benadryl, Imodium, Johnson’s, Listerine, Neutrogena, Rogaine and Tylenol.

Many of Kenvue’s top brands are the market leaders in their categories—sometimes by wide margins. For example, during a May 2024 earnings conference call, Kenvue CEO Thibaut Mongon said the company’s Listerine mouthwash brand is five times larger than its next name-brand competitor.

Kenvue’s business units

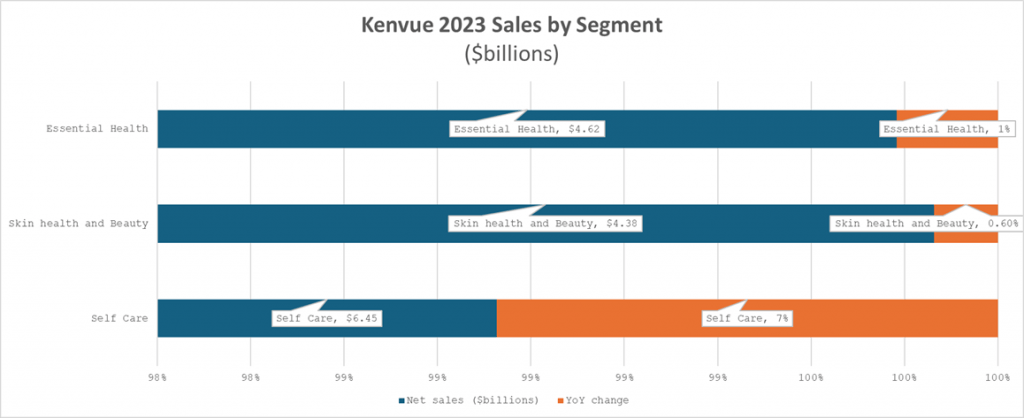

Kenvue is organized into three broad segments:

- Self Care: Over-the-counter medicine and supplements. Revenue from this segment grew 7% in 2023, compared to 2022 performance, reaching $6.45 billion.

- Skin Health and Beauty: Products such as moisturizers, aimed at maintaining healthy skin. Revenue from this segment grew 0.6% compared with 2022, totaling $4.38 billion.

- Essential Health: Personal care products across subcategories like baby care, wound care, oral care and menstrual health. Revenue from this segment grew 1% in 2023, to reach $4.62 billion.

On Kenvue’s May 7, 2024 Q1 earnings call, Paul Ruh, chief financial officer, said the company would cut 4% of its global workforce and “incur restructuring costs totaling approximately $550 million, split roughly evenly between 2024 and 2025, with a payback period of approximately 18 months.”

The changes are part of Kenvue’s Vue Forward strategic plan, which aims to cut costs and includes a focus on 15 priority brands the company views as its best prospects for maximizing return on investment.

Those brands are Aveeno, Band-Aid, Benadryl, Dr.CI:LABO, Johnson’s, Listerine, Motrin, Neutrogena, Nicorette, Tylenol, OGX, Orsl, Rhinocort, Zarabee’s and Zyrtec.

Financial results

Kenvue, posted 2023 sales of $15.4 billion, a year-over-year increase of 3.3%. But that included a Q4 when net sales decreased to $3.7 billion, a 2.7% decline compared to the year-earlier period. Kenvue reported diluted earnings per share of $0.90 and adjusted diluted earnings per share of $1.29 for the 2023 fiscal year.

In Q1 2024, Kenvue reported sales grew 1.1% to $3.90 billion, from $3.85 billion for the year-ago period. While that growth was modest, it was on top of a 7.3% year-over-year increase in Q1 2023. Earnings per share were $0.15 for Q1, down from $0.27 a year earlier.

Outlook for 2024

Kenvue reported Q1 results on May 7, 2024, and provided the following outlook for the full year.

- Net sales growth to be in the range of 1.0% to 3.0%, with foreign exchange expected to be a headwind of approximately one percentage point

- Organic growth (created via its existing resources) in the range of 2.0% to 4.0%.

- Adjusted operating income slightly below 2023, offset by the impact of absorbing a full year of public company costs and approximately 50 basis points of foreign currency effects.

- Adjusted diluted earnings per share to be in the range of $1.10 to $1.20.

A potential megatrends beneficiary

A March 2024 report from Argus Research says Kenvue “is poised to take advantage of megatrends, such as an aging population, the growth of the middle class in emerging markets and increasingly empowered consumers focusing on their health.”

However, Argus cautions that Kenvue faces “deep-pocketed rivals such as Haleon plc, Colgate-Palmolive and Procter & Gamble,” as well as lower-priced private-label goods. And, because Kenvue operates internationally, it is vulnerable to changes in global economic conditions and currency fluctuations.

Kenvue “must also continue to develop innovative products and will likely need to spend aggressively on marketing and promotions,” Argus says.