Amazon’s Tax Gambit

Jeff Bezos and Amazon are supporting higher taxes—a move that’s less counterintuitive than it appears

It’s no surprise that President Joe Biden has introduced sweeping proposals to raise taxes on corporations and wealthy individuals. Biden campaigned for the White House, in part, on the platform of raising taxes to fund infrastructure spending.

“A fireman or a teacher pays 22%, while Amazon and 90 other major corporations pay zero in federal taxes,” then-candidate Biden said on the campaign trail.

While the average taxpayer may not feel the pinch if the individual tax rate is raised only for those making more than $400,000 annually, the story is different (and far more complicated) for corporations. Despite Amazon’s status as the best-known example of a company avoiding significant tax burdens, it may stand to win in the long run if the federal government hikes corporate taxes.

Corporate welfare

One of Biden’s rationales for raising taxes on corporations was that the 2017 Tax Cut and Jobs Act (TCJA) freed many corporations from paying federal income taxes despite turning significant profits. The TCJA reduced the statutory federal corporate income tax rate to 21% from 35%.

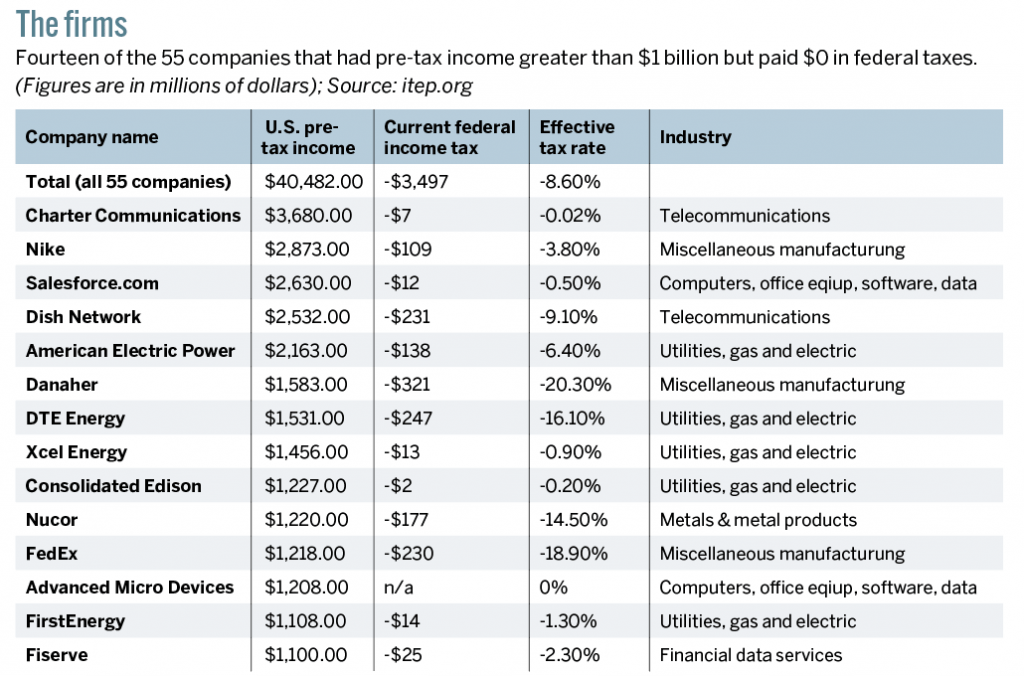

“At least 55 of the largest corporations in America paid no federal corporate income taxes in their most recent fiscal year despite enjoying substantial pretax profits in the United States,” according to the Institute on Taxation and Economic Policy, or ITEP. That’s not quite the 90 that Biden referenced while campaigning, but it’s still significant.

ITEP’s study detailed a potential fiscal windfall for the government if it collected taxes from giant companies that weren’t paying a dime.

“The 55 corporations would have paid a collective total of $8.5 billion for the year had they paid that rate on their 2020 income,” the institute said. “Instead, they received $3.5 billion in tax rebates. Their total corporate tax breaks for 2020, including $8.5 billion in tax avoidance and $3.5 billion in rebates, comes to $12 billion.”

Closing loopholes that enable American corporations to avoid paying taxes could bring in anywhere from $100 billion to $1 trillion over a 10-year period, which would pay for a significant portion of the Biden administration’s infrastructure plan. The American Jobs Plan, as the infrastructure package is called, would cost an estimated $2.3 trillion but could be subject to months-long negotiation.

Bezos plays his hand

What about Amazon paying no federal taxes? Well, it turns out that it wasn’t one of the 55 companies that paid no federal corporate income taxes in 2020. According to Amazon’s 10-K filings for 2019 and 2020, the company paid an effective tax rate of 1.2% in 2019 ($162 million) and 9.4% in 2020 ($1.8 billion).

Facts are facts, and the simple reality is that Amazon has paid less in federal taxes in recent years than it would have had it paid the statutory corporate tax rate of 21%. But its tax burden has risen in each of the past two years. The coronavirus pandemic may have permanently changed consumers’ purchasing habits, so it isn’t far-fetched to think that Amazon’s profits will continue to grow—as well its effective tax rate burden.

Former Amazon CEO and current chairman Jeff Bezos is seemingly sensing which way the winds are blowing, not just on his company’s balance sheet but also in Washington and overseas.

Less arbitrage

In April 2021, Bezos and Amazon came forward with a statement indicating support for the Biden administration’s plan to raise the statutory federal corporate income tax rate from 21% to 28% (the effective tax rate falls closer to 24%). The company issued the statement against the backdrop of Treasury Secretary Janet Yellen forging a path forward with her international contemporaries to end tax arbitrage opportunities by imposing a global minimum tax.

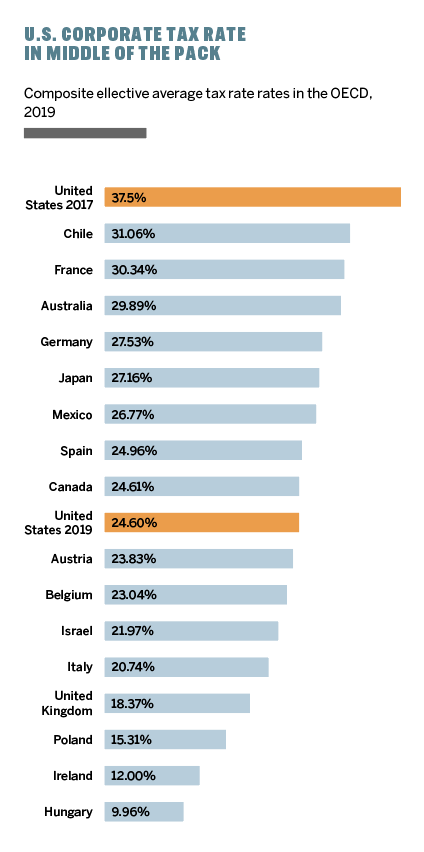

Already, the effective U.S. corporate tax rate is in line with those of the 37 countries that belong to the Organisation for Economic Co-operation and Development, or OECD. (see chart, right.)

In a sense, if Secretary Yellen accomplishes what she set out to do alongside the OECD, then corporate taxes are going up not just in the United States but around the world. That may have the long-term benefit (from the U.S. Treasury’s perspective) of preventing corporations from domiciling overseas for more favorable tax treatment in any of the many countries that still have a lower corporate tax rate than the United States. That, in turn, can help fund infrastructure spending.

Buying goodwill

Taking a step back, it’s clear that Bezos and Amazon’s statement of support for higher corporate taxes is simply good politicking, insofar as a hike in corporate taxes looks like a fait accompli.

By getting ahead of the curve, Bezos is helping to reposition Amazon’s corporate image in a manner that gives it a patriotic air—sacrificing corporate profits for the sake of helping to rebuild America—after a series of setbacks that have irritated politicians on the left and the right. After all, Bezos and his newspaper, The Washington Post, were a favored punching bag of former President Donald Trump, and Amazon defeated a unionization effort in Alabama, much to the chagrin of progressive Democrats.

While The American Jobs Plan carries a hefty price tag that may ultimately produce higher corporate tax rates domestically alongside the OECD’s efforts to put a floor on corporate tax rates globally, Amazon relies on infrastructure to remain profitable. Amazon needs reliable airports, roads, bridges and tunnels if it’s going to meet customers’ demands for shipping goods faster and faster. It also needs improved telecommunications infrastructure for its rapidly growing cloud service, which has an increasingly monopolistic-like hold on the internet.

Of course, Bezos and Amazon stand to benefit in the long run if the infrastructure spending bill gets passed into law. Making Amazon more reliable, more responsive, more able to meet its customers’ demands will only put more pressure on brick-and-mortar businesses that have been struggling for years to compete at scale. From Bezos and Amazon’s perspective, paying a few more billions in taxes over the next few years may be worthwhile if it helps cement market dominance that yields hundreds of billions in profits over that same timeframe.

Christopher Vecchio, CFA, a senior currency strategist for DailyFX, forecasts economic trends in a number of countries. @cvecchiofx