How Much Do Moats Matter?

While Buffett and Musk disagree, a company’s value can reside in its surrounding protective barrier

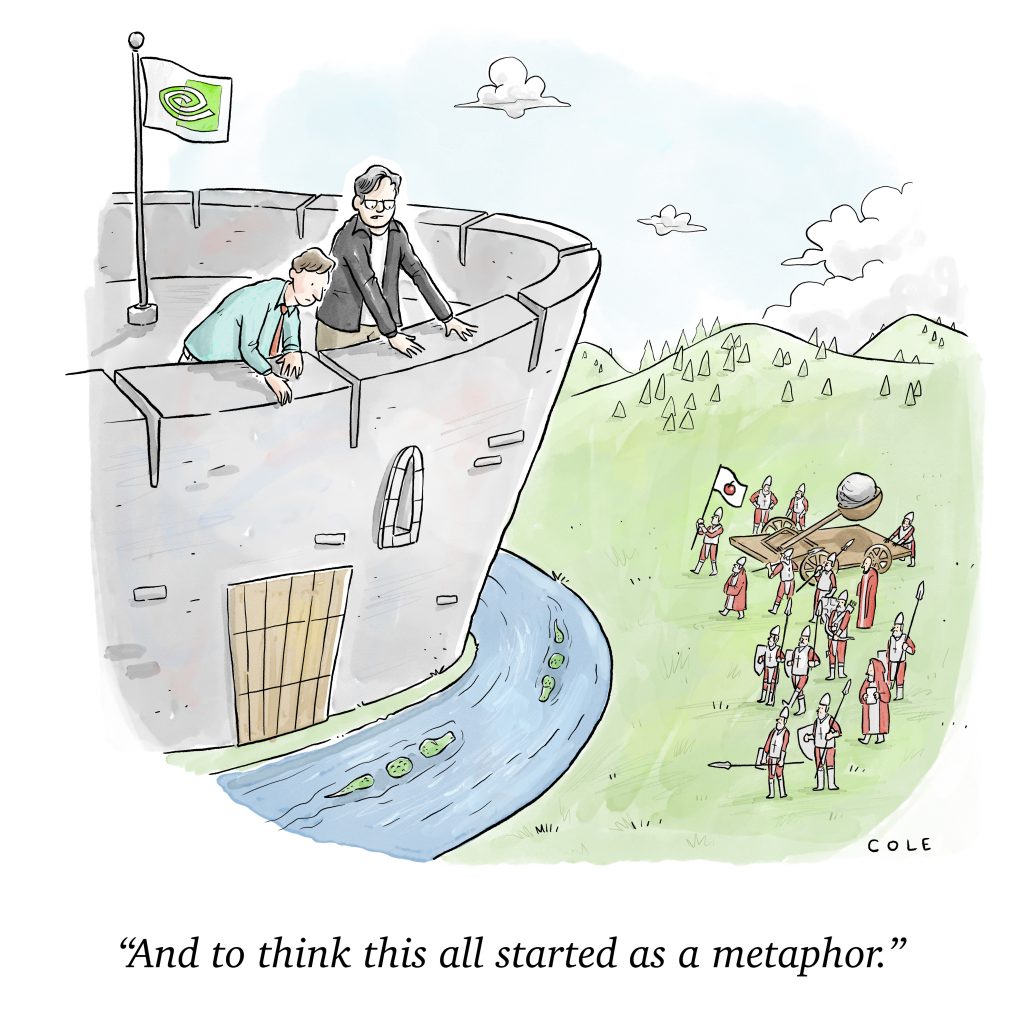

Two of the richest people alive, Warren Buffett and Elon Musk, disagree on a fundamental principle of finance. They’ve expressed diametrically opposing views on the importance of something called an “economic moat.”

We’re not talking about a ditch filled with water around a medieval castle. An economic moat is anything that offers a business a sustainable competitive advantage that safeguards market share and ensures long-term profits. Apple (AAPL) provides a familiar example—who could outdo the clean, distinctive, elegant design of its devices?

“A truly great business must have an enduring moat that protects excellent returns on invested capital,” says Buffett, the legendary 94-year-old chairman and CEO of the holding company Berkshire Hathaway (BRK.A and BRK.B). He’s relied on moats as an investment guide along the way to amassing a personal fortune of $150 billion.

But Musk, who’s gathered up a net worth of $300 billion as head of Tesla (TSLA ) and privately held X and SpaceX, doesn’t share Buffett’s reverence for economic moats. For him, reputedly the wealthiest tech entrepreneur on the planet, it’s all about pursuing something new, not recognizing established value.

“First of all, I think moats are lame,” Musk has said. “They’re like nice in a sort of quaint, vestigial way. But if your only defense against invading armies is a moat, you will not last long. What matters is the pace of innovation. That is the fundamental determinant of competitiveness.”

Reporters approached Buffett for a reaction to Musk’s somewhat disparaging remarks, and they got one. “Being a low-cost producer is an incredibly important moat,” he maintained. “Elon may turn things upside down in some areas.”

It’s interesting when two of the most successful people can’t agree on what breeds success. So, let’s look at what’s behind those divergent statements from financial icons.

Buffett on Moats

Buffet has earned the sobriquet “Oracle of Omaha” because of his prophetic pronouncements on the markets, his well-informed corporate acquisitions and his decision to live and work in his Nebraska hometown. He’s credited with coining the phrase “economic moat” in a 1986 Berkshire Hathaway financial report.

Since then, Berkshire Hathaway’s written communications with stockholders have been peppered with those fateful two words. It’s a mantra, benchmark and measuring stick—a way of viewing the world with an eye toward long-term profitability. It’s not just a catchphrase. It’s more like the basis for investing wisely.

When Buffett sees a believable moat and a reasonable price for a stock or for a whole company, he concludes it’s time to buy. GEICO insurance, one of the dozens of businesses owned by Berkshire Hathaway, provides a prime example.

The GEICO name comes from its original mission as the Government Employee Insurance Company. Today, it’s become a household word, partly because it differentiates itself by offering discounted polices but also because of a relentless advertising campaign featuring “Martin,” the promotional gecko character “born” in 1999.

You could think of Martin as more than just an anthropomorphic representation of a lizard with a slightly Cockney accent. He’s the walking, talking personification of an economic moat. Who could ever conjure his equal as a reptilian company representative?

But Buffet had his eye on GEICO long before the gecko came on the scene. The investor was still a grad student at Columbia University in 1951 when he wrote that GEICO was “the company I like best.” Still, it wasn’t until 1996, after the insurer had nearly collapsed and made a comeback, that Berkshire Hathaway took full possession.

And as a side note, Buffett went on the record as noting that innovation, the pursuit Musk praises, had done little to lower costs at GEICO.

Innovation aside, GEICO became one of dozens of auspicious Berkshire Hathaway takeovers guided at least in part by the search for economic moats. Others include such familiar names as Duracell, Fruit of the Loom, Dairy Queen, Johns Manville, and Kraft Heinz.

What Buffett and Berkshire Hathaway saw in those and many other companies may have been combinations of some of the general attributes that can constitute moats.

Digging a moat

One key element of a moat lies in keeping the cost of production low. That could come from proximity to raw materials or having patented technology. It could result from increasing the productivity of the labor force through improved training and automation. Companies could also achieve it with the help of workflow efficiency and by introducing data-backed efforts at improvement.

High switching costs are often cited as moat-worthy. That refers to the expense customers would incur if they changed brands. An example would be leaving a cellular service that might be buying out a contract or purchasing new equipment.

The network effect can help create a moat. That’s when the value of a product or service depends on the number of buyers, sellers or users. Examples include companies that provide more value when they acquire customers.

Harvard Business School Online puts it this way: “Etsy and eBay offer vastly more value to users if one million, instead of 100, sellers use their platforms. Uber and Lyft provide greater convenience and reliability to riders when more drivers join their platforms. When it comes to social media sites, users find the channels more interesting and varied as more people sign up.”

Another moat builder is intangible assets. They can be patents, goodwill or intellectual property—anything that doesn’t have a physical presence but prevents or at least impedes rivals from entering a market or competing effectively.

Economies of scale can also contribute to forming a moat. It’s a matter of making enough of something that unit costs go down as production becomes more efficient.

It’s hard to believe the value of these moats is lost on Musk. Perhaps he just finds them pale compared to his penchant for creating something heretofore unknown.

Musk on innovation

Musk pursues his goals not through abstract complexity but instead with straightforward simplicity, according to an analysis by the Massachusetts Institute of Technology (MIT).

“What matters is the pace of innovation, access to resources, and raw materials,” MIT quotes Musk as saying.

MIT interprets that to mean “entrepreneurs can quickly and easily gauge whether they have what it takes to turn their wild idea into reality using this simple equation. It breaks down into three basic questions: 1. How long will it take you to build? 2. Do you have access to the right resources? 3. Can you obtain the required raw materials?”

Some might say that sounds a lot like the qualities of the moats that Musk minimizes.

At any rate, another company, Nvidia (NVDA), the subject of this week’s Luckbox magazine lead story, has pursued moats successfully enough to become the world’s most valuable company at nearly $3.6 trillion.

In the process of reaching the pinnacle, Nvidia has invested no less than $2 billion in developing the Blackwell graphics processing unit (GPU), and it’s still working on even more powerful successors to tighten its grip on leadership in generative AI.

Blackwell chips are believed to be two and a half times faster than Nvidia’s older H100 chips, when used to train large-language AI models like OpenAI’s ChatGPT, says Business Insider. They’re five times faster when used to run those models in real applications, a process called inferencing, the site says.

It’s made demand for Blackwell AI chips “insane,” according to Jensen Huang, Nvidia’s co-founder and chief executive. But the moat they’ve created—like most other moats—seems anything but insane.

“Buy the rumor, sell the news?” Maybe it should be “buy the moat.”

Ed McKinley is Luckbox editor-in-chief.