Trading on the Side

It should come as no surprise that trading ranks highest among the side hustles Luckbox readers choose to pursue. In each issue, the magazine’s staff seeks to empower active investors to feel more confident, take control of their trading and investment decisions, and press for better outcomes. In this special section, Luckbox explores trading as a side gig, introduces a trader who’s been fascinated with the markets for more than half a century and offers expert advice on maximizing the after-tax returns of an active-trading side hustle.

Part-time Trading

Uber and Lyft drivers may seem to dominate the gig economy, but only about 1% of the workforce relies on app-based platforms as their single source of income, according to the Bureau of Labor Statistics.

Yet, even without that high-tech help, masses of Americans are finding a place in the new independent workplace, either full-time or part-time. In fact, 43% of workers who hold down a regular full-time job are supplementing their income with second jobs, according to a Bankrate survey.

Surprisingly, 40% of those side hustlers are already successful in their main gigs. They make more than $80,000 a year and hold postgraduate degrees. So, they’re taking on a second job not to make ends meet, but to have more cash to spend.

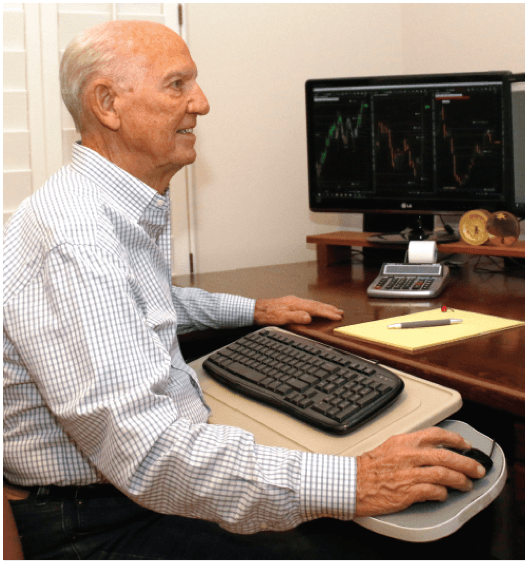

That raises a question—what are the best ways to generate extra income while spending less time doing it? Luckbox readers aside, could part-time trading become the new go-to side hustle? Take a look at a few reasons why.

Few barriers to entry. Although it takes some money to get started, saving to invest could present a better opportunity than simply stashing cash in a savings account or investing start-up expenses in a side gig. Putting money into a savings account is the same as lending it to the bank. Deposits are federally insured up to a certain amount, but with current ultra-low interest rates many banks pay little to no interest, on that hard-earned cash and the prospects seem dim for higher interest rates anytime soon.

Most brokerage accounts require zero minimum to open, so traders don’t need to invest a lot of money. Beyond some small amount upfront, they really just need a smartphone and an internet connection to get started. There’s definitely no need for a car.

Unprecedented access to markets and technology. Aids to trading have never been more readily available or cheap. In the past, investors paid high costs and fees to buy even a single stock, but the industry has now reduced or eliminated commissions. Most brokerages charge nothing to buy stocks, while most investing apps are free to download and use.

Easy access to information and education. Following the markets and finding companies that are good investments requires effort, but information and training for active investors has become available through live and archived online videos from the tastytrade financial network or via user-friendly apps like dough. They can offer a better use of side-hustle hours than spending time driving for a ride-sharing company or toiling over freelance work.

Better returns. Trading also presents an opportunity to outperform a savings account. Yes, it’s possible to lose money investing, and it’s easy to get caught up in trying to beat the stock market or make a huge profit. But focusing on making a profit of 1% or 2% per trade can prove more beneficial. That’s not only feasible but provides a better return than the fractional interest rates paid by the average bank savings accounts.

Finally, profits from trading are taxed between 15% and 20%, depending on the holding period of the investment. For some, that might be lower than their ordinary income tax rate.

Trading’s not about getting rich overnight, which for many isn’t the goal of a second income stream anyway. About 85% of side hustlers make less than $500 per month from their second job, according to the personal loan company Earnest. So, look at it this way—trading can afford a viable second or even third income for the more than 50 million people with side hustles in the gig economy.

dough:A new app-based, commission-free brokerage firm bills itself as a provider of content for “the next generation of investors.”

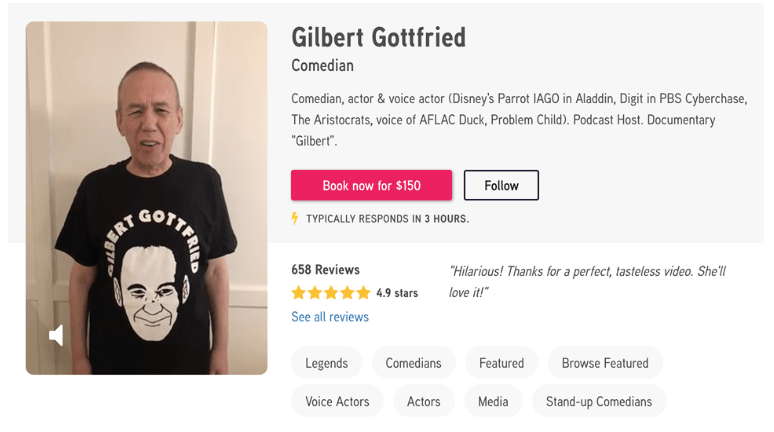

Victor Jones serves as CEO of dough, an investing app with zero account minimums. Jones was formerly director of trading and operations at TD Ameritrade leading trading innovation initiatives in the United States and Asia. @tradewithdough