Uber and Lyft: The Road to Profitability

This contrarian analyst is not selling ride-sharing companies short

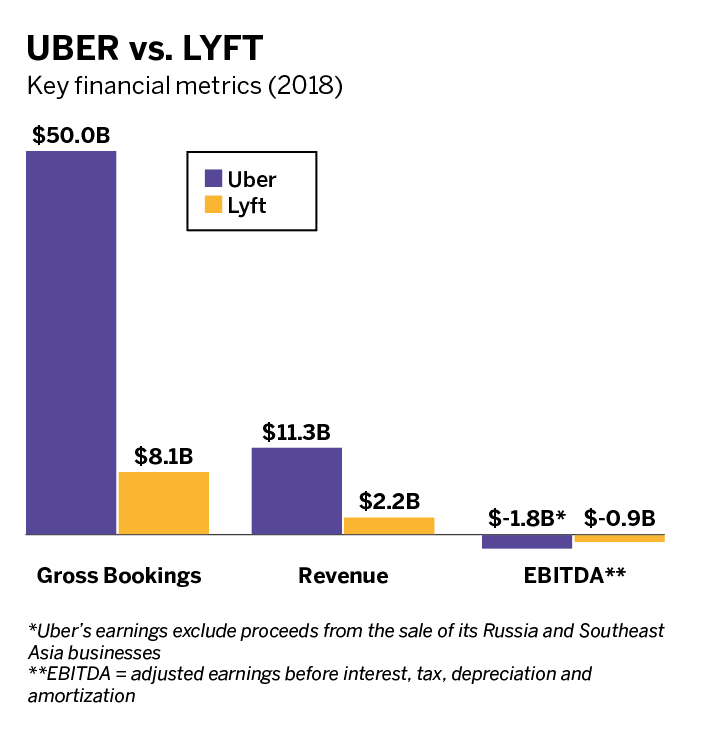

Uber touts overall revenue growth of 20%. On the other hand, Uber is losing approximately $543,000 per hour, putting the company on pace to lose $8 billion this year. While Lyft’s numbers look better, a new California law may impede profitability. With both stocks trading below their IPO prices, and 30% to 40% below their post-IPO highs, analyst Anthony Breen sees an accumulation opportunity—and prefers one company.

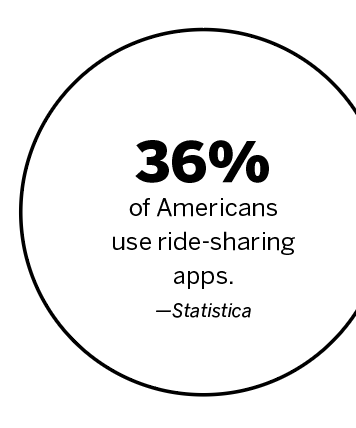

Uber (UBER) and Lyft (LYFT) can seem almost synonymous in North America—functionally equivalent for drivers and riders in most metro areas. Since their IPOs earlier this year, their shares have traded almost in lockstep. But in the wake of WeWork’s recent failed-IPO-turned-bailout, public shareholders are demanding a clear “pathway to profitability,” and revenue growth alone no longer seems like enough.

To assuage shareholders, Uber and Lyft both say they aim to achieve “adjusted” profitability sometime in 2021. Though 2021 still feels far away, that’s significantly sooner than in the timelines both companies provided during their IPO roadshows. Given Lyft’s lower cost structure and its focus solely on North American transportation, the compny’s route to profitability appears less complex than Uber’s. That makes Lyft shares the better buy for those looking to add ride-sharing exposure to a portfolio.

Lyft has lower corporate overhead because it had to be more efficient with capital than Uber during its privately funded growth phase. As recently as 2014, Uber had raised 30 times more capital from private markets than Lyft. That funding gap narrowed over the following years, but Uber has still raised five times as much capital as Lyft. The funding gap has encouraged Lyft to instill a corporate culture focused on efficiency. Subsequently, Lyft has not followed Uber to overextend into food delivery, freight and ride-sharing outside North America.

With three rounds of corporate layoffs since its IPO, Uber is feeling pressure to improve financial results quickly because of its Softbank-

inspired cash burn levels. Uber had negative $2.5 billion cash flow from operations in the first nine months of this year. Lyft’s negative

$59.5 million cash flow from operations in the same period looks saintly in comparison. Uber already has $4.5 billion in long-term debt outstanding. Uber’s outstanding bonds are high-yielding “junk-rated” corporates: They’re rated CCC+ by Standard & Poors and B3 by Moody’s. Conversely, Lyft has no long-term debt outstanding.

Revenue, bookings and take rate

Uber and Lyft’s revenues are reported net of driver pay, which makes sense because the drivers work as independent contractors. But that method of accounting understates the economic impact of the businesses, much the way revenue as a percentage of gross merchandise value (GMV) caused many investors to underestimate Amazon for years. “Bookings” is the GMV of ridesharing, which includes the total fare paid by riders and more accurately measures how much economic activity Uber and Lyft are facilitating.

AB5

Revenue as a percentage of bookings is known as “take rate.” In 2018, Uber’s average ridesharing take rate was 21%, but varied between

12% and 24% depending on the country. Lyft’s 2018 take rate was 26.8%. Drivers want the take rates to be as low as possible, so they get paid a higher percentage of fares. In North America, many drivers operate on both apps and drive for the one they feel is providing a better take rate. Aware of that, both companies compete for drivers by providing alternating incentives to keep them on their platforms.

California Assembly Bill 5, or AB5 law, goes into effect Jan. 1 and limits opportunities to classify workers as independent contractors instead of as employees. But drivers will move to full-time employee status gradually. A base number of full-time drivers in each city may help Uber and Lyft optimize route networks, but it would be economical to employ only a low percentage of the total driver pool full-time. A referendum on alternative legislation is scheduled for November of next year. In the meantime, Uber and Lyft say they will pass along to consumers any AB-related cost increases.

Many Uber and Lyft drivers appreciate the flexibility of working as independent contractors but would like higher pay. After accounting for vehicle expenses, many are barely making more than minimum wage—and, in some cases, less. Uber and Lyft are responding by raising fares and finding ways to increase drivers’ productivity.

Private equity’s influence and lockup expiration

Despite private equity’s penchant for publicly listing portfolio companies just before revenue growth slows, they may have left some meat on the bone with Lyft. Lyft’s 2019 revenue growth should be around 66%. Uber is too large to grow its top line that fast anymore, but its revenue growth did reaccelerate to 30% in Q3 2019. With Uber and Lyft shares down about 50% from IPO highs, public investors now have an opportunity to invest at better prices than some private rounds. Uber’s Series E, F, G, G-1, G-2 rounds were all raised at prices above $30 per share. General Motors (GM) led Lyft’s $1 billion Series F round at $26.88 in January 2016. Alphabet’s (GOOG) CapitalG private equity arm led Lyft’s $1 billion Series H round at $40 per share in October 2017.

With the amount of private capital raised, lockup expiration dates have loomed large over ridesharing investors. Lyft’s lockup expiration was August 19, 2019, and officer sales have been limited in size, mostly to cover taxes from stock and option grants. There have been no reports of either Alphabet or General Motors selling their Lyft stakes. Uber’s lockup expired on November 6, 2019, and it will be interesting to track sales disclosures (and lack thereof) over the coming weeks.

Despite financial media’s current “WeWork on Wheels” analogies, profitability for the ridesharing duopoly should come in due time. Lyft’s market capitalization to trailing revenues ratio has fallen from about 6x to 3x since the IPO. Despite this, a 3x trailing revenue multiple going forward, would lead to future share price appreciation in line with revenue growth.

Anthony Breen, CFA, co-founded Alphamont Funds LLC, a registered investment advisory specializing in concentrated equity portfolios. @breen_anthony