Portfolio Diversification in a Post-Pandemic World

While an international public health emergency like COVID-19 isn’t a frequent occurrence—at least not one affecting such a large portion of the human population—it nonetheless speaks to the importance of a diversified investment portfolio.

As has been well-publicized, the pandemic catalyzed shutdowns of national economies across the globe, and the result has been an impairment of earnings in both public and private companies.

Because profits, or potential profits, are one of the main drivers of valuations in the stock market, the stock market has embarked on a rollercoaster as market participants try to ascertain how much different stocks are worth.

Now that Q1 2020 earnings season is mostly in the books, it’s become clear that the coronavirus pandemic has created a defined group of winners and losers as it relates to the degree of earnings impairment resulting from the crisis.

And beyond earnings, there’s been further confirmation of the “losing” market segments based on increasing layoffs. When companies are facing financial headwinds, they often look to reduce headcount as a way of bringing expenses back in line with dwindling revenues.

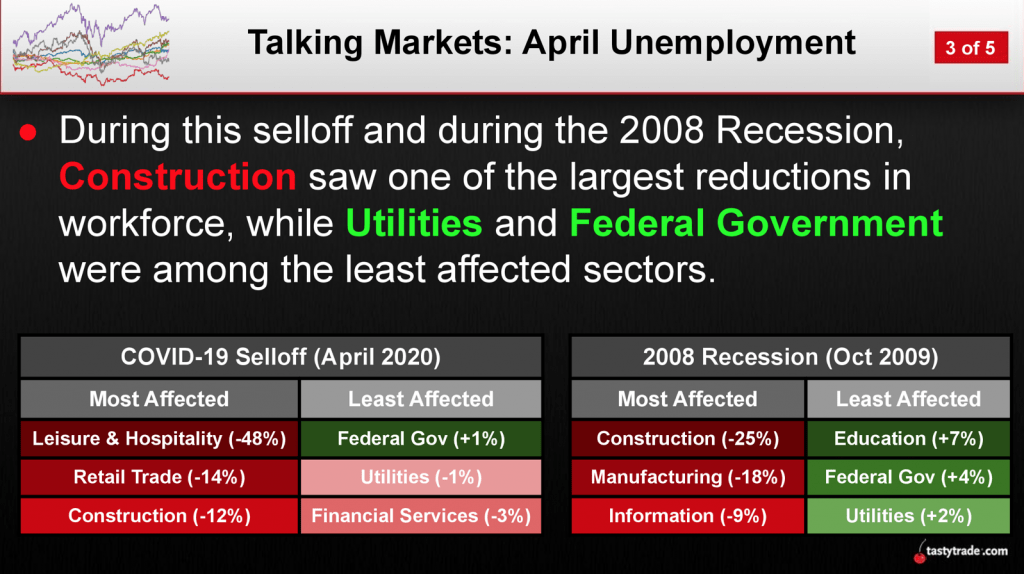

The graphic below highlights how different market segments have been impacted more severely during the 2020 coronavirus crisis, and how the current situation compares to the 2008-2009 Great Recession—from the standpoint of workforce reduction:

The above confirms what most already know: The leisure/hospitality, as well as retail trade market segments have been particularly hard hit during the coronavirus crisis.

This is logical because as many in the world have embraced social distancing, they’ve adjusted their lifestyles to avoid large groups and contact with strangers. Generally speaking, this has materialized in less travel, eating at home more often and fewer visits to brick-and-mortar retail spaces.

As one might expect, the stock prices of companies in the market segments most affected by the crisis have seen outsized losses, the airline industry being a prime example of this unfortunate reality.

In turn, that means investors and traders with concentrated holdings in these market segments have experienced deeper hits to their portfolios when compared to market participants with long positions in market segments that are more suited to the stay-at-home lifestyle.

This latter group includes companies such as Alphabet (GOOG), Facebook (FB), Microsoft (MSFT) and Netflix (NFLX), among others.

Based on these developments, the importance and value of one market philosophy in particular has been enhanced through the lens of the pandemic: portfolio diversification.

In the financial world, diversification speaks to the process of allocating capital in a manner that reduces concentrated exposure to a single asset, product or market segment.

Uncertainty related to the coronavirus crisis has served as a stark reminder that discretionary spending on vacations, luxury items and other non-essential goods and services can dry up amidst a recession, which the United States is almost assuredly experiencing at this very moment.

And while widespread global health pandemics occur infrequently, recent history suggests that market corrections aren’t that rare.

The U.S. stock market has experienced three severe corrections in the last two decades, including the “Dot-com Bubble” (2000-2002), the Great Recession (2008-2009) and the current crisis/recession. Moreover, each of these market contractions has been characterized by different groups of winners and losers, as illustrated in the previous graphic.

As such, it’s impossible to predict what market segments (or asset classes) might be hardest hit during the next crisis, a reality that underscores just how important it may be to diversify going forward.

For those seeking quantitative confirmation on the value of portfolio diversification, a recent episode of Market Measures on the tastytrade financial network provides ample evidence.

On this installment of the series, the hosts review a recent market study conducted by the tastytrade research team that focuses on portfolio diversification. Due to the complexity of this material, a thorough review of the complete episode is recommended when scheduling allows.

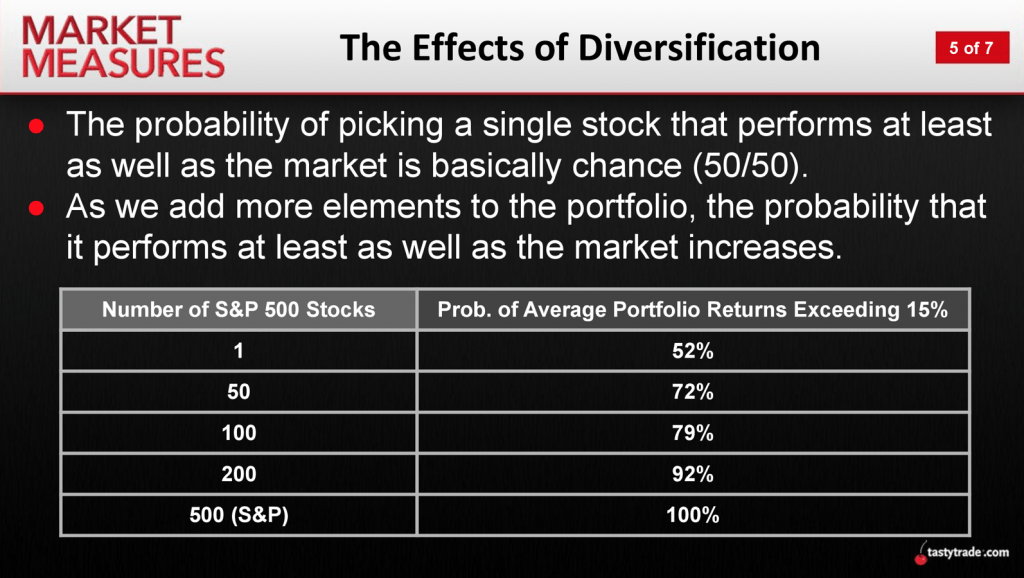

Speaking to the results of the study, the graphic below highlights how attempting to pick a single stock can be a low probability endeavor when it comes to producing consistent, attractive long-term returns.

Instead, research suggests that the likelihood of making consistent, positive returns rises along with the number of underlyings included in the portfolio (or in the product when trading ETFs and indexes):

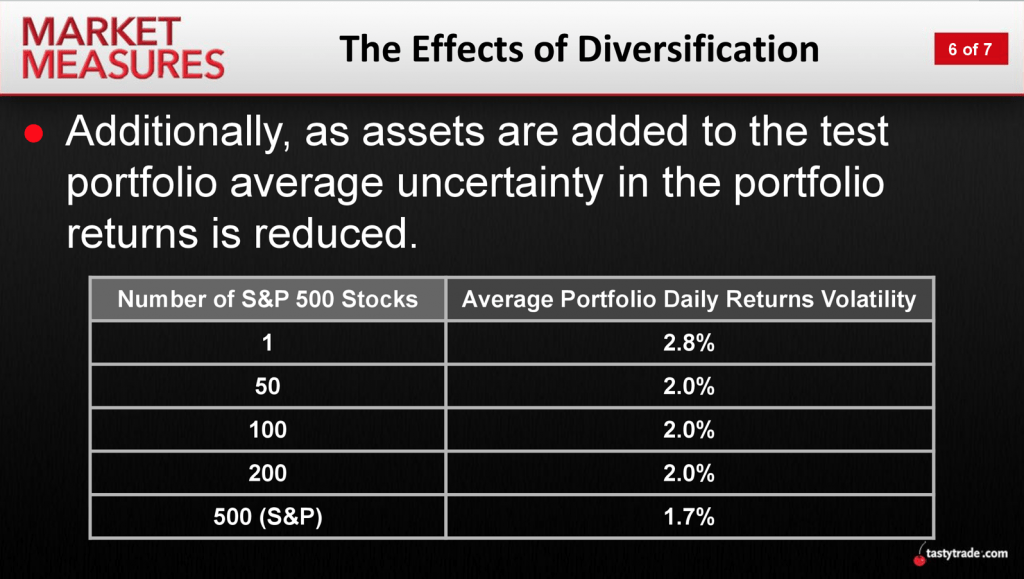

As shown above, when adding more elements to the portfolio, the probability that it will perform at least as well as the broader market increases. An additional benefit of this approach is that by adding diversified exposure to the portfolio, one can also theoretically reduce the daily volatility of returns, as shown below:

Investors and traders seeking these types of benefits may therefore want to make portfolio diversification a focus as they position their portfolios going forward.

For further information on this topic, another new episode of Market Measures titled “Diversifying out Market Correlation” may also be of interest. This show focuses on how the addition of different products to the portfolio, beyond stocks, can also assist in reducing the volatility of returns.

For more information on trading the financial markets, readers may want to review the archives of the tastytrade LEARN CENTER when timing allows.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.