Leveraged and Inverse ETFs Are Now Available on Single Stocks

Single-stock ETFs were first created in the summer of 2022, so leveraged and inverse trading is now available on a limited number of single stocks, much as seen in the leveraged and inverse niche of the existing ETF market.

A single stock refers to a single company and its associated shares and trading ticker, such as Apple (AAPL), Exxon Mobil (XOM) and Microsoft (MSFT).

Exchange-traded funds (ETFs), on the other hand, are typically built using a basket of investments, and are something like a hybrid of a mutual fund and a single stock.

Like mutual funds, ETFs are pooled investment funds that offer market participants ownership in a professionally managed, diversified portfolio of investments. But unlike mutual funds, ETF shares trade like stocks on exchanges, and can be bought or sold throughout the trading day at fluctuating prices.

ETFs are typically built to track the returns of other investment products or themes.

Index ETFs, for example, are designed to replicate and track a benchmark index, like the S&P 500. The SPDR S&P 500 ETF Trust (SPY) is a perfect example of an index ETF. The SPDR Gold Trust (GLD), on the other hand, is a perfect example of a themed ETF, as it was designed to track the value of a tenth of an ounce of gold.

International ETFs offer exposure to a particular region of the world, or a group of international companies with a similar profile. For example, the iShares China Large-Cap (FXI) is composed exclusively of large-cap companies with direct exposure to the Chinese economy.

So what’s a single-stock ETF?

Like most sectors of the economy, the investments and trading industry is constantly evolving. And while some of these innovations become a permanent part of the financial landscape, others quickly fall to the wayside.

One of the latest innovations in the world of finance is the single-stock ETF. As the name implies, these are exchange-traded funds that focus only on a single stock, as opposed to a basket of securities.

Single-stock ETFs were created so that leveraged and inverse trading could be made available on single stocks, as seen in the leveraged and inverse niche of the existing ETF market. Whether there’s demand for such a product in the market is another question altogether.

Previously, leveraged and inverse ETFs have been offered with names like “2x bull” or “2x bear” —like the Direxion Daily CSI China Internet Index Bull 2x Shares (CWEB), or the Daily Energy Bear 2X Shares (ERY).

The new single-stock ETFs are similar to these examples, but instead offer that type of exposure on a single stock. So investors and traders now have access to products that offer amplified and inverse returns on the daily performance of individual stocks.

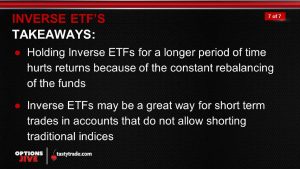

It’s important to note that this also means investors and traders will need to be careful about managing a new dimension of risk, as leveraged and inverse products typically possess increased risk. Moreover, the stated amount of leverage or inverse exposure in most of these products is reset daily, meaning they are essentially short-term vehicles that are not intended to be held over long periods.

As a result, investors and traders that choose to utilize single-stock ETFs will likely do so in order to express short-term bullish or bearish opinions. One example might be to speculate/hedge on an upcoming earnings announcement, or some other single-stock event that is perceived as “binary.”

Binary events are nicknamed as such because they often cause a jagged line on a price chart—catalyzing a big move in either direction. For example, when biotechnology companies submit drug applications to the Food and Drug Administration (FDA), the ensuing approval/disapproval often represents a binary event.

Earnings announcements can sometimes represent binary events as well, especially when they catalyze a move of 20% or more. Snap (SNAP) experienced such a move after its most recent Q2 earnings announcement when shares in the company dropped nearly 40%.

Currently, the single-stock ETF universe is extremely limited, with only a handful of offerings available in the market, but that will likely change soon. AXS currently offers single-stock ETFs on Nike (NKE), Nvidia (NVDA), Pfizer (PFE), PayPal (PYPL) and Tesla (TSLA), as detailed below:

- AXS TSLA Bear Daily ETF (TSLQ)

- AXS 1.25X NVDA Bear Daily ETF (NVDS)

- AXS 1.5X PYPL Bull Daily ETF (PYPT) and AXS 1.5X PYPL Bear Daily ETF (PYPS)

- AXS 2X NKE Bull Daily ETF (NKEL) and AXS 2X NKE Bear Daily ETF (NKEQ)

- AXS 2X PFE Bull Daily ETF (PFEL) and AXS 2X PFE Bear Daily ETF (PFES)

In addition to the above, AXS recently received approval to issue 10 more single-stock ETFs, which will likely hit the market at some point in H2 2022. More will almost certainly follow in 2023.

Direxion and GraniteShares are looking to roll out more than two dozen leveraged and inverse single-stock ETFs at some point in the future, although the final list will ultimately hinge on approval by securities regulators.

As with any new product, investors and traders may want to consider mock trading (i.e. paper trading) single-stock ETFs before deploying a live position in the market. Taking this approach allows one to learn how these positions behave without the risk of capital losses.

To learn more about trading leveraged and inverse ETFs, check out this installment of Options Trading Concepts Live on the tastytrade financial network.

To follow everything moving the financial markets, tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.