The Butterfly Payoff

What’s the right environment for the butterfly spread?

While short straddles and strangles are great trades when investors want to speculate that a stock will not move much, the risk can seem too great. The long butterfly provides a potential alternative.

A butterfly spread has low probability and low risk. That means there’s a low probability of profit but also a low probability of large losses. For that reason, traders can use the strategy when they’re feeling speculative. Even when the butterfly loses money, it typically doesn’t lose big. Because losses will be minimized, it will be cheaper to execute.

But exactly how does this strategy work? And what’s the right environment for the butterfly spread?

An investor who speculates that a stock won’t move very much from its current price can create a butterfly spread by buying one in-the-money option (ITM), selling two at-the-money options (ATM) and buying one out-of-the-money option (OTM).

This leads to paying a debit when opening the trade, which will affect max profit. Overall, the strategy has a neutral assumption, meaning the investor expects the price of the underlying stock to remain fairly close to its current price.

Also, investors typically use butterfly spreads in high implied-volatility environments, which makes butterflies cheaper. Keep the trade as cheap as possible to avoid tying up too much capital and to minimize potential losses.

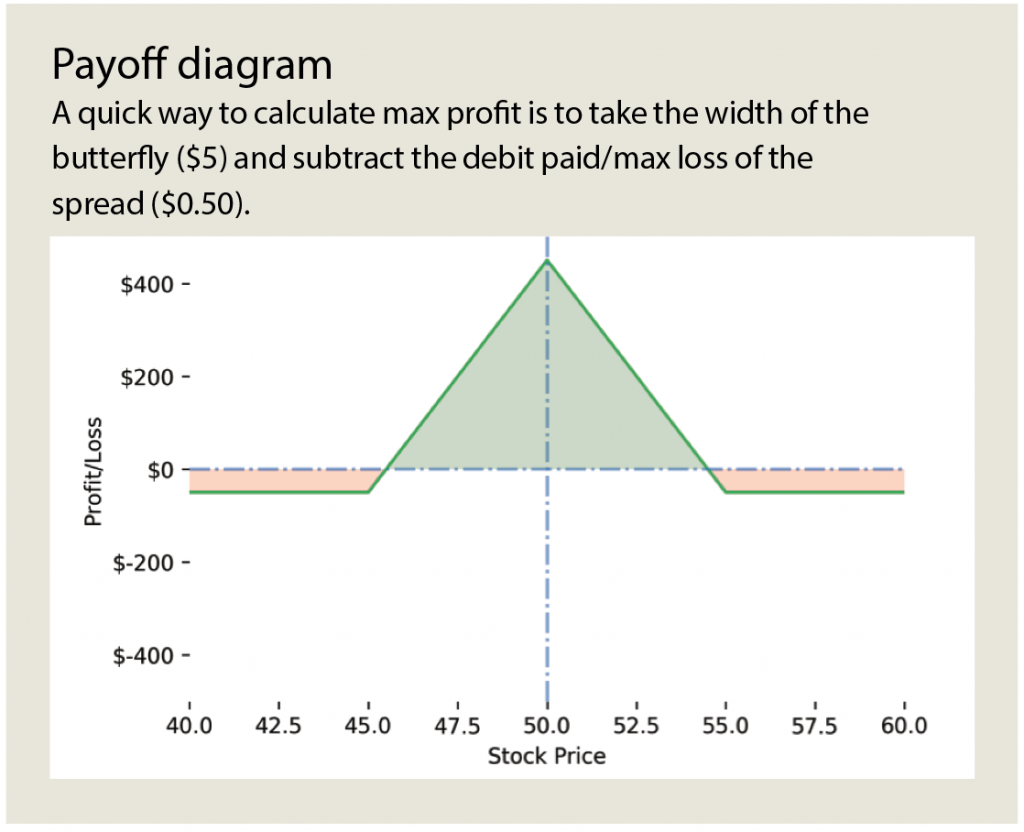

Next, look at the math behind the risk and reward of the strategy. (See “Payoff diagram,” below.)

In the payoff diagram, a butterfly is long one 45 call, short two 50 calls and long one 55 call. It’s a $5 wide butterfly strategy, meaning that the long ITM and OTM strikes are $5 away from the two short ATM options. Say an investor pays a $0.50 debit for this 45/50/500 call butterfly, and assume the stock is at $50. This butterfly has its max profit of $450 when the stock is trading at $50 at expiration and a $50 max loss if the stock is either below $45 or above $55 at expiration. Breakevens for this strategy are $45.50 on the downside and $54.50 on the upside. A quick way to calculate max profit is to take the width of the butterfly ($5) and subtract the debit paid/max loss of the spread ($0.50). In the case of butterflies, the amount an investor pays for it always equals its max potential loss.

This butterfly profits when the underlying price remains between the $45.50 and $54.50 breakeven points, so an investor would want the underlying price to remain fairly close to its current $50 price. Yet even if the underlying price moves outside the breakeven points, it only tests one side, so the maximum loss is that initial debit paid.

Finally, the reason investors want to place this spread in high implied-volatility environments is that the debit paid and max loss will be minimized and max potential profit maximized. Ideally, investors use this strategy when they do not have a directional assumption about the underlying. Because this strategy has positive theta, the ideal scenario is for the stock to stay as close to the ATM short strikes as possible. If that happens, investors realize full max potential profit at expiration. Additionally, profits throughout the trade can accelerate if the implied volatility environment of the underlying drops. That causes the value of the short options to go down more than the value of the long options, thus resulting in a net gain for the overall position.

So, if the implied volatility is high and an investor doesn’t expect the stock price to move much, this strategy could be in the toolbox. But investors should make sure to consider their motives, the current environment and the risk/reward associated with each trade when choosing a strategy.