Switch 2: What’s Next for Nintendo, and Why You Should Care

The highly anticipated gaming console is ready for its debut, but the overhang from tariffs can’t be ignored

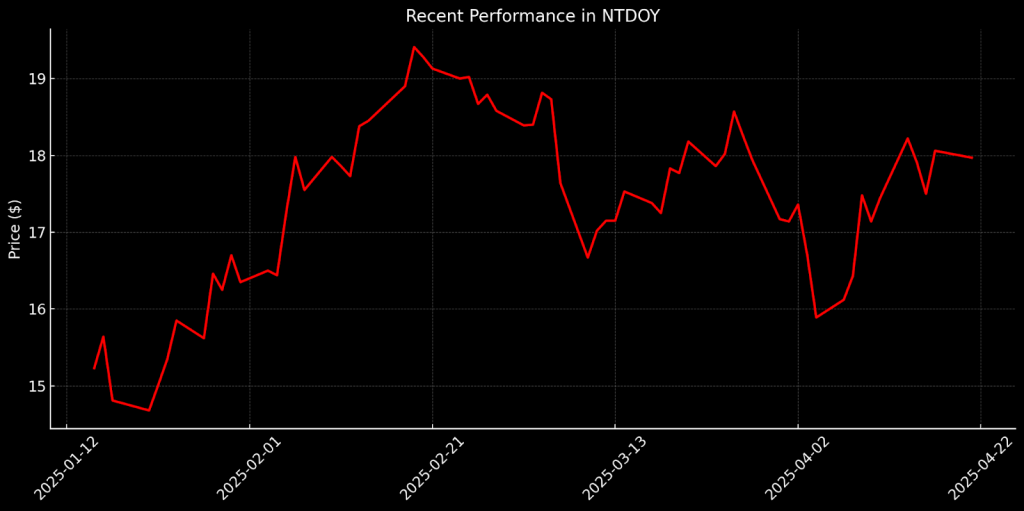

- Nintendo’s stock has surged nearly 50% over the past 52 weeks, driven in part by anticipation of the Switch 2.

- The new gaming console has potential, but tariffs and a premium valuation create near-term risks for the stock.

- The console’s price is $450, and pre-orders are opening today.

Tariffs could force Nintendo (NTDOY) to raise the price of the Switch 2 gaming console it’s introducing this summer, casting a shadow over the company’s financial outlook and raising the question of whether its stock represents a compelling investment opportunity.

The company, famous for its iconic consoles and beloved game franchises, has long been a powerful force in the gaming industry. The Switch 2 was destined to create a sensation, but the timing of the reveal seems especially problematic. The same day Nintendo unveiled details about the device, including its expected U.S. retail price of $450, President Trump declared “Liberation Day” with its widespread import duties.

Japan-based Nintendo spreads its operations spread across Cambodia, China and Vietnam, and at press time the products it ships to the United States from from China face tariffs as steep as 245%.

Fortunately, Nintendo stockpiled about a million Switch 2 consoles in U.S. warehouses during the first two months of 2025, according to Bloomberg. But the company expects to sell upward of 1.7 million units in the U.S. before the June 5 launch. Moreover, the bulk of the consoles arriving this Spring have come from Vietnam, which avoids the crippling tariffs imposed on imports from China. Thanks to the 90-day pause, consoles manufactured in Cambodia and Vietnam are currently subject to a more manageable 10% tariff.

With the Switch 2’s declared value of $338 (the dollar amount subject to the tariff), a 10% duty would add about $34 to the original cost. That would theoretically push the retail price to $484—still within striking distance of the original $450 price point. However, some analysts have speculated Nintendo will stick with the $450 price, even if that means taking a slight loss on some console sales. And based on an April 22 announcement, it looks as though the company has opted for that course of action—at least initially. For now, the Switch 2 will still be priced at $450 per console when pre-orders open today in the United States.

That said, if a 46% tariff were reinstated on imports from Vietnam (the amount Trump originally proposed), the cost of the Switch 2 in the U.S. could rise. Under that scenario, Bernstein analyst Robin Zhu projects Nintendo would raise the price by $50 to $100 per console, pushing the retail from $450 to somewhere between $500 and $550. In Nintendo’s April 22 announcement, the company did warn the cost of some Switch 2 accessories could increase as a result of the tariffs, signaling the pricing is still in flux.

The U.S. market is especially important to Nintendo. Of the 150 million original Switch units sold globally, a staggering 50 million were purchased in the United States. The original Switch is the third-best-selling game console in history, trailing only the PlayStation 2 and Nintendo’s previous handheld success, the DS. But where Nintendo truly excels is in game sales. The company has sold more than 1.3 billion games worldwide for the original Switch, and the combined revenue from Switch hardware and software has already surpassed $60 billion.

So, let’s dive into Nintendo’s financial position and assess its valuation. Shares are listed on the Tokyo Stock Exchange, but American investors can gain exposure to the company through its American Depository Receipts (ADRs), traded OTC under the ticker NTDOY. The ADRs have seen a strong rally recently, surging nearly 50% over the past 52 weeks.

Q4 earnings soften, with Switch 2 sales critical

Nintendo’s recent earnings report makes it clear the company is relying heavily on the potential of the Switch 2. The latest earnings report paints a picture of a company grappling with softer-than-expected sales as the original Switch nears the end of its lifecycle—casting uncertainty over the company’s ability to sustain the growth it’s enjoyed over the past few years.

In February 2025, Nintendo revised its annual profit forecast downward, citing weaker-than-expected hardware and software sales for the original Switch. Through the first three quarters of fiscal 2024, net profit dropped 42% and sales fell 31%. As part of the report, Nintendo scaled back its hardware sales forecast for the original Switch to 11 million, down from 12.5 million. It acknowledged demand was cooling as the console nears the end of its life. The company also reported a drop in digital sales.

The imminent release of the Switch 2 offers a potential turning point for Nintendo. The company aims to build on the original Switch’s success by offering enhanced features and a larger game library. However, the original Switch still has a grip on a large portion of the market, convincing current users to upgrade will be a delicate task. Nintendo’s ability to manage this transition successfully, while maintaining support for existing Switch owners, will be critical to the success of the Switch 2 and, by extension, the company’s financial future.

Despite the recent dip in earnings, Nintendo remains in a solid financial position. The company holds around $9.2 billion in cash and equivalents, along with $4.5 billion in short-term investments. That provides a robust cash cushion to help navigate geopolitical tensions. Beyond gaming, Nintendo is also diversifying its revenue streams through its powerful intellectual properties (IPs), which continue to generate value in emerging sectors. Overall, this financial strength positions the company to weather near-term challenges while laying the groundwork for long-term growth.

For example, the phenomenal success of The Super Mario Bros. Movie, which grossed over $1.36 billion worldwide, highlights Nintendo’s ability to tap into new revenue streams. This film, centered on one of the company’s most iconic franchises, is now the second-highest-grossing animated film of all time, lagging behind only Frozen II at $1.45 billion. With such a strong showing in the entertainment business, it is proving its ability to leverage intellectual properties beyond gaming. Combined with its solid financial foundation, the future looks promising, the company positioned to capitalize on both its traditional gaming legacy and its expanding multimedia presence.

Premium valuation vulnerable to tariff fallout

As we assess the outlook for shares in Nintendo, it’s important to consider the broader market context. On the surface, the Switch 2 should excite investors. It’s a highly anticipated release for a company with a massive and loyal fanbase. New hardware often generates a surge in stock prices, and Nintendo’s track record suggests the Switch 2 could be another hit. However, the path forward depends heavily on how broader macroeconomic risks unfold. The potential for price hikes because of tariffs could hinder Nintendo’s ability to capture the level of success that investors are hoping for.

When it comes to valuation, Nintendo’s metrics indicate the stock is trading at a notable premium. The company’s P/E ratio stands at 41.8, significantly higher than the sector median of 18.8, signaling investors are already paying a premium for Nintendo’s earning potential. However, in light of the risks surrounding the Switch 2’s launch and ongoing trade tension, justifying such a premium becomes increasingly difficult. Similarly, Nintendo’s price-to-sales (P/S) ratio of 10.8 is well above the sector median of 1.1, suggesting the stock is priced at a steep multiple of its sales, which could reflect inflated market expectations. Additionally, the price-to-book (P/B) ratio of 4.9, compared to the sector’s median of 1.9, supports the view that the stock may be overvalued.

Of the 26 analysts covering Nintendo, 17 rate the stock as “buy” or “overweight.” The average price target for the stock is $25 per share, which implies attractive upside from its current price of around $18.50. However, with the stock already having appreciated by roughly 50% in the past 52 weeks, the room for growth may be limited, especially if trade tensions persist or Switch 2 sales disappoint. News related to the trade war could weigh heavily on stock valuations, including Nintendo’s.

Takeaways

Nintendo’s stock is priced at a premium, and with continuing tariff uncertainty the company’s near-term outlook remains clouded. While the Switch 2 holds undeniable long-term potential, the mix of elevated valuation metrics and persistent trade tensions creates a delicate balance, where gains are far from guaranteed. Investor sentiment could shift unpredictably, depending on how these challenges unfold.

On the flip side, a positive shift in the tariff narrative—such as a rollback of trade barriers or easing global tensions—could boost the global economy. If trade tensions subside, a surge in Switch 2 sales might be expected, particularly during the 2025 holiday season. That means a near-term pullback in the stock, which would temper its premium valuation, could trigger a reevaluation of the stock’s relative attractiveness.

In the meantime, investors should keep a close eye on the evolving trade landscape because any shift in the tariff situation could drastically alter the investment case for Nintendo—either unlocking potential for growth potential or deepening the company’s challenges.

Andrew Prochnow, Luckbox analyst-at-large, has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.