2022 Tax Day: Trades, Crypto & NFTs

In 2022, the deadline for filing federal taxes for most taxpayers is Monday, April 18, but extensions can still be filed using Form 4868, which gives taxpayers until Oct.17, 2022 to file a return.

In 2022, the deadline for filing federal taxes for most taxpayers is Monday, April 18.

This is a change from the usual April 15 deadline because April 15 falls on both Good Friday and Passover this year.

The IRS announced an extended tax filing date (May 16) for victims of winter storms in Tennessee, Illinois and Kentucky, and victims of wildfires in Colorado (from affected counties in those states).

Tax filers not able to meet the April 18 deadline can still request an automatic extension using Form 4868. Filing this form gives taxpayers until Oct. 17, 2022 to file a return. To get the extension, taxpayers must estimate their tax liability on this form and pay any amount due.

For those owing money, the penalty for not filing one’s taxes on time is 5% of the total unpaid taxes for each month that the return is late, maxing out at 25%. Those that file on time, but fail to pay, are charged 0.5% per month, to a maximum of 25%.

If a filer is expected to receive a refund, there is no levy applied for filing late—the only negative being a delay in receiving the refund. The IRS announced in 2022 that filers can expect a refund within 21 days, assuming there are no problems with the return.

For status updates on tax refunds, filers can use this link. Updates on this website are usually made available 24 hours after a return is filed electronically, or 3-4 weeks after a paper return is filed.

Questions for the IRS can be addressed via the International Taxpayer Service Call Center, which operates Monday through Friday from 6 a.m. to 11 p.m. ET. To reach the call center, filers can use this phone number: 267.941.1000.

Tax Treatment of Trading and Investment Activity

Given the explosion in trading activity last year, it’s guaranteed there will be many new tax filers reporting such activity in their 2021 returns.

While such reporting can be complex—depending on the type of products traded and degree of activity—there are plenty of online resources available to assist investors and traders with associated tax-reporting rules and guidelines.

Brokers issue Form 1099-B to report their client’s gains and losses, and some of that information is also reported to the IRS. This form is helpful when preparing one’s tax return.

It’s important to review Form 1099-B closely for accuracy, particularly any line items that say “undetermined” or “basis not reported to the IRS.” Tax filers typically need to fill in any missing information.

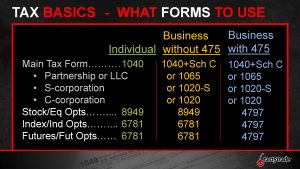

Form 1040-Schedule D is where most tax filers report capital gains and losses. As of 2011, the IRS has required Form 8949 in addition to Schedule D for some taxpayers. Active investors and traders will likely need to complete both.

Securities gains and losses must first be reported on Form 8949, which then flows into Schedule D. For more information on these forms, readers can review this link.

In general, if an asset held for twelve months or less is sold for a profit, it is considered a short-term capital gain. Short-term capital gains are taxed at the taxpayer’s normal tax rate (i.e. “ordinary rate”).

On the other hand, if an asset held for more than twelve months is sold for a profit, it is considered a long-term capital gain. Currently, long-term capital gains are taxed at a maximum of 20% (actual rate varies by taxpayer).

If an asset held for twelve months or less is sold for a loss, it is considered a short-term capital loss. Short-term losses are limited to a maximum deduction of $3,000 per year, which can be used against earned or other ordinary income.

And finally, if an asset held for more than twelve months is sold for a loss, it is considered a long-term capital loss.

Long-term capital losses are generally deductible up to $3,000 per year against other types of income. Any amount over $3,000 is carried forward and deducted at $3,000 per year until it is completely deducted or offset by capital gains.

Tax Treatment of Cryptocurrencies

This year, there’s an extra wrinkle on Form 1040 that specifically relates to cryptocurrencies (aka “digital currencies” or “virtual currencies”).

Just below the “personal information” section of Form 1040 there is a question that reads, “At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?”

Obviously, this question needs to be answered truthfully, but tax filers should be aware that the answer “yes” will likely flag the return such that the IRS will be on the lookout for an associated capital gain or loss on Schedule D.

According to the IRS, tax filers can answer “no” if they merely owned (i.e. held) a virtual currency during 2021, but didn’t engage in any transactions involving that position.

That’s because digital assets like cryptocurrencies and non-fungible tokens (NFTs) are treated as “property” by the IRS, which means any profits from such trades/investments are subject to capital gains taxes.

Like stocks, trades/investments involving digital assets are therefore categorized by short-term and long-term, and taxed accordingly.

It should be noted, however, that taxpayers only owe such levies when those gains are recognized. That’s why tax filers that only held a position, and didn’t engage in any transactions, can answer “no” to the aforementioned virtual currency question on Form 1040.

That means a tax filer would have needed to buy and sell a given position during 2021 for it to be considered a taxable event. A taxable event is any action or transaction that may result in taxes owed to the government.

If a cryptocurrency position was simply held in 2021, but not closed (i.e. sold), then taxes wouldn’t yet be owed until the tax year in which the position is sold (i.e. “disposed of”).

It should be noted that using a fiat currency like the U.S. dollar to purchase a virtual currency is not in itself a taxable event. Just like buying a stock using dollars isn’t a taxable event. The taxable event occurs when that stock or digital asset is disposed of.

However, importantly, swapping one digital asset (i.e. Bitcoin) for another digital asset (i.e. Ethereum) does represent a taxable event. Because in such a transaction one digital asset has been “disposed of” for another.

Every crypto-to-crypto transaction must therefore be reported on one’s tax return, along with any associated gains/losses.

Tax Treatment of Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) are one-of-a-kind digital “collectibles” that are authenticated using blockchain technology and typically purchased with other digital assets.

Despite being labeled as “collectibles,” NFTs are categorized the same as cryptocurrencies when it comes to their tax treatment (i.e. treated as “property”).

Taxable NFT-related activities therefore include: purchasing an NFT using a digital asset such as Bitcoin, selling an NFT for another NFT (i.e. swapping NFTs), or selling an NFT for another asset (digital or otherwise).

As noted previously, any transaction involving two digital assets will trigger a taxable event. Because in such a transaction one of the digital assets has essentially been “disposed of” for another.

Every digital asset-to-digital asset transaction must therefore be reported on one’s tax return, along with any associated gains/losses.

Physical Collectibles

Physical collectibles are defined as works of art, rugs, antiques, metals (such as gold, silver, and platinum bullion), gems, stamps, coins, and alcoholic beverages (among other items), and have their own tax category.

If physical collectibles are held for more than one year, they are taxed at a maximum rate of 28% (actual rate varies by taxpayer). If they are held for twelve months or less they are taxed at the taxpayer’s normal tax rate (i.e. “ordinary rate”).

Additional Notes

This material has been prepared for informational purposes only. Luckbox and its affiliates do not provide tax, legal or accounting advice.

For more on tax-related information pertinent to investing and trading, readers can review this installment of Tasty Extras on the tastytrade financial network.

Updates on everything moving the markets are also available via TASTYTRADE LIVE, weekdays from 7 a.m. to 4 p.m. CT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.