Covered Calls

Stocks tend to rise on about 55% of days, which gives buyers a statistical edge. But poor timing and short-term volatility can spoil profits even with that broad historical statistic working in the favor of stockholders. Luckily, that’s not the highest probability strategy investors have at their disposal.

Buy and hold investors who are wary of turbulence in their portfolio can take advantage of stock options. They can append call and put options to stock positions in ways that trans- form probabilities of profit and risk. The most popular such strategy is the covered call.

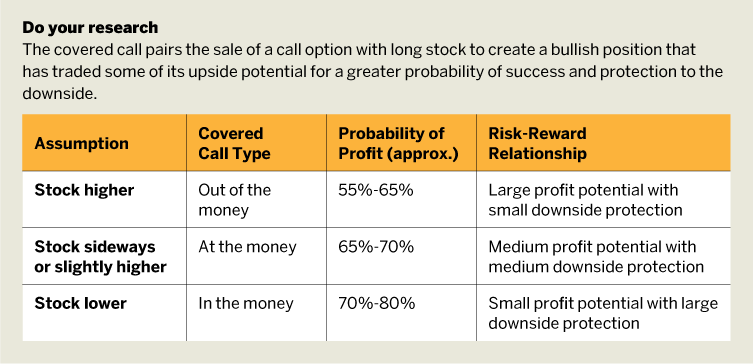

The covered call pairs the sale of a call option with long stock to create a bullish position that has traded some of its upside potential for a greater probability of success and protection to the downside. This low-maintenance extra step in the direction of active investing can make the difference between prof- its and losses in a portfolio. It also reduces volatility, thus alleviating at least some of the potential headaches of buying stock (see “Do your research,” below).

Investors who are wary of turbulence can turn to stock options

Executing the covered call starts with the simple purchase of stock and concludes with the less straight- forward sale of a call option on that stock. This is done at a ratio of 100 shares of stock for every call option because options contracts maintain 100 shares of exposure per contract.

After finding an underlying market, investors should choose an expiration for the sale of the call. The stock portion of that strategy will live on into perpetuity, barring a buyout or bankruptcy, but the call is not so easy to hold. Most investors default to the expiration closest to a month in the future because it is usually the most liquid market and holds some of the greatest premium relative to time. However, investors can adjust that to suit how active they are because they have to buy back the call and resell it in the days before expiration (known as “rolling”). Investors with less time to trade might opt to sell their calls in expirations with several months left.

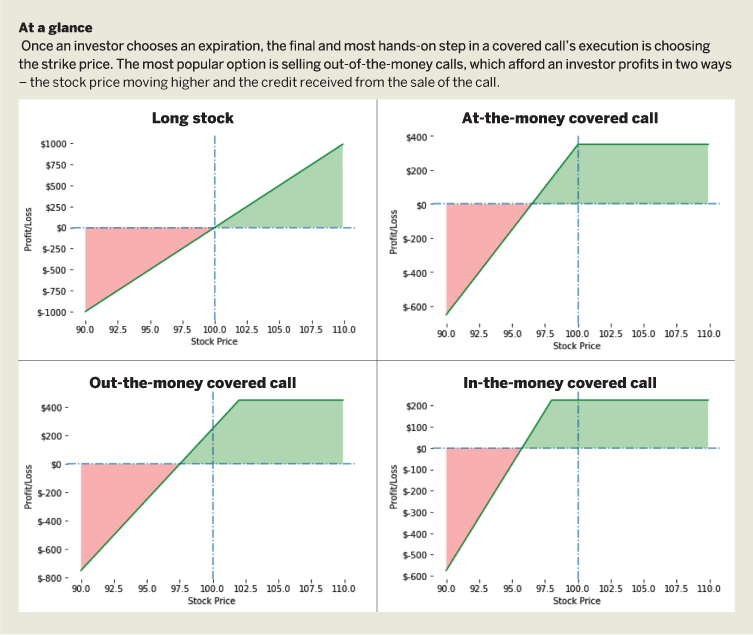

Once an investor chooses an expiration, the final and most hands-on step in a covered call’s execution is choosing the strike price. The most popular option is selling out-of-the-money calls, which benefits investors in two ways – the stock price moving higher and the credit received from the sale of the call.

This option, however, grants the covered call the lowest probability of profit. Going to the at-the-money strike offers the most even mix of potential profit and protection. In theory, the expected profit is simply the credit received from selling the call, as there is no upside potential. The last option – selling an in-the-money call – is the least popular alternative. Though this strategy has the highest probability of profit, investors rarely use it because of its relatively small reward.

S&P 500 ETF

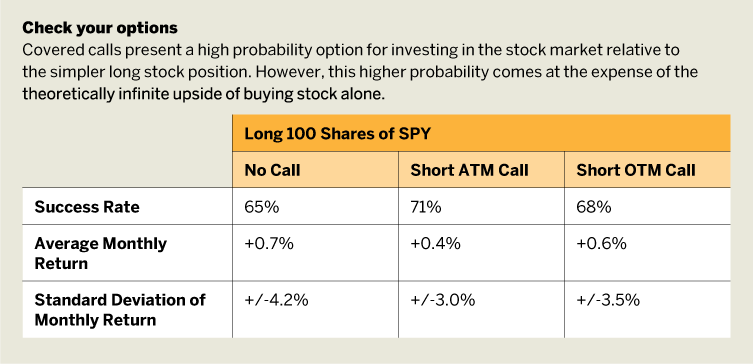

Covered calls present a high probability option for investing in the stock market relative to the simpler long stock position. However, this higher probability comes at the expense of the theoretically infinite upside of buying stock alone. But how much of a bump does the investor get in probability of profit and risk reduction from the short call? How much do they give up for this luxury?

In sideways and down markets, covered calls outperform buying stock alone

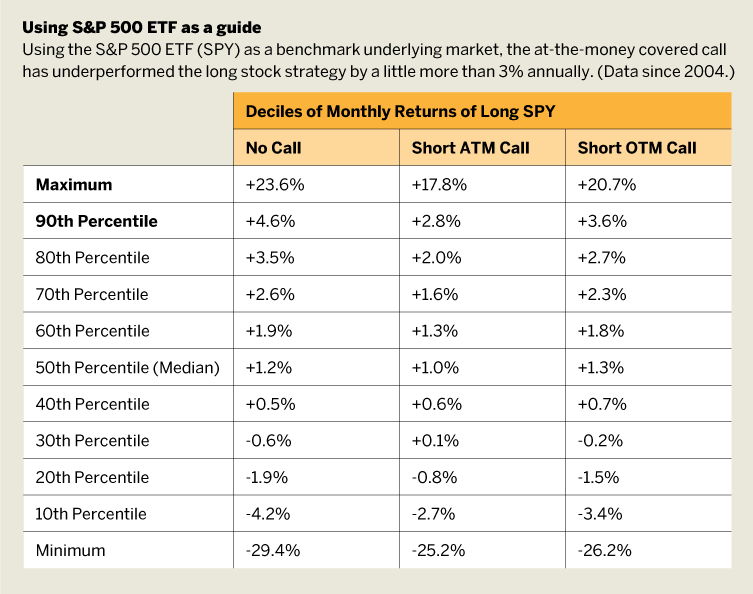

Using the S&P 500 Exchange- Traded Fund (ETF), the SPY, as a benchmark underlying market, the at-the-money covered call has under- performed the long stock strategy by a little over 3% annually. However, the addition of the call dropped the annual standard deviation – a measure of portfolio volatility – by more than 4%, while also reducing the worst-case scenarios.

This study was performed during a bullish period in the S&P 500, which almost guarantees that the naked long stock trade would outperform the covered call strategies. Yet, that’s not a valid assumption for future movement.

Covered calls not only reduce the volatility of a long stock portfolio in all environments, but also outperform buying stock alone in sideways and down markets. In fact, covered calls are bullish positions that can profit even if stocks are down in a given timeframe. At-the-money covered calls profited 25% of months when the S&P 500 was negative in that same month.

Naked shares of stock have greater upside potential, but those greater returns on especially bullish months come at the expense of better returns for slightly bullish or slightly bearish months (see “Using S&P 500 ETF as a guide,” page 60).

In fact, the median return of the covered call strategy using out-of-the- money calls was higher than the stock alone. Also, the at-the-money covered call strategy was so good at mitigating losses that its positive returns extended all the way to 70% of the monthly data points compared to just 60% in the case of the stock position.

Moving the short call out of the money pays the investor both for movement higher in the stock and from the natural decay of the call price. How far the call is moved out of the money is up to the trader. Know- ing that the S&P 500 has returned less than +2% in more than 60% of past months makes the call strike that is 2% away from the stock price a solid choice. This setup still ensures a decent downside protection, while profiting from a realistic gain in the stock.

Cover Your Call

One might think a call greater than 5% above the S&P 500 price is a better choice since 90% of S&P monthly returns reside below +4.6%, but call credits can be so small that they offer little to no downside protection that far away.

The degree of bullishness of the covered call – out-of-the-money being the most bullish and in-the-money being the least bullish – will dictate returns and volatility. In-the-money covered calls often show the smallest volatility of returns to go with the smallest average returns. Out-of-the-money covered calls exhibit a volatility and return similar to that of naked stock, and at-the-money covered calls are between the two. The simple addition of a short call to a long stock position reduces portfolio volatility, while also outperforming the naked stock position a significant portion of the time. The main decision involved in implementing the covered call resides on which strike to choose, which is a function of an investor’s risk tolerance and bullishness.

In-the-money covered calls often show the least volatility and smallest average returns

Those who think stocks have some upside potential in the short term should buy the S&P 500 ETF and simultaneously sell calls around 2% above the stock price. While investors with a less optimistic view of the market can buy shares of SPY and reduce the bullishness of the strategy by selling calls closest to the stock price.

Selling the at-the-money call might be a more prudent decision given the recent bullish movement in stocks. With the S&P 500 up 8% in just the month of January, the market could move sideways or give back some of those gains in upcoming trade. Also, bullish movement in stocks can reduce the amount of premium in their options markets making the out-of- the-money calls less attractive due to their reduced credit. The aggressive ATM covered call solves for both the potential of less bullish movement and smaller call premiums.

Frank Kaberna, a former professional trader, is an online personality for tastytrade.com where he focuses on advanced futures and options strategies.