The Power of Diversification

Stock prices don’t all move in the same direction at the same time, so diversifying a portfolio helps control risk

Despite what financial advisors say, perfect diversification doesn’t exist. Advisors might suggest a little big cap here, small cap there, international this and fixed income that. Then they wave a diversification wand and call upon the magic financial fairy to eliminate risk from the portfolio.

All of this works well as long as the market keeps going up. When the market heads south, that fairy is nowhere to be found. Neither is that financial advisor. But investors who learn a few techniques can succeed no matter what direction the overall market takes. Real diversification doesn’t guarantee high rates of return—its purpose is to gain greater control of the risk in the portfolio through careful selection of uncorrelated products and the mechanical application of selling options.

Diversification provides control of investments by treating them as a portfolio of correlated and uncorrelated positions. Let’s examine a simple portfolio of four symbols and then explore how using options can create positive cash flow each month.

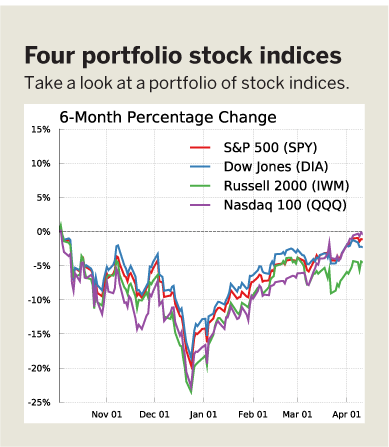

Four portfolio stock indices

Take a look at a portfolio of stock indices.

Take a look at a chart showing a portfolio of stock indices (see “Four portfolio stock indices,”). While they’re all moving in (mostly) the same direction, a slight amount of diversification is gained because the indices contain a large number of stocks and different allocations of components. Thus, the investor is dealing with “unsystematic risks,” which are specific to a company, industry or sector and can be reduced through diversification. But one can do better.

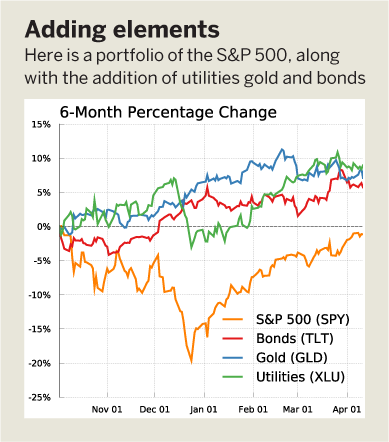

Now take a look at a portfolio of the S&P 500, along with the addition of utilities, gold and bonds in “Adding elements,”.

Even though taking a long position in all of them, the positions don’t all move in the same direction all of the time. So, when equities decline, not all of the portfolio’s positions decline in value. Often during equity declines, gold and bonds increase in value as the market deems them “safer.” Utilities comprise less than 5% of the S&P 500, so many investors’ portfolios are underrepresented in that important sector of the economy. Many long-term investors like utilites because of their historical stability and relatively high dividends (3%), compared to the S&P 500 (1.8%).

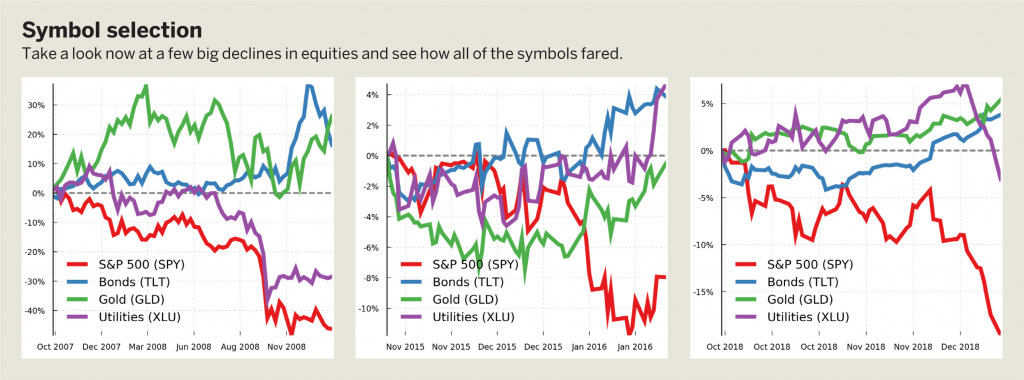

Take a look now at a few big declines in equities and see how all of the symbols fared in “Symbol selection,” below. In all of the scenarios, the S&P 500 declined by significant amounts, yet gold, bonds and utilities either didn’t fall by as much or actually increased. That’s real diversification, and it significantly reduces overall account volatility by lessening the severity of the declines.

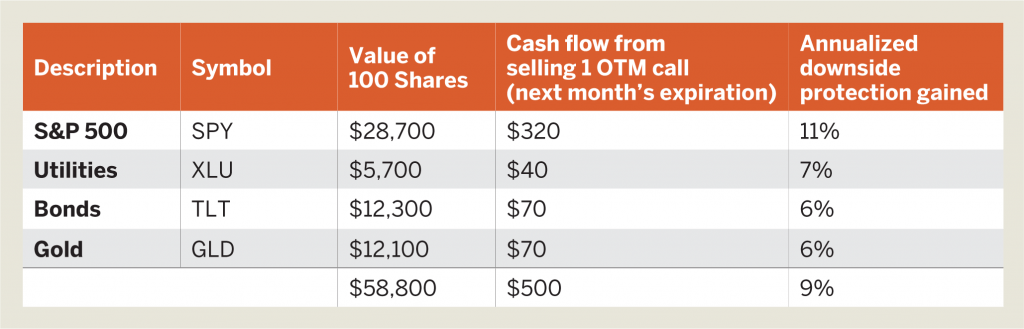

Symbol selection isn’t the only way to achieve diversification. Another way is through strategy selection— selling calls against long positions to reduce risk and create a bit of buffer. Take a look at a portfolio of the four symbols along with a covered call strategy in each in “Power of diversification,”below.

In this diversified portfolio, the investor bought 100 shares of each of the symbols and then sold a call using the first, out-of-the-money strike in the following month’s expiration. In other words, if XLU has a price of $57.25 in June, a trader would buy 100 shares and then sell the 58 call using the July expiration. Using another example, if TLT has a price of $121.10 in June, a trader would buy 100 shares, and sell the $122 call using the July expiration. Owning the stock has the advantage of being able to collect the dividend, while the call works by providing additional cash flow in the account. When the call is near expiration, simply close the call and open another one using the nearest out-of-the-money call. Rinse and repeat!

Selling calls against long positions reduces risk and creates a bit of a buffer

If these numbers are annualized, which is the equivalent of doing these strategies every month on the stocks held, it provides roughly $5,000 worth of premium. This means the stocks could decline by 9% before we theoretically begin losing money. Buying stock alone doesn’t have the same ability to reduce costs. Options provide this value. The drawback is that returns are sometimes capped during strong upward swings, but historically selling the call has the ability to outperform during longer stretches of times. This is the power of diversification.

Power of diversification

Take a look at a portfolio of the four symbols along with a covered call strategy in each. If these numbers are annualized, which is the equivalent of doing these strategies every month on the stocks held, it provides roughly $5,000 worth of premium.

Michael Rechenthin, Ph.D. (aka “Dr. Data”), is head of research and data science at tastytrade.