Calling on Commodities

Just when investors need diversification in the most volatile markets ever, traditional equity products are failing as hedges and diversification tools

With the coronavirus sweeping the globe, equity markets are careening from highs to lows and back again with more volatility than ever before. During the last three years the average daily move in the S&P 500 was around 1%, but it’s jumped to more than 3% since the start of 2020.

The wild swings can feel unsettling, but traders can cushion the shock by constructing a diversified portfolio where healthy increases in one product offset dizzying down moves in another.

For many, diversification involves buying stocks from different sectors. A portfolio of technology, financial and industrial companies, for example, offers more resilience than just owning stock in Apple (AAPL).

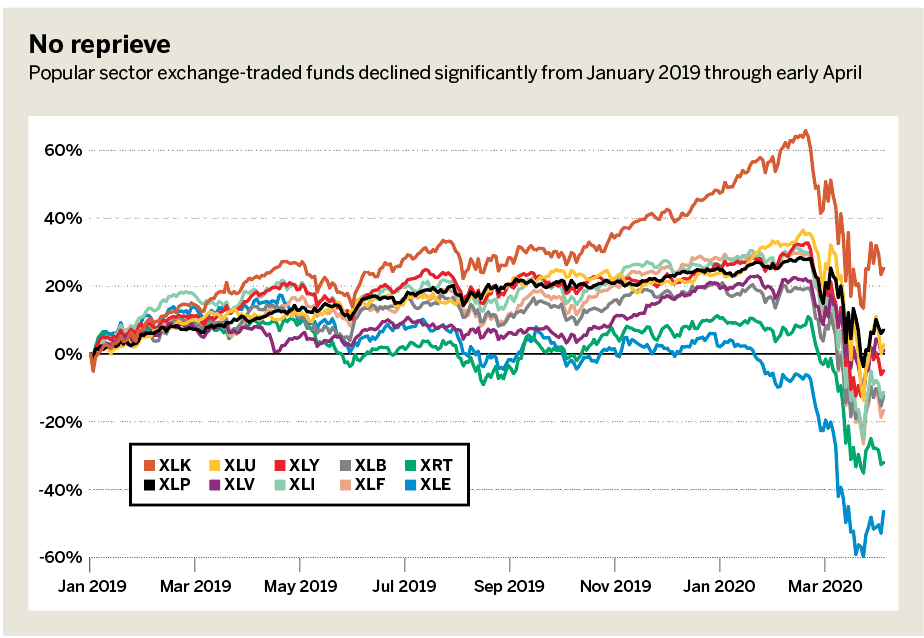

But when volatility increases, even portfolios with stocks from every sector feel the pain. Consider “No reprieve” (below), which depicts the percentage change in popular sector exchange-traded funds (ETFs) from January 2019 until present. While most of the time these products move independently, they all experienced a similar decline when the broad equity market took a hit in late February.

From early February to the time of this writing, the worst-performing ETF, Energy Select Sector SPDR (XLE), was down 50%, while the best-performing ETF, Consumer Staples Sector SPDR (XLP), was down 20%. A portfolio of stocks from several sectors hardly offered a reprieve from the equity market decline.

To diversify a portfolio in a volatile market, investors might want to consider opening their product mix to include commodities. While stock sectors afford decent diversification under normal market conditions, their correlations converge to one when volatility increases.

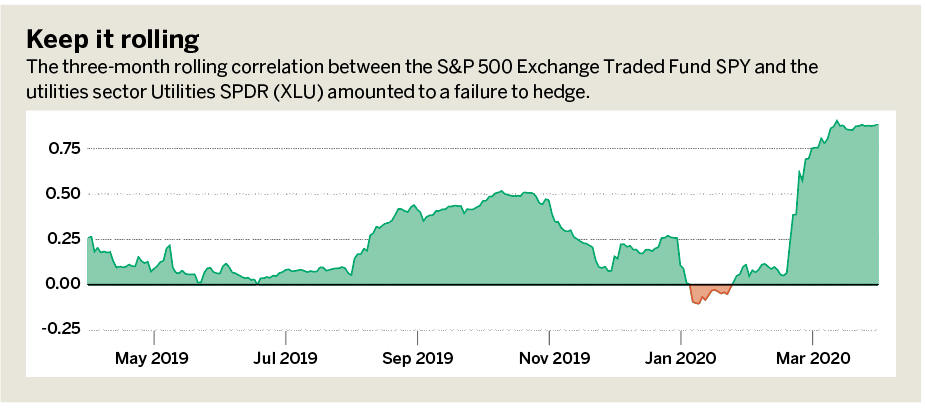

The chart in “Keep it rolling” (below), shows the three-month rolling correlation between the S&P 500 Exchange-Traded Fund SPY and the utilities sector ETF Utilities SPDR (XLU). Through most of 2019 and in early 2020, the utilities ETF exhibited a correlation with SPY of between -0.25 and 0.50.

That means it moved largely independent of the broad equity market. However, just as volatility spiked in February, so too did the correlation. A product that traditionally moved independent of the market and offered great diversification was now moving nearly point for point with SPY. Just when an investor needs diversification most, the hedging relationship failed.

Commodities, such as gold, bonds, oil, foreign exchange and agricultural products, afford more robust diversification that tends to hold up in choppy markets. For the most direct exposure to commodities, investors can use futures contracts. Several ETFs that track these markets serve as decent replacements. During the sell-off depicted in “No reprieve,” commodity markets moved largely independent of equities. Some traded higher, some lower and others remained unchanged.

Commodities can insulate traders from market volatility during all market scenarios. Two of the most useful for robust diversification are gold and bonds. Today, the three-month correlation between gold and the S&P 500 is 0.04, while the correlation between bonds and the S&P 500 is -0.60.

That suggests gold moves largely independent of the stock market and bonds move inversely, making them great products to complement an equity portfolio. More important, these correlations remain consistent and have done so for the last several years.

For additional ways to diversify, consider incorporating a variety of trading strategies, including futures calendars, option spreads and pairs trades.

Michael Gough enjoys retail trading and writing code. He works in business and product development at the Small Exchange.