GameStop Games Stop — A Post-Mortem

A short primer on short interest and the short squeeze

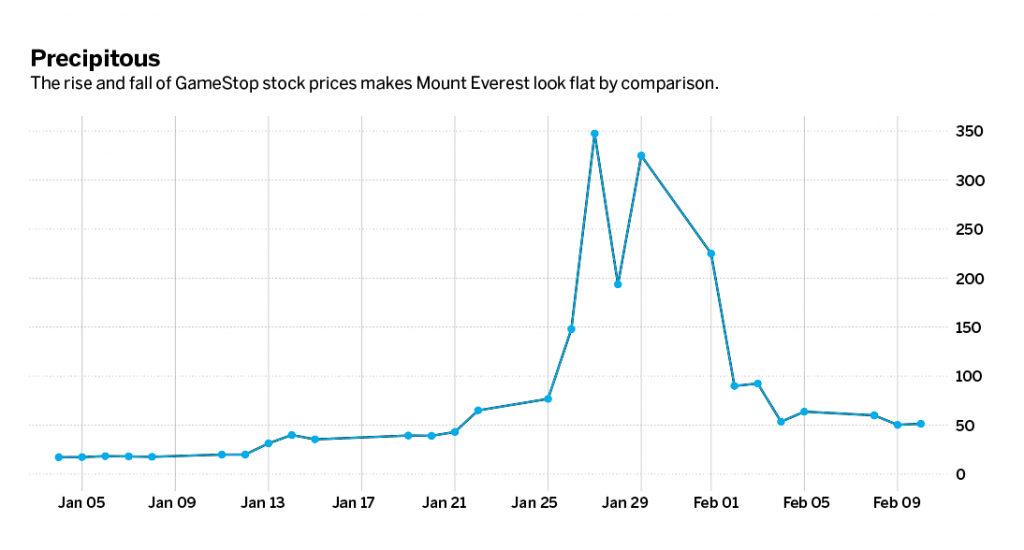

GameStop (GME) caused quite a commotion in the markets early this year when its historic rally became headline news for nearly every major media outlet. In fact, play-by-play coverage of the electronic game retailer’s seesawing stock prices pushed news of the markets’ substantial volatility off the front page of The Wall Street Journal.

The articles chronicled the adventures of traders who made or lost millions, depending on which side of the trade they chose. Hedge funds blew up, and for the first time in recent history, the Street recognized retail investors as a “force to be reckoned with” in finance.

But why GameStop? Thousands of small stocks languish unnoticed, many of them smaller in market value than the video game chain. Yet GameStop spiked from $20 on Jan. 12 to a record high of $483 on Jan. 28. How is that possible?

Short interest

Luckbox will refrain from exploring the reasoning behind the spike, such as who pushed the stock up and why. Instead, let’s study how this came about and why it happened to GameStop in particular.

The short answer is high short interest. The short interest percentage is the number of shares held short, divided by the shares in the “float.” A stock’s float is how many shares traders can buy or sell in the open market. It’s defined as shares outstanding (total number of shares in existence), minus restricted and treasury stock (stock that cannot be sold, usually because it’s held by executives or employees of the company, or held by the company).

In January, GameStop had a float of around 50 million shares. That matters because the number of shares that were sold and that investors held short in mid-January was around 60 million. That’s not a typo. Some 60 million shares sold short with only 50 million shares available to trade. How is that possible?

Coverage of GameStop’s seesawing stock prices pushed other big financial news off the front page.

Because many institutional investors were bearish on GameStop, they had a lot of short positions on the stock. In fact, short interest peaked at around 120% of the float (60 million share short interest, divided by 50 million shares in the float) in mid-January.

Stock is traded anonymously, so no one knew who was buying stock to cover shares that were “shorted” (borrowed from an investor and then sold) or who was buying from someone who actually owned the stock (the owner of record).

However, the clearing firms and brokers know which shares are being loaned and available for shorting, and which orders to sell are closing or short. That information is reported to the stock transfer agent (a separate organization) that keeps track of the owners of record.

More than 100%?

The key to understanding why short interest can be greater than 100% of the float is that the person who owns stock and lends it to be shorted is no longer the owner of record. The owner of record is eligible to receive dividends paid by the company and has the right to vote in corporate elections.

The person who loaned the stock can’t vote the shares, and instead of the dividend receives a “cash-in-lieu” paid by the trader who’s short the stock to the trader who loaned the stock. It’s important to understand that the owners of record do not own more shares than the float.

Here’s an example: Bob, the owner of record of 100 shares of GameStop, allows his broker to lend those shares as part of the short-selling process. Percy, who’s bearish on GameStop, borrows Bob’s 100 shares to short them. When he lends the 100 shares, Bob is no longer the owner of record, even though he has the same risk and potential reward of being long those 100 shares. Alice, who’s bullish on GameStop, buys the 100 shares from Percy when he shorts them.

Alice becomes the owner of record and allows her 100 shares to be loaned. Mike, who’s bearish on GameStop, borrows the shares from Alice to short them. Ed is bullish on GameStop and buys the 100 shares from Mike when he shorts them. Ed becomes the owner of record of 100 shares of the stock. However, both Percy and Mike are short 100 shares, for a total of 200 shares. That’s two times greater than the 100 shares of the owner of record (the float).

But add the 200 shares loaned by Bob and Alice to Ed’s 100 shares, and the 200 shorted shares of Percy and Mike do not exceed that number. The issue of short interest exceeding the float is really about the lack of reporting and suggests the float isn’t the proper denominator for the equation to calculate short interest.

Percy and Mike eventually need to close their short positions, so they each need to buy back the shares they borrowed. If a lot of traders are short the same stock in a short period of time, that creates a potential short squeeze. It’s where traders who are short the stock have to deliver long stock against the stock they borrowed, causing everyone to buy the stock at the same time.

Combining that phenomenon with outsiders who suddenly have an interest in the stock sets off a perfect storm where not only the short sellers are trying to buy stock all at once, but also retail traders are crowding out the supply for the existing short sellers. The stock jumps up in price, and traders call away even more short positions. Suddenly, everyone and their mother is buying GameStop.

The upshot

What’s the lesson here? Don’t worry too much when the short interest rises above 100%—just understand that it’s very high. Short sellers should monitor the stock’s short interest relative to the float. If the number of shares short is a large percentage of or larger than the float of the stock, traders have higher risk of a short squeeze, forcing them to buy back the stock at an unfavorable price.

Anton Kulikov is a trader, data scientist and research analyst at tastytrade. @antonkulikov97