At-the-Money Long Call Spread

Have a hunch a stock will go higher? Here’s a way to buy in at a lower cost and with less risk

This strategy has a 50%

chance of winning and pays 1:1

Sometimes an investor has a bullish hunch and wants to take a shot on a stock going higher. What are the ways of doing that? Well, an investor could buy the stock outright, but that’s usually expensive, carries more risk than a portfolio can handle and ties up capital needed for core positions. A smarter way reduces the big numbers and works with a smaller account.

It requires constructing a position that enables an investor to take a 50/50 shot to the upside (just like buying stock), while limiting risk to a known level (which stock can’t do) and taking up only a little capital. It doesn’t overshadow the core positions, either.

That’s known as a long at-the-money call spread. It has a 50% chance of winning, and it pays 1:1— risk $1 to make $1. Additionally, the strategy is scalable, which means the investor can define the risk to whatever amount they choose, according to the size of the account.

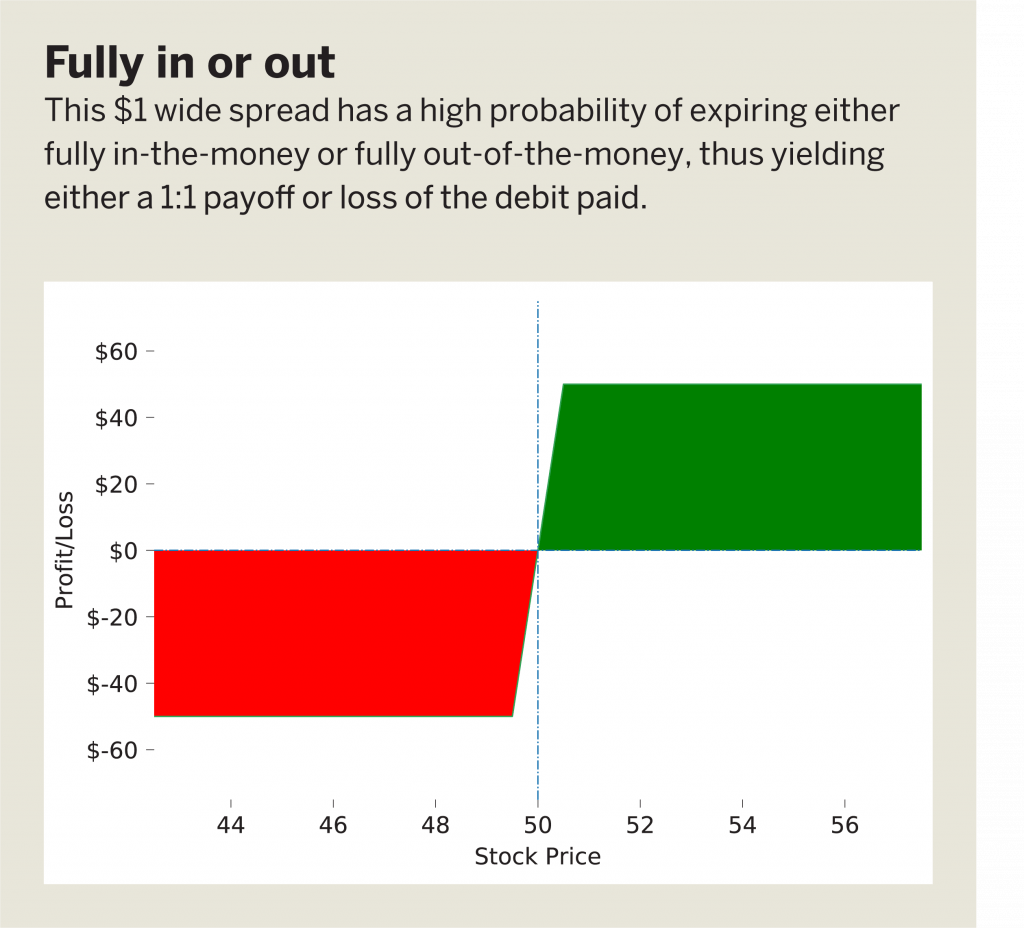

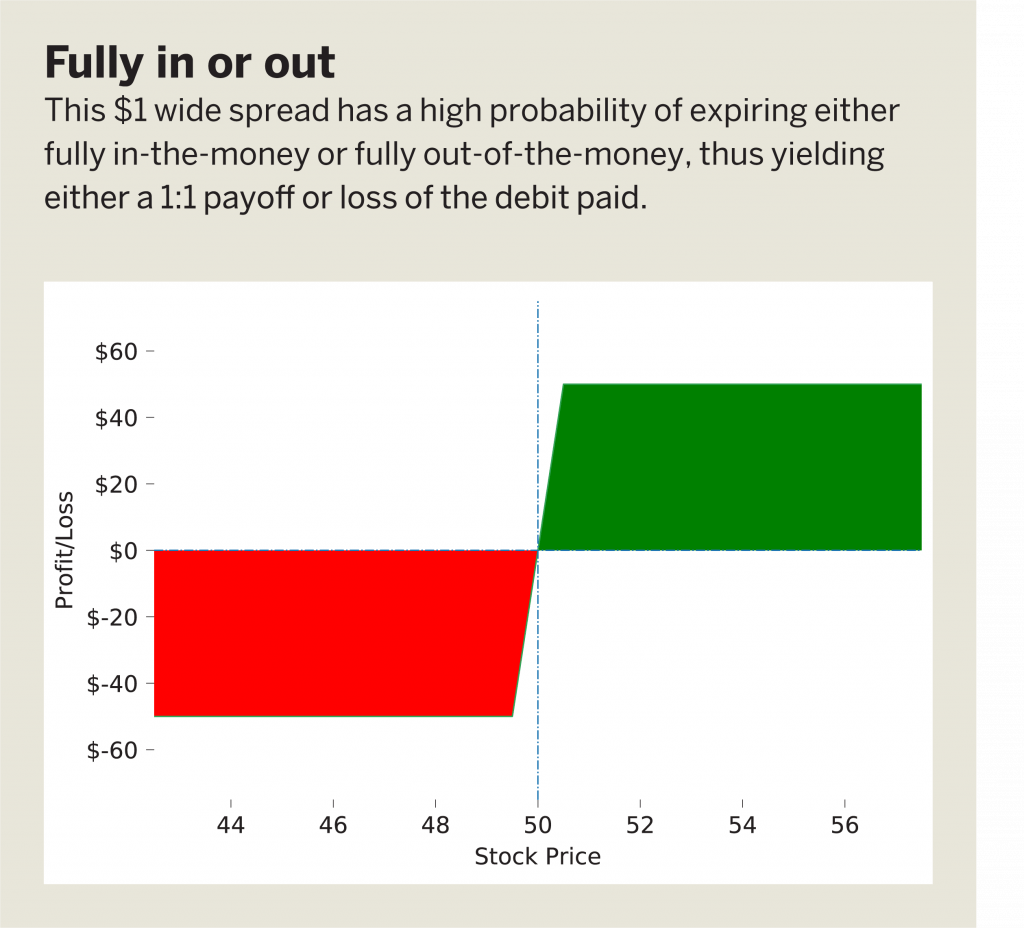

Look at an example. Stock XYZ is trading at $50, and the investor buys a $49.50 call expiring around 45 days from now and sells a $50.50 call with the same expiration date. That’s known as a long call vertical.

In liquid underlyings, the amount paid for the spread should roughly equal the amount the investor stands to make

In liquid underlyings, the amount paid for the spread should roughly equal the amount the investor stands to make

Because that trade has a 50% chance of winning, the payoff has to be 1:1 to make it worthwhile. So for this particular spread, an investor should expect to pay around $50 to have the chance of making $50.

How does one calculate that? Take the probability of profit, 50%, and multiply it by the width of the spread, $50.50 minus $49.50, which equals $1.00. 50% times $1.00 equals $0.50, and we multiply that by 100 to get the net debit paid for the spread. Because the width of the spread is $1.00 and the investor is paying $0.50, the goal is for the spread to be worth $1.00 by expiration, yielding a $0.50 profit, or a payoff of 1:1.

When an investor can’t get perfect symmetry around the stock price, buy the first in-the-money call and sell the first out-of-the-money call. The probability will be around 50%, and investors can multiply that by the width of the spread to calculate how much they’re risking and the payoff.

The amount the investor actually pay for the spread varies but in liquid underlyings, the amount paid should roughly equal the amount the investor stands to make.

What if the amount one stands to make seems too small? Just increase the number of contracts so that the desired risk matches the spread risk. It will always be a 1:1 payoff, but the absolute amount risked can be determined by the number of spreads purchased. That’s the scalability factor.

This strategy has a 50% chance of winning and pays 1:1

Anton Kulikov is a trader, data scientist and research analyst at tastytrade.