Slow-motion Rewards

Incrementally scaling into a position can be a more prudent and sustainable way to play stock comebacks

Kirk Gibson came off the bench to pinch hit for the Dodgers in the 1988 World Series. Despite two injured legs and a stomach virus, he walloped a two-run homer that won the game and helped clinch the championship.

It was quite a comeback for Gibson and for Los Angeles. But a prudent trading strategy shouldn’t depend on such exhilarating turnarounds—explosive comebacks are neither predictable nor sustainable. It’s the grinding, mundane recoveries that lead to successful long-term investing.

Those slow-motion comebacks require segueing in and out of trades instead of assuming an all-or-nothing mentality. Let’s use Apple (AAPL)—a widely held and widely traded stock—to illustrate that point.

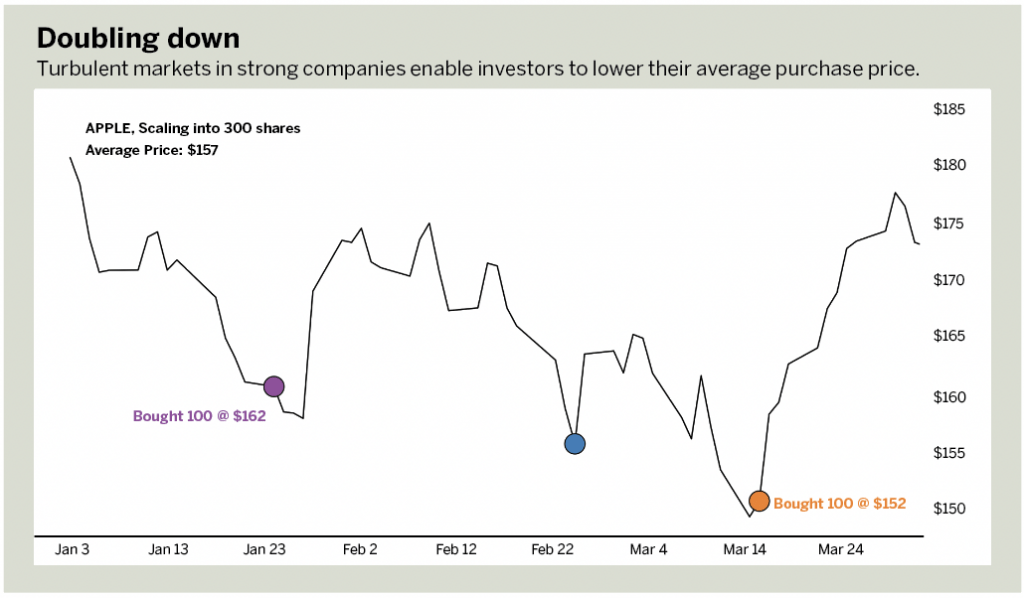

At the end of January, Apple was trading at $162 per share, down from a $182 high earlier in the month. Some investors would see this down move and want to get long on the stock with what’s called “buying the dip.” However, as with all investment decisions, investors should have a price and a time in mind when making a trade.

If capital is available, an investor might choose to buy 300 shares and hold them for four months. That investor could do that at the outset or establish a comeback over time. To accomplish the latter, the investor would buy a first round of 100 shares. If the stock loses value, an investor could purchase another 100 shares at the lower price. If it falls in price again, the investor could buy another 100 shares and then sit back and wait for the stock to make a comeback.

The investor should also set a target price to get long. In this case, that price should be between $155 and $160. But comebacks aren’t immediate. Apple’s stock eventually rallied, coming back to trade above $174 between March 25 and April 5, providing a tidy little profit. Just the same, investors using this scaling approach should set a time and price target. Then they have to be patient yet poised—which is also an art.

As investors become more experienced at scaling, they develop a better sense of choosing logical points of entry and exit. An investor just getting started might prefer to start with just price, then identify three or so possible intervals. After becoming more comfortable, an investor could use the Fibonacci sequence or more frequent intervals to increase the size of the overall position.

The point is that the basic concept does not change, but the way it’s adopted may change to fit an investor’s wants and needs. Although a dramatic Gibson-style comeback home run is exciting, scaling empowers investors to make a series of less dramatic but still profitable smaller comebacks.

JJ Kinahan is vice president and chief market strategist for tastytrade. @thejjkinahan