The Futures of Technology

A new futures product helps investors balance exposure to tech stocks

The line between retailing and technology has blurred. Who can decide whether to call Amazon a retailer or a tech company? What about Target? In certain cities, Amazon offers in-person shopping while e-commerce represents almost a fifth of Target’s revenue.

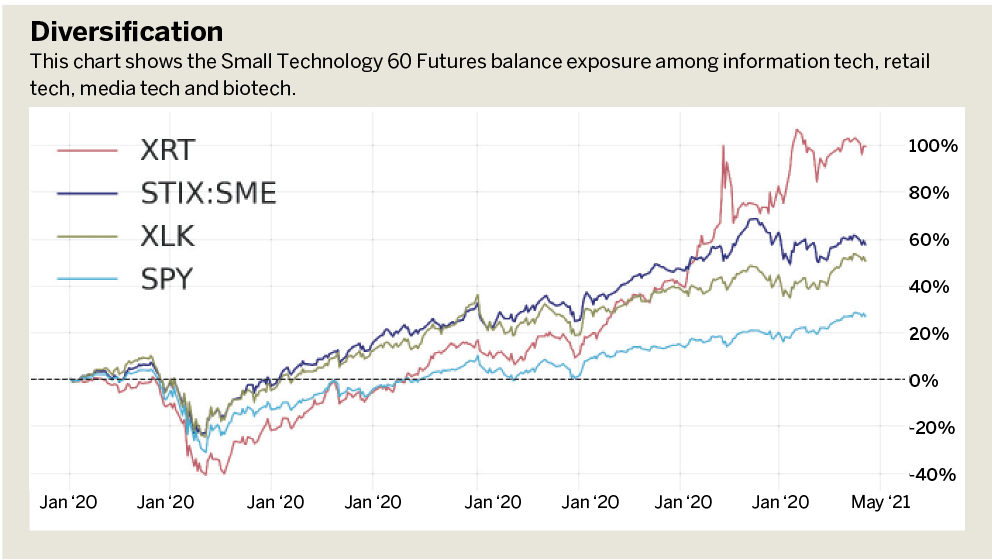

But classifications aside, the retailing and tech sectors have both ballooned since the start of the pandemic. Just check out the S&P 500 versus XLK, a technology sector exchange-traded fund, or ETF, and XRT, a retail sector ETF. (See “Diversification,” below.)

Instead of choosing between the two, why not try a product that balances the best of both? Recently, the Small Exchange launched a market that fits the bill. The Small Technology 60 (STIX) futures product provides exposure to tech stocks but breaks the category down into four subsectors: information tech, retail tech, media tech and biotech.

So, roughly a quarter of the product provides exposure to retail technology companies. The breakdown creates a nice balance between the exposures of both XLK and XRT with some added benefits that only futures contracts can provide.

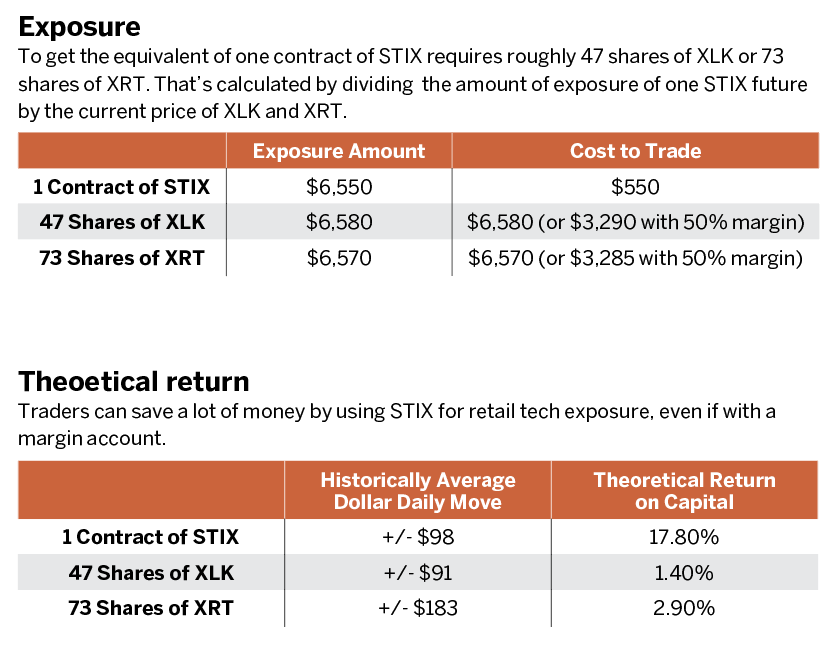

Futures afford a number of benefits over stocks and ETFs, the largest of which is their capital efficiency. To demonstrate that idea, consider the amount of exposure an investor obtains by investing in one contract of STIX versus one share of XLK or XRT. One contract of STIX provides about $6,550 worth of exposure versus just $140 and $90 for XLK and XRT, respectively. Calculate the amount of exposure for STIX by multiplying the current price by 100 because the contract has a $100 multiplier and the exposure amounts per ETF are just the current prices of the ETFs.

It’s important to equate those exposures to derive a cost per exposure. To get the same amount of stock exposure as STIX with XLK or XRT requires roughly 47 shares and 73 shares, respectively. Calculate that by taking the amount of exposure of one STIX future and dividing it by the current price of XLK and XRT. Now that the exposures are roughly equivalent, observe the cost to trade each product in (Exposure, below.)

The cost savings obtained from using STIX for retail tech exposure are substantial, even in a margin account. Compare a theoretical return on capital for each product. The average historic daily moves for these products since the start of the year are listed in Theoretical return, (below) along with their theoretical returns on capital had an investor captured this full move in profit.

While futures do come with options-like complexities, such as contract multipliers and expiration dates, they shouldn’t be an ignored product class. Whether an investor is looking for stock, commodity or interest-rate exposures, futures can afford significant capital savings that investors can use to hedge, speculate and invest.

Michael Gough enjoys retail trading and writing code. He works in business and product development at the Small Exchange, building index-based futures and professional partnerships.