The Myth of the Protective Put

Buying an expensive “portfolio insurance policy” hardly ever works

In Chicago, the weather can seem as volatile as the market. A day that begins with a 5% chance of rain can end with a torrential downpour. In a similar way, buying put options to protect a portfolio against a downturn seems a lot like grabbing the umbrella before heading out the door to work. The cost is low and the benefits can be huge.

Put options can protect a portfolio during a downturn by locking in a selling price before the market crashes. Assume the market is trading at 3,000 and an investor thinks it could fall 10% in the next 45 days. To protect a portfolio, an investor buys the 2,700 put option for $3. Several days later, the market crashes to 2,000. With the 2,700 put option, the investor can immediately sell the portfolio for 2,700, which is a much better price than the current 2,000. Buying the put has protected the investor’s portfolio against the extreme down move.

But this investment narrative is missing details. Firstly, market participants are already pricing in the possibility of a large down move in the market. This risk is manifested in the price of put options. On average, put options trade almost twice as rich as the same delta call options on SPY, the S&P 500 exchange-traded fund. Trying to maintain a hedge with long put options quickly becomes futile as the high cost diminishes their potential benefit.

Secondly, if the investor buys the put, it requires near-perfect timing for the hedge to be profitable. If, in the previous example, the market didn’t correct—poof, there goes $3 in option premium. Or, even more demoralizing, the market falls to 2,000 on the 46th day. Maintaining the hedge requires consistent put buying, and that cost can quickly add up, especially during a bull market rally like that of 2009 to present.

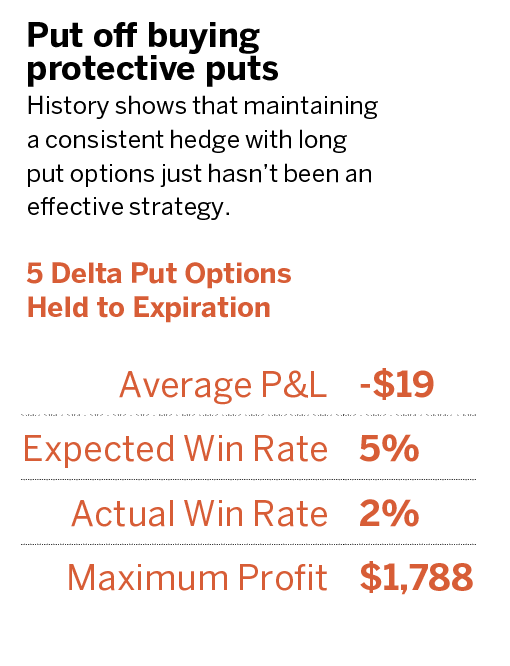

Maintaining a consistent hedge with long put options has historically been an ineffective strategy. The explanation in “Put off buying protective puts,” above, presents statistics on the value of buying puts. From 2005 to the present, buying 45-day portfolio insurance with long put options in SPY has resulted in an average trade performance of -$19.00. Given the option’s delta and its probability of expiring in the money by expiration, these options should have been profitable around 5% of the time. In reality, they were profitable only 2% of the time.

During this back-test period, the largest profitable long put option netted a gain of $1,788. Depending upon the timing, that may be enough to convert the cost of buying puts but would probably not cover the losses incurred in a long stock portfolio.

Long put options can provide portfolio peace of mind, but they aren’t an effective tool for maintaining a consistent hedge because of their high cost and reliance on perfect timing. More effective strategies, such as portfolio diversification and delta hedging, can provide similar portfolio protection without the high cost.

Learn more about the cost of protective puts here.

Michael Gough enjoys retail trading, and writing code. He works in business and product development at the Small Exchange, building index-based futures and professional partnerships.