The Semiconductor Trade: Correlation & Volatility

The sector yielded startling increases last year, but it’s not right for every portfolio

Semiconductors have become increasingly popular with traders because of the sector’s deep liquidity and potential for large moves. Let’s examine the two largest exchange-traded funds, or ETFs, that track semiconductors: iShares PHLX Semiconductor ETF (SOXX) and VanEck Vectors Semiconductor ETF (SMH).

In 2020, those two ETFs returned around 53%, and that includes the big dip last March. In fact, from their March 18, 2020 lows to the beginning of this year, the two were up more than 100%. Although those returns are far from average, two questions may arise: “Is this growing sector a good fit for my portfolio? If so, how much should I add?”

To answer those questions, look at two metrics: correlation and volatility. Correlation answers whether semiconductors are a good fit for a particular portfolio, and the volatility of semiconductors shows how much to add.

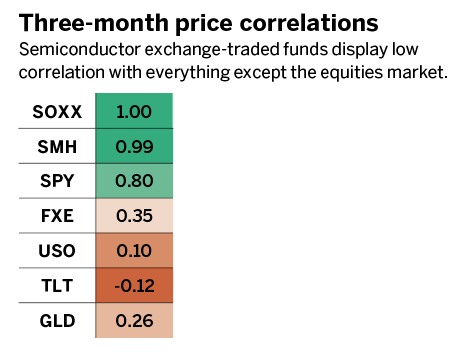

First, look at the last three months’ correlation between SMH, SOXX and other assets: SPY (the equity market), FXE (the currency market), USO (oil), TLT (fixed income) and GLD (metals). To decide if semiconductors are a good fit, determine how the portfolio looks and its exposure. In other words, if the portfolio has a lot of equity exposure, then semiconductors may not be the best fit because SPY and SMH/SOXX are highly correlated. They therefore provide little to no diversification.

However, if the portfolio is heavy on any other asset, then the semis may be a good fit because the semiconductor ETFs have very low correlation with everything except the equities market.

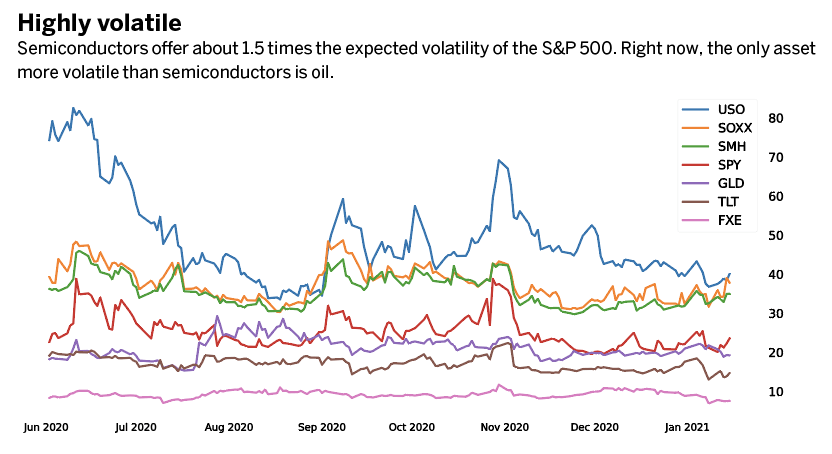

Semiconductors are quite volatile. In fact, they display about 1.5 times the expected volatility of the S&P 500. The only asset more volatile than semiconductors at the moment is oil, with an expected volatility two times the S&P 500’s.

So, when adding semiconductors to a portfolio, add about half as much as the largest current position to make the movements from semiconductors approximately the same as the other positions. For example, if a trader has a $10,000 portfolio of GLD, add just $5,000 of SMH or SOXX to get the same magnitude of movements as GLD, because GLD is half as volatile as the semis.

Anton Kulikov is a trader, data scientist and research analyst at tastytrade. @antonkulikov97