Three Ways to Short the Market

A menagerie of options strategies called zebras, lizards and spreads can help investors profit from a continued decline in stock prices in the new year

Active investors have become accustomed to managing their portfolios during up-trending markets. But after a turbulent year in 2022, they may be ready to bet prices for stocks, bonds and nearly every other asset class will continue to decline in 2023.

With that in mind, let’s examine three strategies for taking advantage of a downward market.

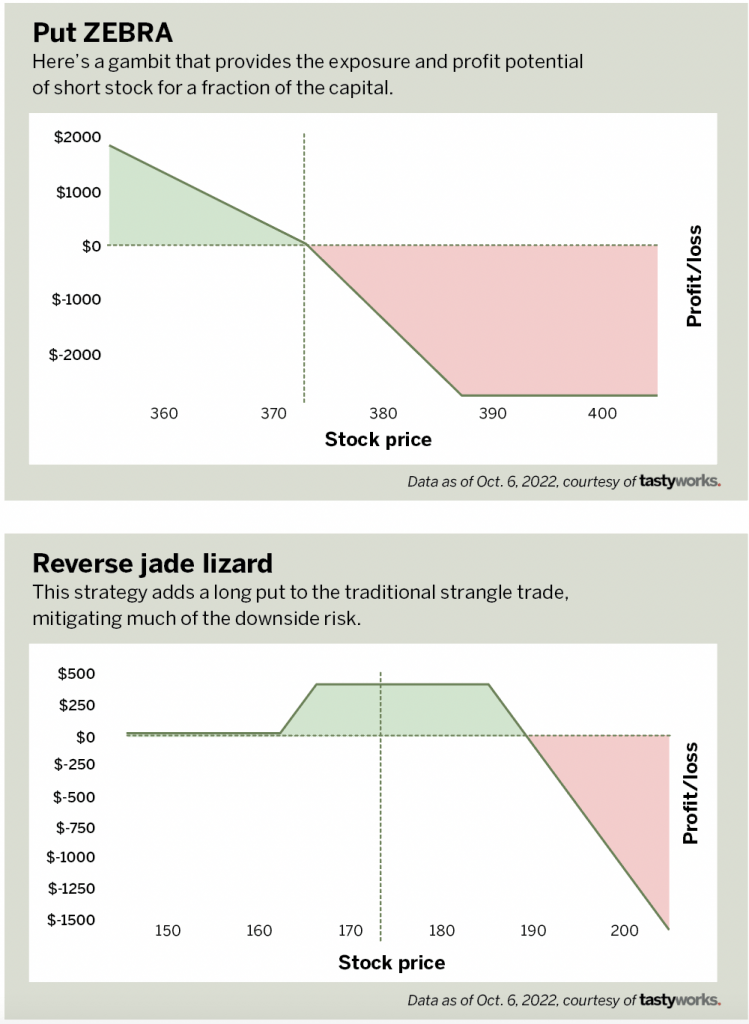

First, investors who want a short stock position but don’t have the capital or don’t want to allocate 50% of the stock value, can choose a capital-efficient alternative called a put ZEBRA.

It stands for zero extrinsic back ratio spread, and it doesn’t decay over time the way a normal long put option does.

The put ZEBRA consists of selling one at-the-money (ATM) put with a delta of 50 and buying two in-the-money (ITM) puts with deltas of 70. The ATM put is all extrinsic value, and the ITM puts are part extrinsic and part intrinsic value.

By combining the two positions, investors take advantage of the leverage from options without having to suffer the time decay that normally occurs with long options.

This trade is routed for a debit, meaning investors must pay to enter the trade. From a capital efficiency standpoint, they can place a put ZEBRA in SPY, the S&P 500 ETF (exchange-traded fund), for $2,800, whereas an equivalent short position of SPY shares would consume $15,000 in buying power.

Another strategy for those looking to remain net premium sellers instead of buyers is the reverse jade lizard. It operates much like a strangle but removes the risk from one side of the trade, thus becoming more directional.

It’s constructed by selling an out-the-money (OTM) call and then selling an OTM put spread. As long as the net credit collected is greater than the width of the put spread, this trade has virtually no risk to the downside.

Because of the short call, this strategy carries net negative delta, meaning investors realize a profit if the underlying goes down.

In IWM, the Russell 2000 ETF, an investor could place a reverse jade lizard by selling the 30 delta call and put and buying the 25 delta put to limit the risk to the downside. The trade would collect $4.30, and the width between the 30 delta put and the 25 delta put is $4.00. So, even if the underlying goes past the long put, the trade will make a small profit.

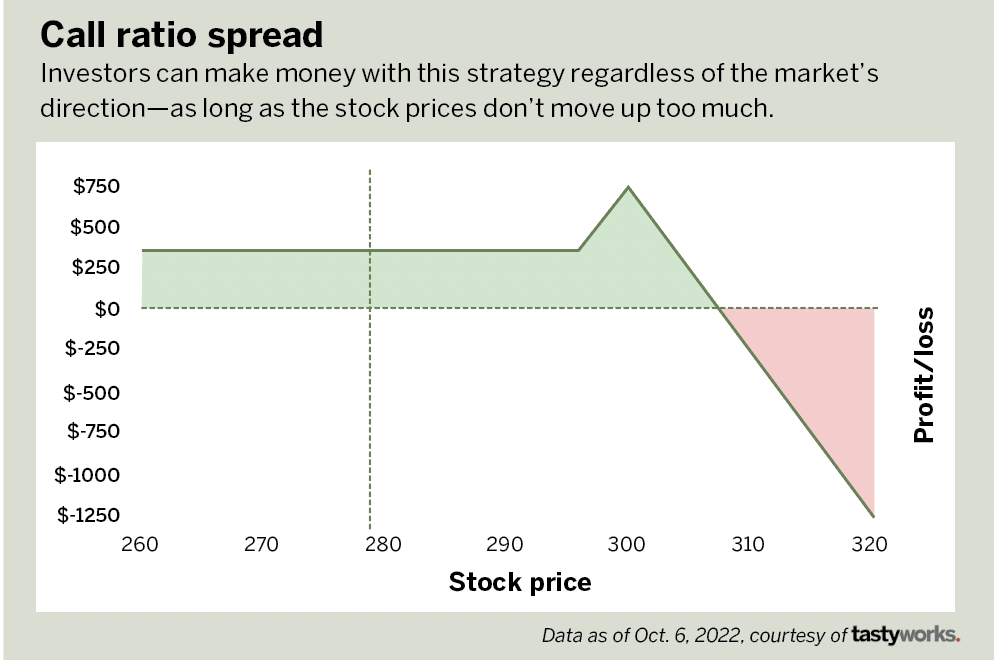

Bearish investors looking for a higher probability of profit may want to consider the call ratio spread. It’s created by buying one call closer to the stock price and then selling two calls farther from the stock price.

The two short calls must combine to collect more credit than the investor spends for the long call, creating a trade that can profit in any direction—otherwise known as an omnidirectional trade. In other words, if the stock goes up, down or sideways, investors have an opportunity to make money.

Because this strategy is ultimately long a call spread and short a call, the risk is to the upside and the breakeven can be calculated by adding the net credit to the strike of the short calls.

The trade realizes maximum profit if the stock goes up slightly, but the directional bias as seen by delta is still negative, meaning investors would prefer the stock decreases in value.

In QQQ, the Nasdaq-100 ETF, investors can create a call ratio spread by buying one 30 delta call and selling two

25 delta calls. They can place that trade for a $3.50 credit with no downside risk and an upside breakeven 8% above the current price.

Eddie Rajcevic, a member of the tastytrade research team, serves as co-host of the network’s Crypto Corner and Crypto Concepts. @erajcevic11