Pairs Trading with Futures

For a pairs trade, find two highly correlated assets that have recently diverged in performance

Pairs trading involves buying and selling related markets to capitalize on performance disparities. Traders can use the strategy to reduce outright risk, diversify a portfolio and find new trading opportunities when markets seem recalcitrant.

To structure a pairs trade, look for two highly correlated assets that have recently diverged in performance. Find two related products because outright losses in one position will be offset by gains in the other position.

Two such products are gold and silver. Investors can use the same gold to silver ratio pairs trade described in the Basic Tactics article in this series with futures to realize immense cost savings.

Experienced traders might consider using futures to trade the gold to silver ratio because of their capital efficiency. Exchange-traded funds (ETFs) often require 100% of their notional value—which means size or underlying value—in margin, but traders can achieve the same exposure with futures for only 10% of their notional value.

In other words, $100 of ETF exposure requires $100, while $100 of futures exposure requires only $10. Investors can use those cost savings to hedge a portfolio, make short-term speculations or contribute to long-term investments.

Before jumping in, consider the subtle differences between ETFs and futures pairs trades. When calculating the notional value that determines the proper ratio of each leg to buy and sell, traders should consider each product’s contract specifications.

Unlike ETFs, where the notional value is equivalent to the price of the product, futures have more-nuanced notional values. Gold and silver represent a classic case because one gold contract controls 100 troy ounces of gold, while one silver contract controls 5,000 troy ounces of silver. Therefore, an extra step that considers these subtleties is required to compute the proper trading ratio.

Besides considering the contract size, traders should adjust each product’s notional value by its volatility to derive a more accurate pairs ratio. While traders can never perfectly hedge a pairs trade, adjusting by the volatility helps equate the risk on both sides of the trade.

Failing to incorporate volatility can result in accidental over or under exposure to one market, which effectively defeats the purpose of pairs trading. Thus, to calculate the volatility-adjusted notional value of gold and silver futures, apply the following formula:

Volatility Adjusted Notional =

Number of Troy Ounces x Price Per Ounce x Implied Volatility

As of this writing, that equates to:

Gold Volatility Adjusted Notional =

100 x 1,589 x 11% = 17,479

Silver Volatility Adjusted Notional =

5,000 x 17.86 x 18% = 16,074

These volatility-adjusted notional values reveal the proper pairs trading ratio for a gold and silver pairs trade is one for one. If after looking at the gold to silver ratio traders believe the ratio will increase, they can buy one gold future and sell one silver future. Vice versa, if they believe the gold to silver ratio will decrease.

While the number of troy ounces per gold and silver future is unlikely to change, prices and implied volatilities are dynamic and should be recalculated before entering a new position.

Besides reducing capital requirements, incorporating futures can add a level of opportunity that’s unattainable with ETFs. While there are liquid ETFs for gold, silver and the major index funds, several other exciting markets—such as foreign exchange, interest rates and agricultural products—are accessible only with futures.

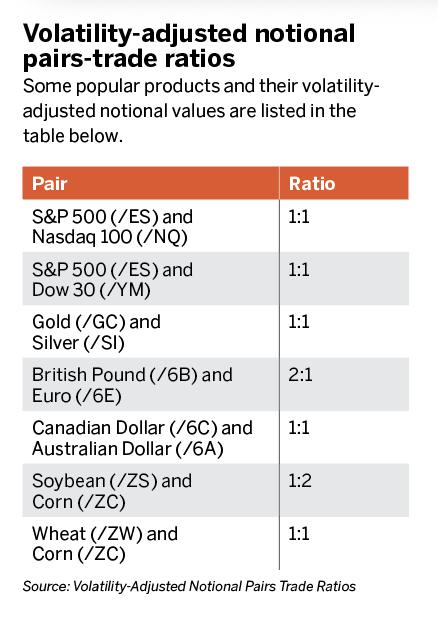

Some popular products and their volatility-adjusted notional values are listed in “Volatility-Adjusted Notional Pairs Trade Ratios,” below.

Michael Gough enjoys retail trading and writing code. He works in business and product development at the Small Exchange, building index-based futures and professional partnerships.