Scaling up Options Trades

Trading bigger doesn’t always mean more contracts. There are ways investors and traders can increase exposure without dramatically increasing tail risk.

At some point, most options traders consider scaling into larger positions. Ultimately, the decision to do so depends on one’s market outlook, risk profile and strategic trading approach.

But scaling doesn’t necessarily mean more contracts need to be traded. Along those lines, the tastytrade financial network has conducted several market studies that can assist market participants in their scaling decisions.

For example, a new episode of Tasty Bites compares how two different scaling approaches have performed historically: scaling with higher delta options and scaling with more contracts.

In order to produce the necessary data for this comparison, tastytrade conducted backtests on the two different scaling approaches, one that targeted scaling with higher delta options (i.e. closer to at-the-money options), and one that targeted scaling with more contracts.

The backtests conducted in this market study used historical trading data in the SPDR S&P 500 ETF (SPY) and were run according to the following parameters:

- Period studied: 2005-2021

- Underlying: SPY

- Average days to expiration (DTE): 45 days

- Backtested two scaling approaches (contract size vs. delta)

- All trades managed early (21 days to expiration)

- All occurrences involved IV Rank greater than 30%

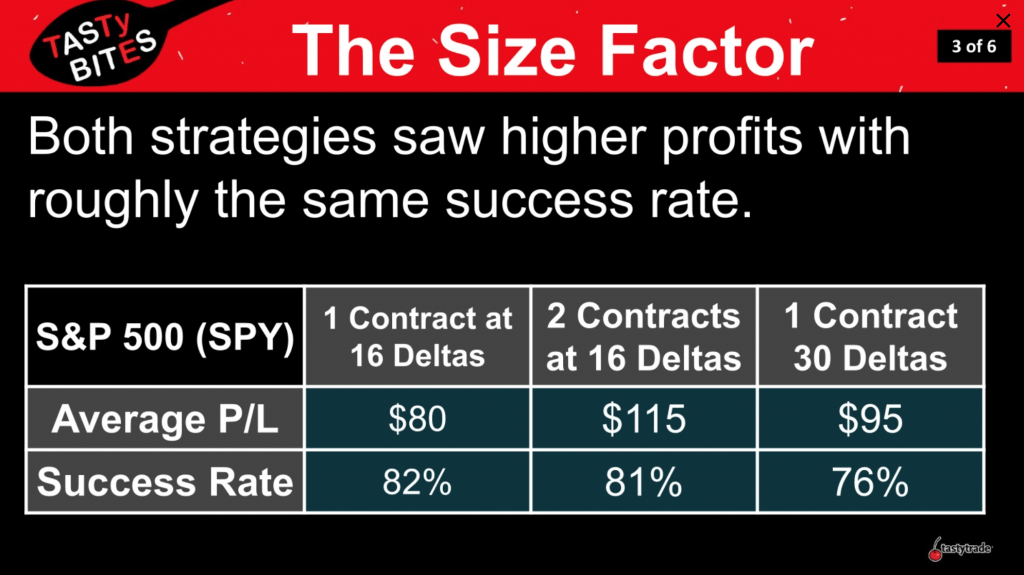

The results of these backtests are highlighted in the graphic below.

As one can see in the above graphic, scaling up with either higher delta options or more contracts both produced higher absolute returns than the original position. Interestingly, both approaches also exhibited attractive historical win rates.

However, the tastytrade team examined another performance metric from these two backtests and discovered one more important takeaway. When examining “largest loss,” it was found that scaling with more contracts exposed the position to significantly larger losses ($3,500 vs. $1,800) in the worst-case scenario.

The potential for a worst-case scenario is often represented through a concept known as “tail risk”—often defined as unexpected and highly impactful events in the marketplace. The sharp market selloff associated with the onset of the COVID-19 pandemic is a good example of tail risk.

So while absolute returns increased by scaling with more contracts or higher delta options, the former approach also significantly increased theoretical exposure to an unexpected event in the market.

This information may help traders better evaluate how and when to scale, according to one’s market outlook and existing trading conditions.

Previously, tastytrade also examined the relative merits of scaling up options spreads. In this market study, the tastytrade research team analyzed how scaling with more contracts compared to scaling with wider “wings.”

The information was presented on a previous episode of Market Measures, and serves as a good complement to the new episode of Tasty Bites.

To learn more, readers may want to review both of the aforementioned episodes:

- Tasty Bites: Scaling with More Contracts or Higher Delta?

- Market Measures: Scaling Spreads with More Contracts or Wider Wings?

To follow everything moving the markets, readers can also tune into TASTYTRADE LIVE, weekdays from 7 a.m. to 4 p.m. Central Time.

Offer extended through April 1st:

Subscribe to Luckbox in print and get a FREE Luckbox T-shirt!

See SUBSCRIBE or UPGRADE TO PRINT (upper right) for more info.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.