Short Strangles in Selloffs

When uncertainty increases in the financial markets, that is almost always represented through an uptick in implied volatility. Option prices get more expensive as buyers of protection enter the market.

While most traders attempt to make rational, disciplined choices during these periods, it’s not always easy to keep a cool head. But corrections don’t always last that long, and it’s often the traders who act swiftly and decisively who harvest the greatest rewards.

Traders looking for more information to assist them with decision-making during selloffs may want to review a recent episode of Market Measures on the tastytrade financial network.

On this installment of the popular series, the hosts review the findings of a recent study conducted by the research team at tastytrade. The intent of the research was to provide more context on the performance of short premium positions that are initiated during a correction, as compared to “normal” trading conditions.

In order to provide a robust perspective on this comparison, the research team examined a wide-range of corrective trading conditions. For example, intraday corrections of 1%, 2%, and 3% were included in the study.

For those that may be unfamiliar with tastytrade market research studies, the general approach is to backtest historical trading data to investigate how a specific trading approach performed across a wide range of conditions. While past behavior is certainly not predictive of future behavior, it does provide valuable insight that can potentially be applied to future trading situations.

In this particular study, tastytrade researchers backtested the historical performance of 16-delta short strangles deployed in the S&P 500 (SPY).

Because the goal was to better understand short premium performance during selloffs, this trading strategy was backtested across a variety of different market conditions – all of them involving a net down day in SPY, including:

- any day that SPY was down (for example, “all instances”),

- days in which SPY sold off by more than 1% (but less than 2%),

- days in which SPY sold off by more than 2% (but less than 3%), and

- days in which SPY sold off by more than 3%.

Trading data used in the study was from 2005 to present. All options backtested were held through expiration, and had on average 45 days-to-expiration (DTE).

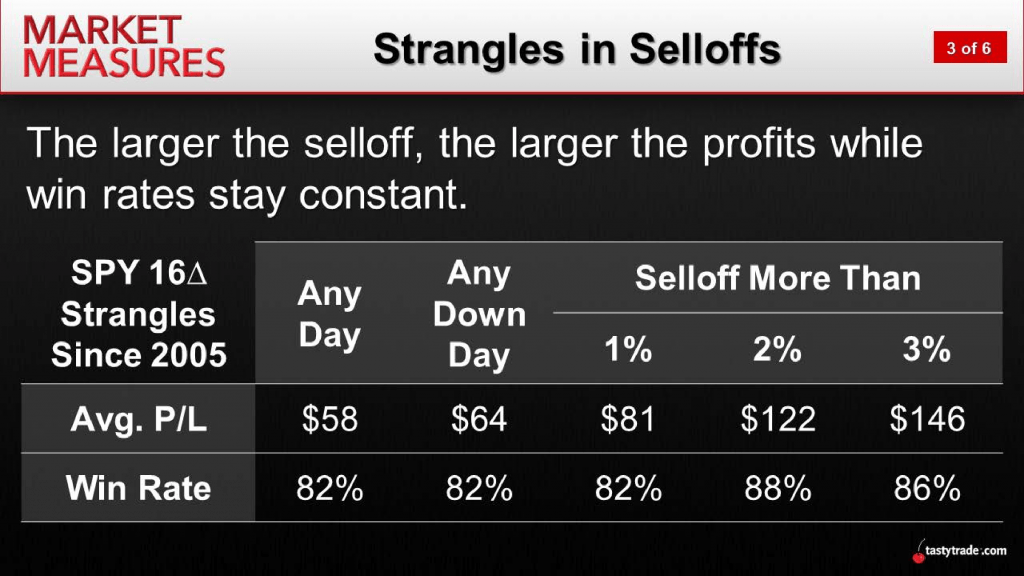

As one can see in the summarized results below, the data clearly indicated that the highest win rates and average P/Ls were observed when the SPY selloff was most severe (greater than 3%).

What’s most interesting about the above data is that the average P/L not only clocked in at the highest average level when the SPY experienced a 3% (or greater selloff), but the win rate was also the highest. That means that according to historical data, the potential reward went up, along with the likelihood of winning.

As many traders are naturally skeptics, it’s likely many are wondering how those two advantageous trends could develop concurrently. And the answer is rooted in the theoretical fundamentals of options trading.

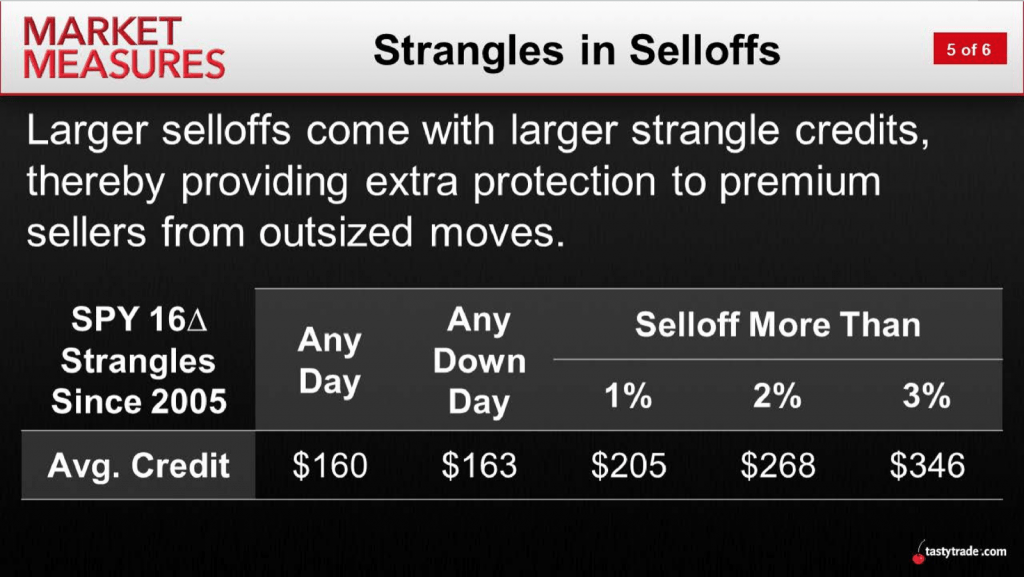

As outlined on Market Measures, the larger selloffs (in percent terms) also have the biggest impact on implied volatility. Meaning as the selloff intensifies, so too does the “fear” which gets priced into the underlying price of the option. In turn, that means that the credit received for the sale of a given option is also higher, which provides the trader with a greater buffer between profit and loss for a short strangle.

The table below provides further insight into how the credit received for a given short strangle rises (on average) as selloffs intensify:

While every trader has to decide whether trading during heavy volatility fits their own unique risk profile and trading approach, the data presented on Market Measures certainly helps frame the risk-reward dynamic in such environments.

Traders seeking to review this tastytrade study in greater detail can watch the complete episode of Market Measures focusing on strangles in selloffs when scheduling allows.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.