The Implied Volatility-Realized Volatility Spread

With equity markets currently in melt-up mode and the VIX dragging near historical lows, there haven’t been a myriad of great opportunities to sell options premium.

However, while the VIX may not be flashing “sell” when it comes to short volatility, options traders have the ability to filter for potential opportunities using another tactic—namely, the spread that exists between implied volatility and realized volatility (aka actual volatility).

As most traders already know, implied volatility represents the current market price for volatility based on the market’s expectations for future movement in a given underlying. This value is “implied” by the dollar and cent value of options trading in the marketplace.

Realized volatility, on the other hand, is the actual movement that occurs in a given underlying over a defined historical period of time. Volatility traders obviously care not only about what is expected to occur, but also about what actually transpired.

For this reason, options traders often leverage the spread that exists between implied volatility (IV) and realized volatility (RV) to better gauge the relative attractiveness of a given trading opportunity.

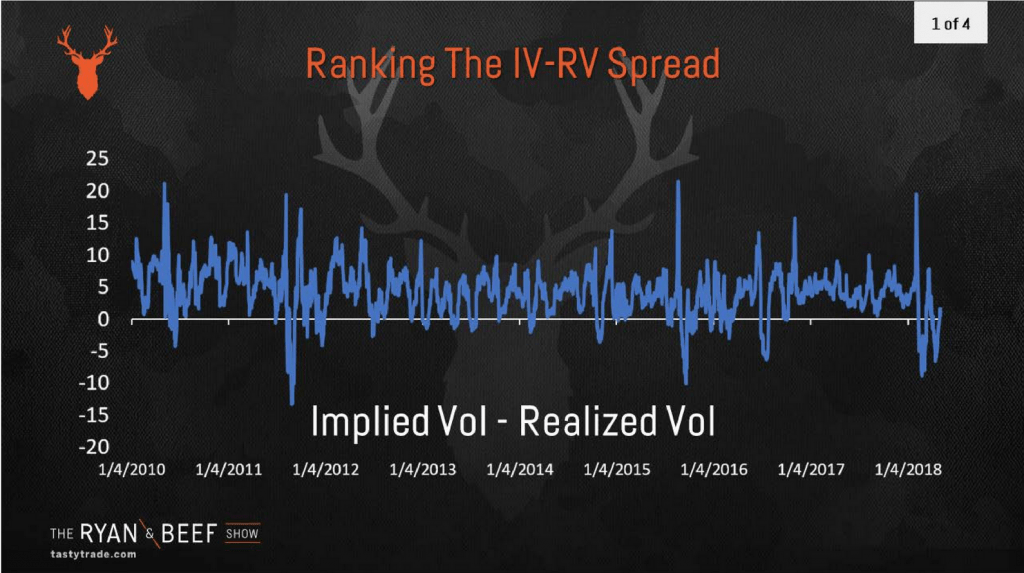

A positive IV-RV spread indicates that implied volatility is higher than realized volatility, while a negative spread indicates the reverse. As one can see in the graphic below, historical data in SPY clearly illustrates that the bias in the IV-RV spread has been consistently positive. It’s this reality that underpins the value proposition of the short premium approach in the options marketplace:

While the above is great information to be aware of, previous research conducted by the tastytrade financial network takes the practical application of the IV-RV spread one step further.

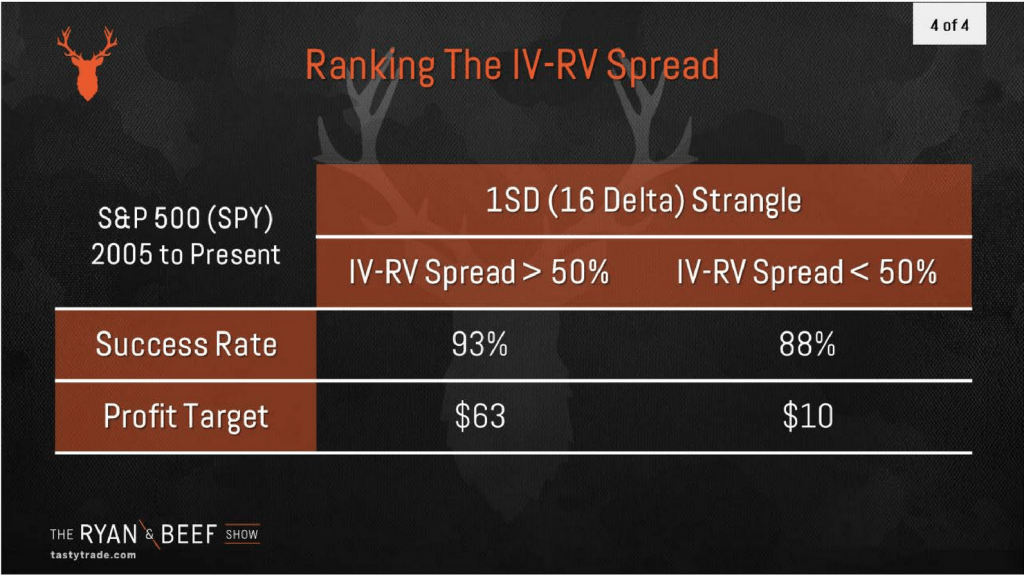

Using a series of backtests, market researchers at tastytrade looked at historical data in SPY to ascertain the performance of short strangles deployed in SPY across a range of different widths in the IV-RV spread.

As one might suspect, the findings from this research revealed that short premium approaches tend to outperform when the spread between IV and RV are at the wider end of the range, as illustrated below:

Per the findings above, short strangles in SPY have performed more efficiently (higher win rates and higher profit targets) when deployed according to a trading approach that capitalizes on wider widths in the spread between implied volatility and realized volatility.

Due to the importance of these findings, traders are encouraged to review the complete episode of Ryan & Beef focusing on the historical spread between IV and RV when scheduling allows.

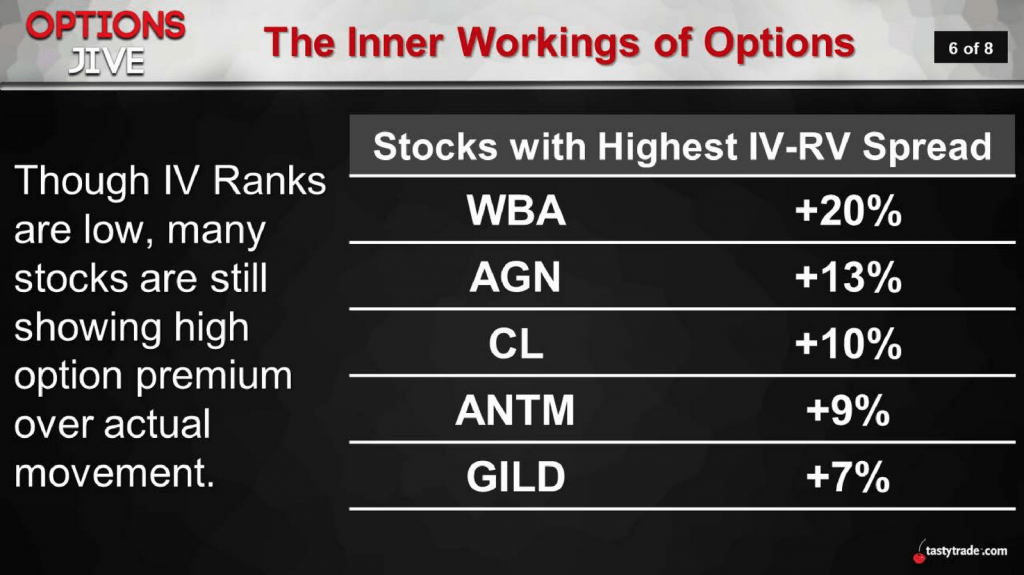

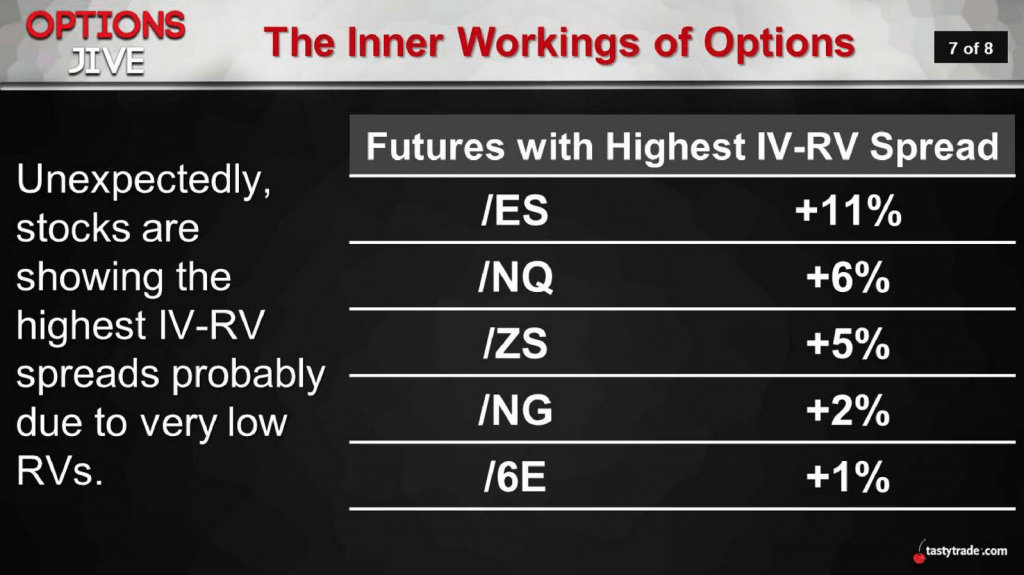

As a complement to that information, traders may want to watch a new installment of Options Jive on the tastytrade network that focuses on current potential opportunities in both equities and futures options where the spread between IV and RV is currently the widest.

While the current low volatility environment may not compel traders to take a high degree of short volatility risk, the aforementioned approach leveraging the IV-RV spread can also be utilized in high volatility trading environments to provide additional insight on potential opportunities.

Additional information on trading equities, options, and futures is also available in the tastytrade LEARN CENTER.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.