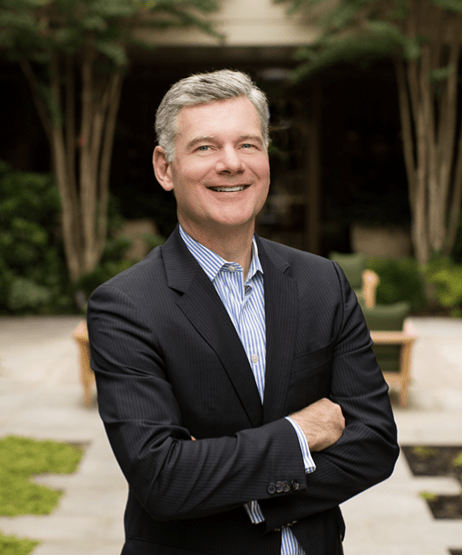

A Six-Pack with Mark Yusko

An institutional investor answers six questions on SPACs

Mark Yusko founded Morgan Creek Capital and now serves as the firm’s CEO and chief investment officer. In February, the company teamed with Exos Financial to create the Morgan Creek-Exos SPAC Originated ETF (SPXZ). The ETF offers broad access to investing in blank check companies.

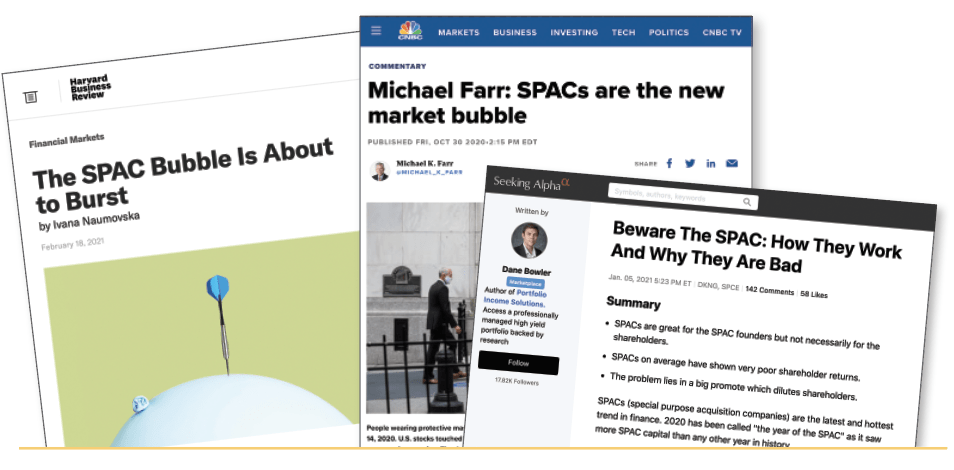

To complement this issue’s focus on the surge in special-purpose acquisition companies, or SPACs, and to dispel some of the surrounding media-driven misinformation, Yusko provided his thought-provoking takes on the industry.

On SPAC innovation

Yusko maintained that SPACs bring forward venture capital and democratize the opportunity for investors to take part in early-stage companies. “Historically, regulations limited access to venture capital wealth solely to the super-rich,” he said. “If you weren’t an accredited investor or qualified purchaser, you were prohibited by law from investing in venture capitals.” SPACs make it possible for everyone to take part in the process.

SPAC growth

Not a single SPAC had to liquidate last year, a monumental event for the financial sector that Yusko traced to a rule change in 2015. “Regulators figured out that by not allowing companies to make forward-looking statements by requiring an operating history and profits, you were restricting new companies,” he said. Before the change, companies remained private longer, a benefit to venture capitalists. Today, companies no longer need forward-looking statements or operating profits to go public.

Companies of the future

A “company of the future” is one “where the best days are ahead of it,” Yusko maintained. Today, his firm operates in five industries: space travel and tourism, electrification of vehicles, autonomy, esports, and online gaming. All of those industries have a future that’s better than the past, he said. Although he doesn’t plan to travel to space himself, he noted that many people will do so. Meanwhile, online gaming and gambling are growing, he continued, citing ESPN’s adoption of live broadcasting of odds as an example of the trend. He also predicted a boom in autonomous robotic taxis.

SPAC structure

Asked if he focuses on the managers or the deal when selecting companies to fund, Yusko invoked the metaphor of betting on the jockey or the horse. He believes he’s betting on the jockeys (or managers) because the horse is good. “All the horses are thoroughbreds because the SPAC structure is superior as a means to go public for high-growth, innovative companies,” he said, noting once again that because SPACs provide superior investment structures, everyone has a “good horse.”

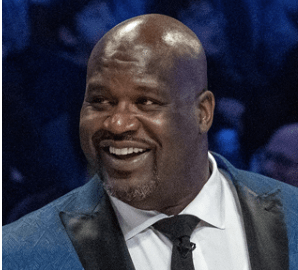

Celebrity SPACs

Yusko views every deal as an opportunity but sometimes hesitates when the sponsors are celebrities. He believes those groups are typically “late adopters” in the SPAC business, and he prefers trailblazers with strong operating teams, venture capitalists and private equity investors.

Why SPACs?

SPACs are the perfect investment vehicle because they offer protections before a deal commences, Yusko maintained. One of the biggest misconceptions about SPACs centers on sponsor compensation, he said. “For a SPAC, I have to put up real capital, and if we don’t do a deal, I lose it. It’s gone,” he continued. “That’s a different alignment of interests than what people understand.” Most believe sponsors just get paid and walk away rich, but he noted that sponsors lose money if they don’t complete a deal. Sponsors also lose money if they make a bad deal. But if they complete a good deal, they can make a lot of money. “If you do good and you add value, then there should be an exponential growth curve,” he said. “To me, that’s the power of the SPAC model.”