Goodbye YOLO Brick Road

Forget meme stocks and overcome the fear of missing out (FOMO). Come back to basics. Here are four time-tested investment strategies.

As valuation compression continues for growth stocks in tech and communications, active investors should come back to four “boring” strategies to make real money.

Market fundamentals might not matter much on the way up, but they do on the way down. Investors in growth stocks and you-only-live-once (YOLO) assets, including technology and communications stocks popular during the pandemic, have one last chance to avoid the fallout.

Turning the odds in one’s favor requires time, patience, diligence and strategies that don’t correlate with what the crowd is thinking. Luckbox digs into four strategies that have yielded sizable returns in non-YOLO markets dating back more than a decade.

First, a little on the history of value compression—that means a company’s earnings are increasing but the price of its stock isn’t moving.

Much like during the dot-com crash, some companies have declines in price-to-earnings, price-to-sales and other metrics, even though they maintain strong profits and improved balance sheets. As a result, investors aren’t willing to pay a higher premium for equities.

Charting Value Compression

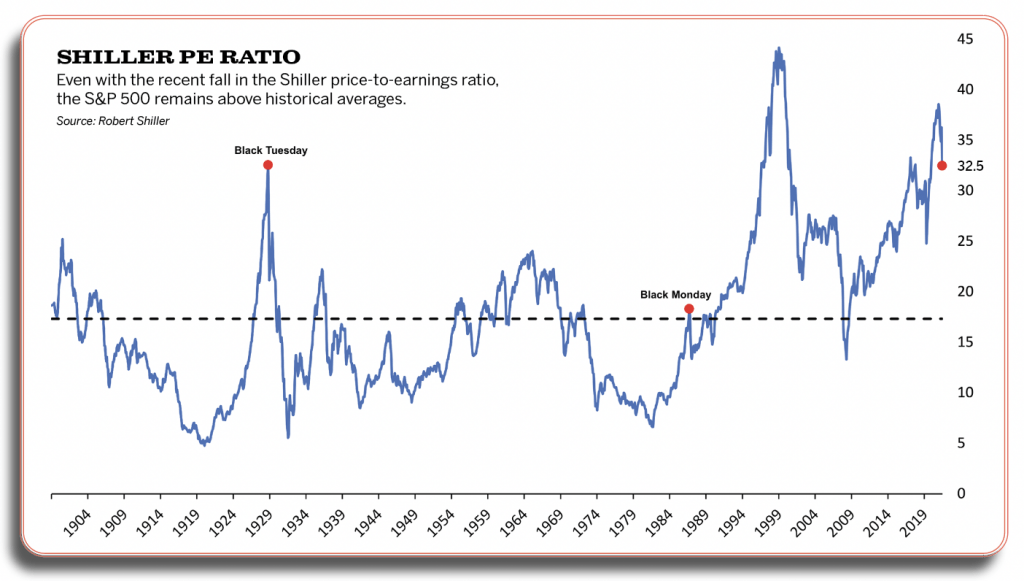

The chart on the opposite page tracks the history of the Shiller PE ratio,

which measures the average price-to-earnings ratio for S&P 500 stocks. As of May 1, the Shiller PE ratio stood at 32.5, well above the historical average of 17.35 (1900-present).

A further decline feels inevitable as the Fed begins to tighten its balance sheet by selling its war chest of bonds and mortgage-backed securities.

The Fed’s liquidity drain will likely create more volatility, selling and valuation compression. As a result, active investors may want to consider time-tested investment strategies in what continues to be an unpredictable market.

- Community bank mergers and acquisitions (M&A)

In the mid-1980s, the United States had roughly 15,000 banks, but that’s down to fewer than 5,000. The downturn is tied to the consolidation of community and regional banking.

The annual consolidation rate has consistently run 3% to 5%, according to Hovde Capital, and there’s no reason to believe the dealmaking will slow down.

Community banking—defined as financial institutions with a market capitalization of less than $2 billion—is marked by several trends that make companies with lower valuations attractive takeover targets.

A larger bank can use either of two methods to increase its depositor accounts and use that money for traditional lending.

First, it could benefit from a dramatic uptick in the local population and local wealth. Community banks in the Sun Belt are receiving an influx of capital as populations increase because of the COVID-19 migration. Cities like Naples, Florida, for example, have experienced dramatic growth in recent years.

The second option for growth is to buy another bank. Cities like Boston saw a spree in community bank deals recently despite its 1% decline in population between 2020 and 2021.

Meanwhile, the need for costly new technology and expensive cybersecurity measures makes it difficult for smaller banks to compete against larger rivals. JPMorgan spent $600 million on cybersecurity in 2018—more than the market capitalization of 198 U.S. banks trading on domestic exchanges, according to GuruFocus.

Smaller banks have also struggled to attract talent. They often have older boards of directors as younger financial talent joins next-generation projects like decentralized finance or moves to New York and other financial hubs to join large investment banks.

Banks remain attractive takeover targets when the Fed raises interest rates to levels not seen in more than a decade. The last time the federal funds rate stood at 3% was early 2008.

That’s why it may be lucrative to buy banks that are trading under a price to tangible book value of 1 or less (TB/V of under 1). That means the bank effectively trades for less than its liquidation value.

Think of it this way: A bank might be worth $1 billion. But the market—for some reason— trades it at a valuation of $800 million. That would be a price to tangible book value of 0.8. As of May 1, 45 U.S. banks traded on domestic exchanges at a price under a tangible book value of 1.

Using a strategy of buying and holding these banks since 2000 has delivered annualized returns of 25.8%, compared with the S&P 500’s 7.5%, albeit with higher volatility.

Patient investors who want to ride the M&A wave on cheap community banks can consider the fact that Blue Foundry Bancorp (BLFY) trades for 77% of its tangible book value and Territorial Bancorp (TBNK) trades for 83% of its TBV. Third Coast Bancorp (TCBX) trades at a slightly higher level of 1.09 times TBV but has had lots of insider buying in recent months.

2. Rational liquidation value

The 1991 film Other People’s Money stars Danny DeVito as “Larry the Liquidator,” an activist fund manager who targets a small-town business called New England Wire & Cable Co. and values the assets in a worst-case scenario of $100 million or $25 per share. When he began his campaign push for the company’s sale, shares traded at $10. He projects a potential 150% upside.

Larry’s valuation of a company’s real estate, fixtures, equipment and inventory is a rational liquidation value strategy. An investor looks at the sum of the parts and buys the stock because the combined assets are worth more than what is reflected in the stock price. It’s best to use tangible book value as the anchor, like community banking. Anything trading at a tangible book value of less than 1 is trading more than the sum of its combined assets.

Most investors might be impatient when it comes to this strategy.

However, a simple backtest to 2000 shows the universe of these stocks has provided investors an annualized return of 32.6%.

That figure is important because the S&P 500 averaged 7.5% during the same period. Over the last two decades, the strategy has endured three major market downturns and presents itself as a strong alternative for 2022 and beyond.

Attractive companies trading under liquidation value today include auto power and security giant Strattec Security (STRT) at 74% of its liquidation value; steel products manufacturer Friedman Industries (FRD) at 70%; and the 11th largest U.S. home manufacturer, Beazer Homes USA (BZH), at 64%.

3. The insider value portfolio

In January 2022, the insider buying to selling ratio—on a dollar-for-dollar basis—reached its highest level since April 2020, according to secform4.com. However, insiders have largely remained on the sidelines when purchasing its stock since that late-January window. With so many executives selling stocks in 2021, investors should have confidence in companies where insiders maintain large amounts of company shares. With solid insider holdings, investors can look at lower, attractive valuations to identify opportunities. Returns have been strong for companies with solid insider buying mixed with low buyout multiples.

For example, high insider buying combined with an EV/EBIT (enterprise value/earnings before interest and tax) of 10 have delivered annualized returns of 19.3% since 2000, according to Insider123, a backtesting and research software tool. The strategy also saw a slightly lower maximum drawdown compared with the S&P 500—51.6% compared with 55.4%.

Today, investors can consider Dick’s Sporting Goods (DKS) with a 40% insider holding and EV/EBIT of 4.6. In addition, consider Taitron (TAIT) at an EV/EBIT of 6.7 with 74% insider ownership.

4. Small cap value

It’s a well-known market anomaly that small-cap stocks outperform the broader market. This is linked to the fact that smaller companies have longer growth runways than their larger rivals.

But in an adverse momentum market that has seen outflows of speculative capital, small-cap investors and traders should turn their attention to companies with solid balance sheets and low valuations. To determine a strong balance sheet, pay close attention to the Piotroski F- and Altman Z-scores.

The F-score, created by Joseph Piotroski, who taught at Stanford University and the University of Chicago, is a nine-point system that rewards each company for meeting a certain criterion on its balance sheet. Metrics include higher return on assets year-over-year, decreasing outstanding shares year-over-year and lower leverage year-over-year.

Companies with F-scores in the 7 to 9 range are showing improving balance sheets annually.

The Altman Z-score is a weighted average of five metrics to determine a company’s bankruptcy probability. Typically, investors can play it safe with companies with an Altman Z-score over 2.6. Finally, to assess valuation strength, look at companies trading at an EV/EBIT under 8.

Since 2000, the small-cap value strategy has been more volatile than the S&P 500 but generated annualized returns of 36.9%.

Consider Rex American Resources (REX), Zedge (ZDGE) and A-Mark Precious Metals (AMRK).

Praying for a rebound

It’s not too late to get out of the way of the valuation compression that appears to be an inevitable trend in 2022 and 2023. Instead of trying to catch the falling knives of the technology and communications sectors, active investors should turn their attention to the deep values a market sell-off can create. Many strong companies ripe for investing have solid balance sheets and great business models.

Active investors should turn the odds in their favor and stop thinking that this time is different.

Tim Melvin, a 30-year veteran of financial markets, uses rigorous quantitative analysis based on the principles of deep value and private equity styles of investing.

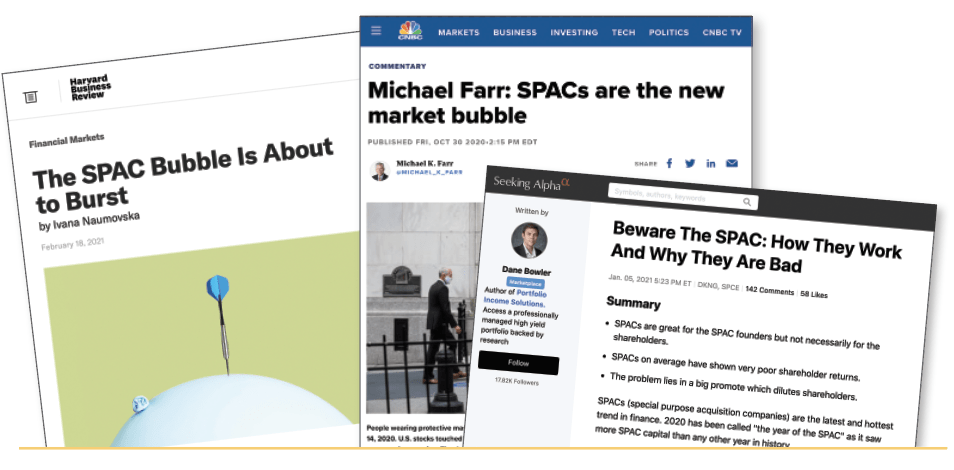

Ticking Time Bombs

In April, Luckbox examined the ARK Innovation exchange-traded fund strategy of purchasing “disruptive” growth stocks that traded at extremely high multiples and showed minimal track records of executive insider buying. ARK Innovation is managed by “innovation enthusiast” Cathie Wood.

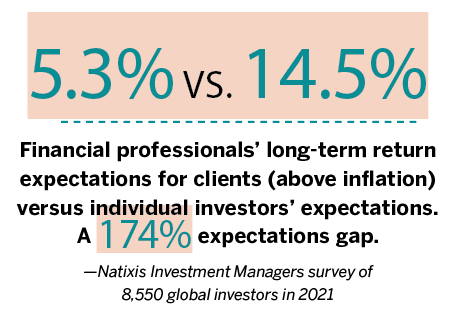

Wood doesn’t pay much attention to valuations, insider buying or hedging strategies. That’s perilous at a time when

valuations are still high.

Historically, a stock trading at 10 times revenue (price-to-sales) can be dangerous.

To justify such an investment multiple, investors must expect a company to pay 100% of its revenues for 10 straight years as a dividend, with no accounting for expenses, taxes, research and development—just 100% of the revenue.

This prospect was insane in 2000. But, with the Federal Reserve jackknifing the economy, raising rates and cutting its balance sheet to contain inflation, any company trading at these levels could face a reckoning.

It’s safe to assume that hedge funds and other institutions recognized this danger in January.

All year, institutions have used any short-term uptick in the market as justification to sell equities ferociously, particularly stocks on the Nasdaq-100, anything with a high PS multiple and companies trading like the ones owned by Cathie Wood.

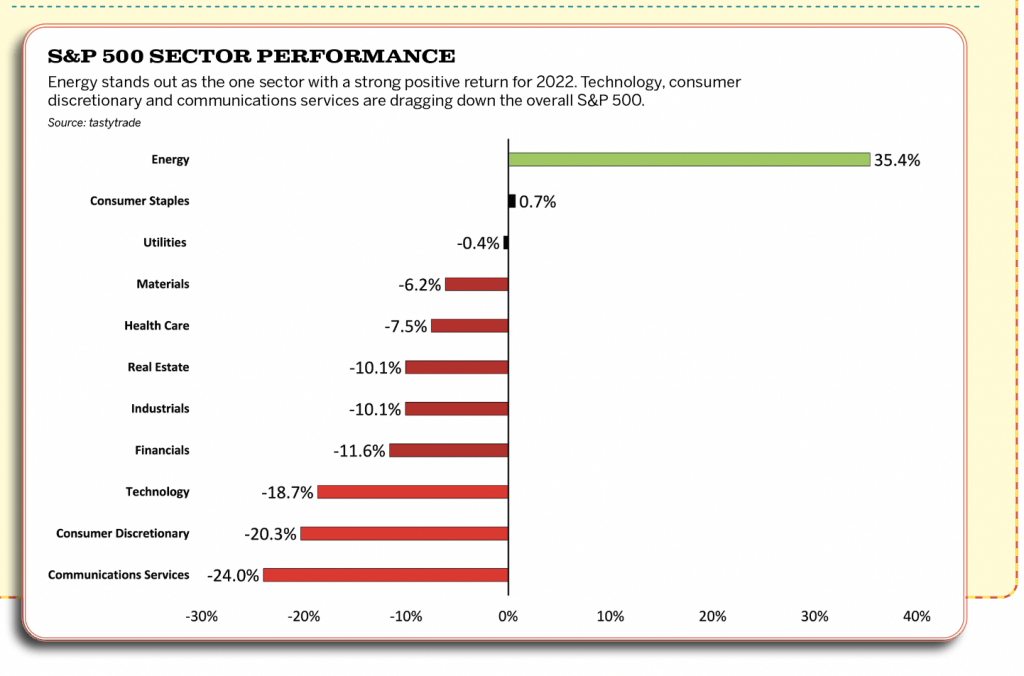

The three worst-performing S&P 500 sectors of 2022 are consumer discretionary, technology and communications—all down more than 18% on the year.

However, iconic companies in those three sectors are still trading at high multiples.

As of May 1, more than 60 companies from those sectors are trading at a nosebleed level of 20 times sales, according to GuruFocus.

At that price ratio, a company would require a 20-year dividend of all revenue to justify the share price. Among the largest by market capitalization, companies with a PS ratio over 20 include Snowflake (SNOW), Crowdstrike (CRWD), DataDog (DDOG), Lucid Group (LCID), The Trade Desk (TTD), ZScaler (ZS), Bill.com (BILL), GitLab (GLAB), Confluent (CFLT), Plug Power (PLUG), MongoDB (MDB) and Rivian Automotive (RIVN).

Institutions have been selling those stocks at a breakneck pace into every rally this year. That list of 12 stocks represents an average decline of 37.1% in four months ending May 1.

But it gets worse. Six companies with a market capitalization of over $15 billion are trading at a PS ratio over 35. That list includes Snowflake, Datadog, Lucid Group, Cloudfare, Rivian Automotive and Bill.com.

Buyer beware.

Garrett Baldwin is a momentum trader, economist, editor-at-large of Luckbox, co-host of The Prediction Trade podcast and the executive producer of Money Morning LIVE.