Media Coverage of SPACs

Some financial journalists can’t be bothered with telling the true story of complex investment structures

Print journalists and television talking heads seem plenty worried about SPACs, the special-purpose acquisition companies formed to acquire private companies and take them public.

They agonize over a perceived bubble and fret about valuations they deem too high. Have they seen Tesla’s P/E? They also talk endlessly about having the wrong celebrities at the helm—even if they’re not really at the helm.

But there’s nothing new here. SPACs have been weighed down with unfounded negative perceptions for decades—long before Facebook and Twitter were even invented.

And the bad rap has become so entrenched that it isn’t ending anytime soon. Harvard Business School analyzed media perception of reverse mergers between 2001 and 2012 found that out of 267 articles, 113 were negative and 148 were neutral. Just six were positive.

A case in point

Take the example of some overly tired Wall Street junior bankers. They may have found themselves in a state of fatigue because of their heavy workload, the restrictions caused by the pandemic or the uncertainties of the political climate. But CNBC pointed the finger at the SPAC frenzy.

Was there any truth to that assessment? Well, Goldman Sachs analysts studied the situation and pulled together PowerPoint presentations tracing burnout to 100-hour workweeks and bosses who didn’t listen to reason.

In fact, none of the respondents to a Goldman survey on working conditions mentioned SPACs as a problem. The firm’s technology, media and telecom team was already heavily engaged in merger and acquisition activity before the SPAC boom.

Just the same, other media outlets appear to have unquestioningly picked up the CNBC conclusion that SPACs were the culprit for burnout and reused the mistaken factoid without attribution.

Fortunately, not everyone fell into that trap. Vice Media covered the Goldman survey without mentioning SPACs and headlined the story this way: Working at Goldman Sachs Suuuucks, Leaked Internal Survey Shows.

But in general, the media’s skepticism of SPACs has continued unabated. It’s even becoming deeper as prominent citizens lend their names to the investment vehicles.

Celebrity SPACs

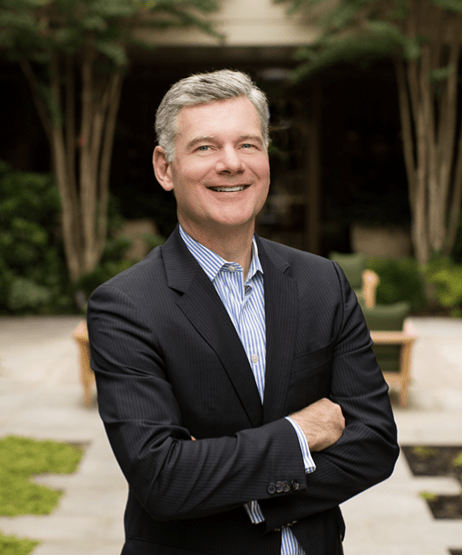

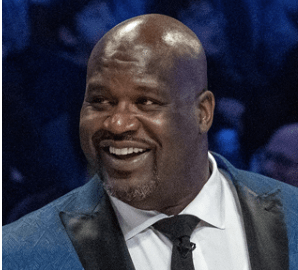

When well-known figures from the worlds of sports or entertainment attach themselves to SPACs, the media often fail to look below the surface. Sometimes the celebrity connections serve as mere window dressing, but occasionally the stars bring financial acumen to the deal.

The New York Times, for example, published an article about Shaquille O’Neal’s participation in Forest Road Acquisition Corp. but failed to mention the former NBA star’s extensive business experience—or his MBA and his doctorate in education. O’Neal has even earned the praise of SPAC expert Doug Ellenoff for serving on the board of Papa John’s Pizza.

Moreover, some reporters seem to scoff at the very idea of celebrity SPACs. In February, Matt Egan, a highly regarded financial journalist, wrote an article called, Celebs including A-Rod and Ciara are getting into SPACs. What could go wrong?

But the contempt for celebrity-related SPACs seemed like part of Egan’s disdain for SPACs in general.

Negativity prevails

In his article on celebrity SPACs, Egan quoted Yale professor Jonathan Macey, who said, “With a SPAC, it’s like you have a captain, and the captain is telling you he will buy a ship and then figure out where it will go.”

Egan wrote about the need for investor diligence and noted the massive amount of money pouring into SPACs. He reminded readers that markets are ruled by emotion and not rationality, which is the essence of behavioral finance.

Late in the article, he finally mentioned that what matters with SPACs is having management teams that know how to write business plans and take companies public.

But his article lacked any insight into the guardrails and advantages of SPACs, which include the IPO vote, arbitrage, warrants, the redemption potential and the capacity to eliminate risk (see here).

There’s no good reason for fear-mongering about SPACs. Give the participants the details, and let the market decide.