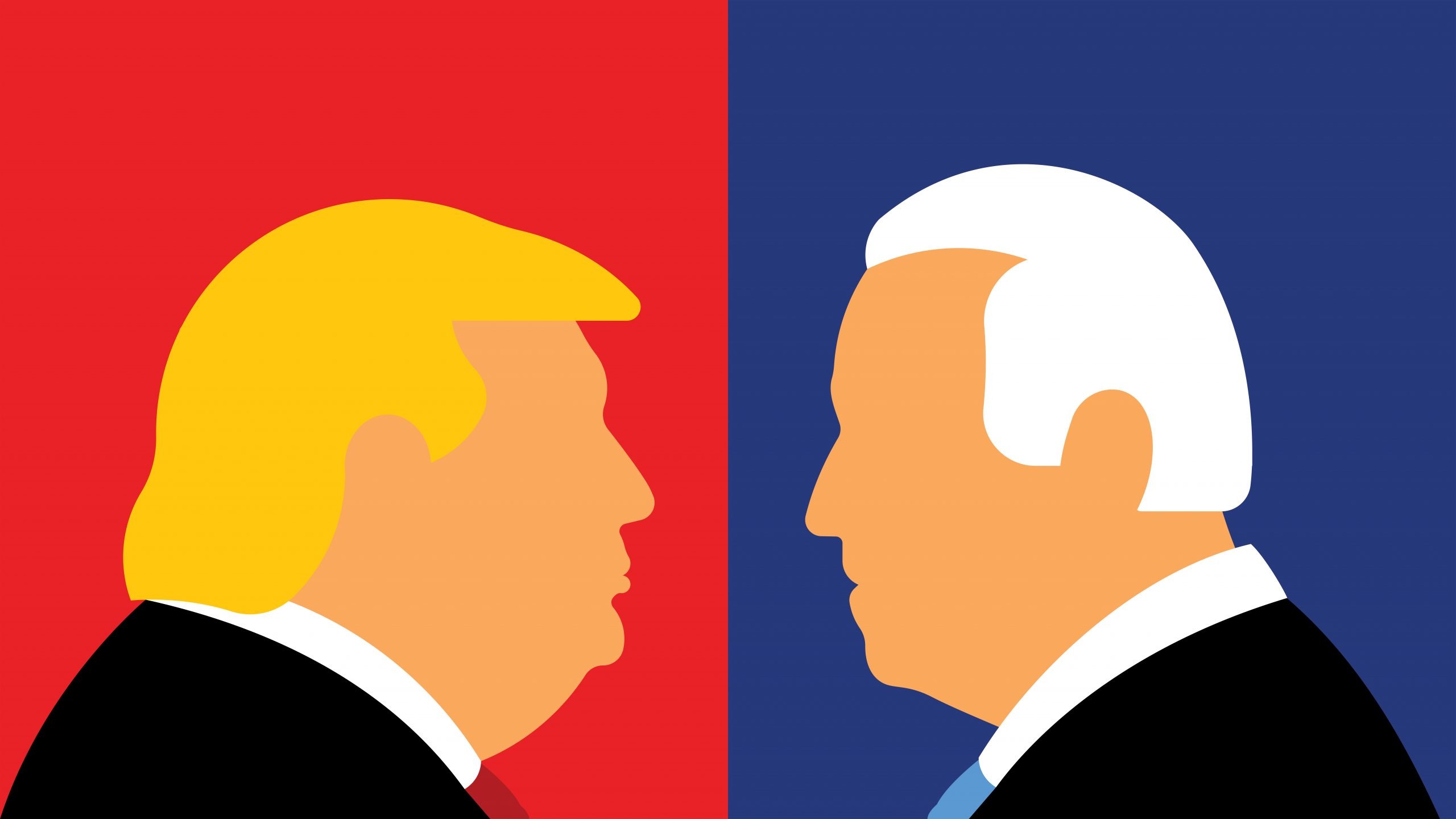

A Trump Reelection Could Shake Up the Energy Industry

If Donald Trump is reelected for a second term in November, the energy sector could experience a shake up due to renewed support for traditional fossil fuel companies and a rollback of legislation supporting renewable energy sources

- Looking ahead to the 2024 presidential election, one of the market sectors that could be most heavily impacted by the reelection of Donald Trump would likely be the energy sector.

- During his first term, former President Trump favored the expansion of domestic fossil fuels production, and has expressed skepticism over the potential of renewable energy sources.

- Another key issue in the upcoming election is the deteriorating fiscal health of the U.S. federal government, which needs to raise additional tax income—and cut spending—to alleviate widening budget deficits, and slow down worrying growth in the national debt.

Luckbox magazine is no stranger to prediction markets, but it’s a bit too early to dive into the potential outcome of the 2024 presidential election. On the other hand, it’s not too early to start thinking about which sectors of the market could be most impacted if Donald Trump is reelected as president in November.

As of right now, the energy sector looks primed for a shakeup if Trump wins reelection. Political ideologies have shifted in recent years, to say the least, but the environment is one issue that’s still fairly cut-and-dried when it comes to the two major political parties in the United States.

Democrats typically prioritize environmental protection and advocate for measures that address climate change, promote renewable energy sources and protect and preserve natural resources. In contrast, Republicans tend to prioritize economic considerations and regulatory reform in favor of restrictive environmental regulations and frameworks.

This divide is evident in historical Congressional voting patterns, such as the rejection of the Green New Deal proposal in 2019, which was strongly opposed by Republican lawmakers. On environmental issues, President Joe Biden and former President Donald Trump have typically aligned closely with their respective party ideologies.

President Biden, for example, has prioritized environmental protection and climate action, consistent with his party’s platform. Former President Trump, on the other hand, has pursued a different approach to environmental policy, emphasizing deregulation and economic growth over environmental protection. During the Trump administration, the government rolled back numerous environmental regulations, including those related to emissions standards, water quality and public lands protection.

Not long after he was elected to the White House, Trump withdrew the United States from the Paris Agreement on climate change. The Paris Agreement, which was adopted in 2015 under the United Nations Framework Convention on Climate Change (UNFCCC), aims to limit global warming to well below 2 degrees celsius above pre-industrial levels.

Illustrating their conflicting ideologies on the environment, President Biden signed an executive order to readmit the United States into the Paris Agreement on his first day in office. As a result of these opposing ideologies on the environment, the energy sector looks like it would be most affected by a change of leadership in the White House.

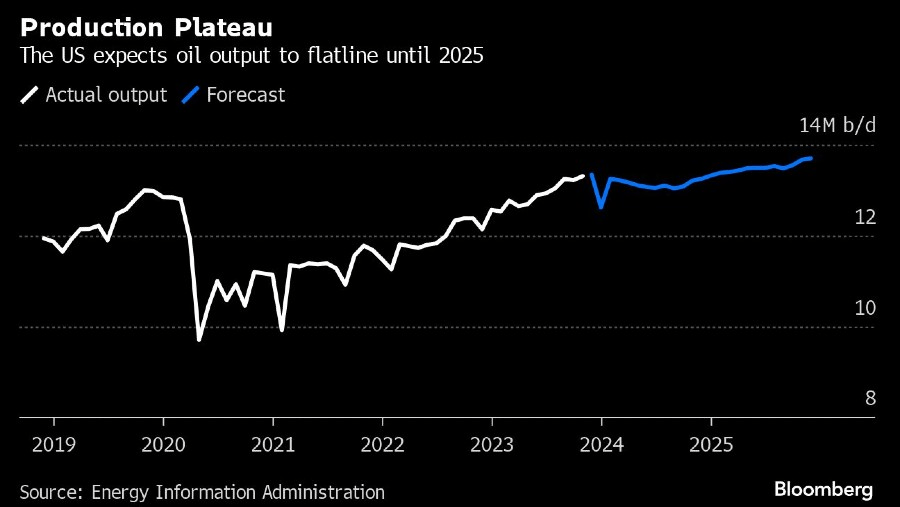

Throughout his first term, Trump pursued policies aimed at bolstering domestic fossil fuel production, while also working to reduce regulatory barriers for companies operating in this sector. A continuation of these policies could result in further deregulation of the fossil fuel sector, making it easier for companies to explore, extract and transport oil, natural gas and coal. This could lead to increased investment in fossil fuel infrastructure and potentially contribute to improved profitability, which would benefit traditional energy companies.

Conversely, the alternative energy sector, often referred to as green energy or renewable energy, could face challenges and setbacks under a second Trump administration. In previous comments and statements, Trump has expressed skepticism about the viability and effectiveness of renewable energy. And if Trump is elected to a second term, he’s expected to roll back some of the Biden administration’s new investments into alternative energy, such as those outlined in the Inflation Reduction Act.

Looking ahead into 2025, reduced federal support for green energy initiatives could make it more difficult for renewable energy companies to compete with the established fossil fuel industry. Under this scenario, the future outlook for the alternative energy sector would likely diminish, potentially weighing negatively on the shares of alternative energy companies.

Some of the largest and best-known alternative energy ETFs include the ALPS Clean Energy ETF (ACES), the iShares Global Clean Energy ETF (ICLN), the Invesco WilderHill Clean Energy ETF (PBW) and the Invesco Solar ETF (TAN).

In terms of traditional energy ETFs, investors and traders can track and trade the Energy Select Sector SPDR Fund (XLE), the iShares Global Energy ETF (IXC), the Oil Equipment & Services (OIH), the Vanguard Energy ETF (VDE) and the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).

Deteriorating fiscal health of the U.S. federal government

While it isn’t specific to the stock market, another key issue in the upcoming election is the fiscal health of the federal government. In campaign terms, this issue is often couched as the “Trump tax cuts.”

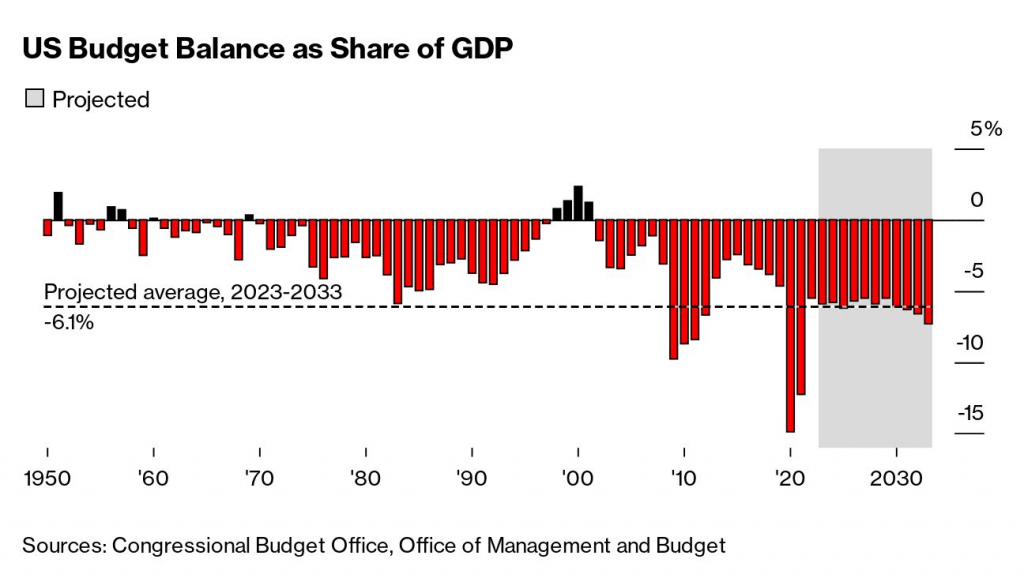

The U.S. federal government is currently spending a lot more than it collects in tax revenue. That’s not a new development, but the gap between spending and tax receipts has grown in recent years, and in the process transformed into an elephant in the room. In 2024, the Congressional Budget Office (CBO) forecasts that the federal government will run a budget deficit of roughly $1.5 trillion.

One key reason for the government’s continuing budget deficit is insufficient tax receipts. Back in 2017, Republican lawmakers—in conjunction with then-President Trump—enacted a significant tax cut for both corporations and individuals in the United States.

Notably, however, the majority of that tax relief went to the U.S. corporate sector, with some describing it as the largest corporate tax cut in history. For example, Sonali Kolhatkar recently referred to the 2017 corporate tax cuts as “the single largest reduction ever in that category.”

As a result of those 2017 tax cuts, the tax rate for large corporations dropped from 35% all the way down to 21%. Obviously, a tax cut of historic proportions has serious repercussions, and in order to balance the budget, the U.S. government theoretically needed to reduce spending to bring it in-line with reduced tax revenue. Unfortunately, the onset of the COVID-19 pandemic—which required significant government support—made widespread spending cuts unfeasible.

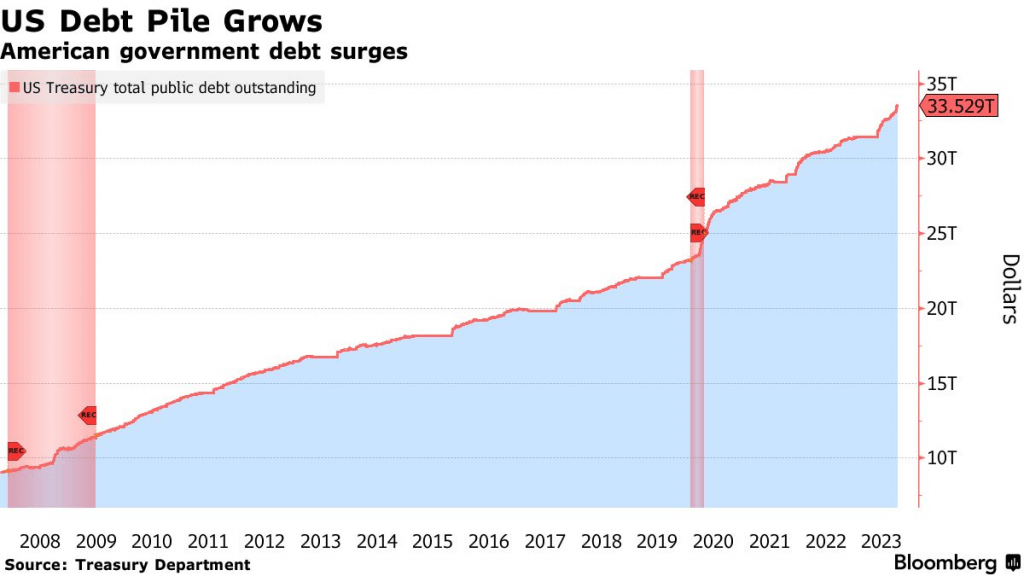

Six years removed from those tax cuts, the federal government has yet to remedy this imbalance, and continuing deficits in the government’s annual budget have contributed to a rapid increase in the country’s national debt, which has ballooned to nearly $35 trillion. This figure represents the total amount of money that the U.S. government owes to creditors, both domestic and foreign, stemming from cumulative budget deficits over time.

Looking on the bright side, the 2017 tax cuts have undoubtedly contributed to the bull run in the stock market, because reduced corporate taxes have contributed to enhanced corporate profitability. It’s no coincidence that corporate profit margins have been hovering near all-time highs, in the wake of those tax cuts. But this situation has also weakened the government’s overall fiscal health.

Last year, two different global debt ratings agencies downgraded the credit rating of the U.S. federal government. With the national deficit continuing to rise at an uncomfortably rapid pace, lawmakers in Washington D.C.—including both Congress and the White House—must navigate a resolution to this increasingly critical situation. This will almost certainly involve a combination of spending cuts and tax increases.

This issue is paramount at this time because the aforementioned tax cuts are scheduled to expire at the end of 2025. So if Trump is elected to a second term—alongside Republican sweeps in the House and Senate—he is expected to prioritize the extension of the tax cuts. But if proportional cuts to government spending aren’t enacted at the same time, then the country’s fiscal situation could go from critical to an imminent threat. Under this scenario, further downgrades to the U.S. government’s credit rating would be virtually assured.

Alleviating future budget deficits

For his part, President Biden has indicated that he would prefer to make up the government shortfall by raising taxes on the ultra-rich, and raising the corporate tax rate back above 21%—probably somewhere between 25-28%. Together, those policies would help alleviate future budget deficits and help slow the rate at which the national debt is rising.

But the aforementioned tax increases would also need to be paired with spending cuts. And that’s where things get a bit complicated. With the threat of a U.S. recession already hovering over the economy, any significant drop in government expenditures would almost certainly contribute to slower economic growth.

Obviously, neither candidate is going to support raising taxes on middle-class Americans. Advocating for higher taxes on middle-class Americans is basically akin to political suicide. But by continuing to kick the can down the road, the U.S. is setting itself up for a potential disaster.

This year, the U.S. government is expected to spend $870 billion, or 3.1% of GDP, on interest payments. If the current bout of fiscal irresponsibility isn’t resolved soon, those payments could rise further, as foreign creditors demand higher interest rates to compensate for the rising risk of default.

For the aforementioned reasons, the extension of the so-called “Trump tax cuts” isn’t necessarily the primary issue in the upcoming election. It’s far broader than that, and a lot more critical. If these fiscal issues are left unaddressed, they could eventually trigger another financial crisis, which could wipe out recent gains in the stock and housing markets, as was observed back in 2008-2009.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.