Trading the Top-performing Bond ETFs and Bond Funds in 2023

The bond markets have traded mostly sideways in 2023, but that’s a big improvement from 2022, when the bond market experienced one of its sharpest corrections since the 2008-2009 Financial Crisis

- Last year, the bond market suffered one of its worst corrections since the 2008-2009 Financial Crisis.

- This year, bonds have been on a bit of a rollercoaster, as interest rate expectations have shifted throughout the year.

- However, as a result of continued rate hikes by the Federal Reserve, gains in U.S. government bonds have been limited.

Bonds haven’t been a top performer in the financial markets this year, but in relative terms, they’ve produced far better results as compared to last year.

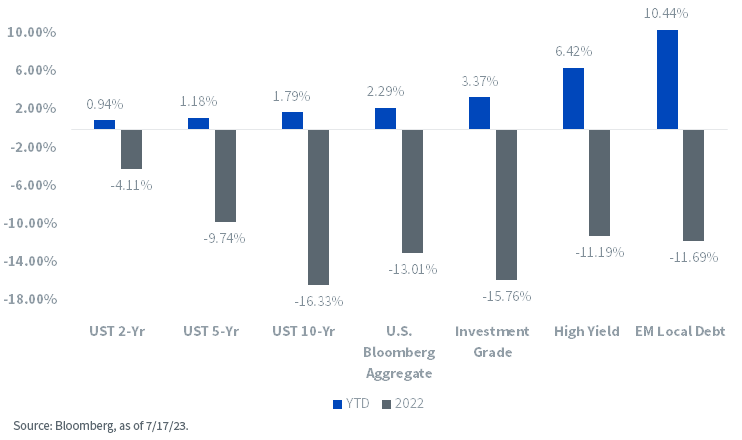

As most investors and traders are aware, the Bloomberg U.S. Aggregate Bond Index was down 13% in 2022, which represented the first double-digit drop in that index since 1976.

This year, bonds have been on a bit of a rollercoaster, as interest rate expectations have shifted throughout the year.

At the start of the year, most investors in the bond market were expecting the Fed to pivot away from its current rate-hike cycle. However, those hopes haven’t come to fruition, and in fact, the Fed may still raise rates again in the fall.

Those sobering developments appear to have temporarily squashed the bond bulls, which helps explain why bonds were mostly up in Q1 and then came back down to earth in Q2.

In the first quarter of this year, the Bloomberg U.S. Aggregate Bond Index was up nearly 3%, but then lost some steam in the second quarter. Year-to-date, the index is up roughly 2%.

Bond indices like the Bloomberg U.S. Aggregate provide a nice overview of overall performance in the bond market because they are composed of a cross-section of different types of bonds, such as government bonds (i.e. U.S. Treasuries), agency bonds, corporate bonds and other fixed-income products.

Much like the stock market, some niches of the bond universe have performed better than others. The image below highlights the relative performance of the primary bond categories so far in 2023.

Source: WisdomTree

Investment grade, high yield and emerging market fixed-income products have performed far better than U.S. government bonds so far in 2023.

However, that could change if the Fed ever pivots away from its current rate-hike cycle—or better yet, starts to cut rates.

Listed below are some of the top-performing bond managers in the United States during the last 52 weeks (from the end of Q1 2022 through the end of Q1 2023, net return).

- 16th Amendment Vicksburg, +56.2%

- Federated Hermes Trade Finance, +6.3%

- Eaton Vance Global Macro, +5.1%

- BNP Paribas Mortgage Alpha, +4.89%

- Potomac Income Plus, +4.5%

- Herzfield Tax-Exempt Composite, +4.3%

- Mellon Opportunistic Fixed Income, +3.8%

- One Oak Enhanced Municipal Portfolio, +3.7%

- FIAM Leveraged Loan Composite, +2.9%

- T. Rowe Price Floating Rate Bank Loan, 2.9%

Obviously, outperformance in the 16th Amendment Vicksburg sticks out in the above list.

Managers don’t typically publish the secret sauce in terms of their strategic approach, but the co-founder and managing member of 16th Amendment Advisors John Lee recently told Pensions & Investments that Vicksburg is “a total return, institutional fixed-income strategy and that it holds investment-grade municipal bonds, corporate bonds and their hedges in a strategy that is targeted to investors looking for non-correlated, high-grade fixed-income exposure.”

The above list also highlights how some of the non-traditional bond managers have seen success in the current environment.

For example, the trade finance niche, as highlighted by recent performance in the Federated Hermes Trade Finance fund. Trade finance refers to the short-term floating interest rates that are utilized by cross-border import/export companies.

The head of the Trade Finance team at Federated Hermes told Pensions & Investments that, “The overall investment philosophy of Federated Hermes places a premium on diversification and the trade finance strategy reflects that since it works as a diversified source of alpha.”

Considering the outperformance in emerging market fixed income, it’s also no great surprise to see the Eaton Vance Global Macro fund clocking in at No. 3 on the list of top performers.

Top-performing Bond ETFs in 2023

Investors and traders seeking exposure to the bond markets can also use the ETF universe to meet their needs.

As ETFs have grown in popularity, so have the number of ETF offerings linked to bonds. And much like traditional bond funds, there’s a wide variety of ETFs to choose from that cover a wide range of themes and strategies.

One of the best-known bond ETFs is the iShares 20+ Year Treasury Bond ETF (TLT), which focuses specifically on U.S. government bonds.

TLT is basically a proxy for long-term US government bond prices (20+ years) in ETF form. This is outlined clearly in the TLT fund summary, which indicates that TLT invests “at least 95% of its assets in U.S. government bonds.”

As most investors and traders are aware, bond prices and interest rates share a strong inverse correlation. That means when interest rates go up, bond prices go down, and vice versa.

That relationship helps explain why many bond-focused products underperformed last year, when the Federal Reserve raised benchmark interest rates at the fastest pace since the 1980s.

This year, the pace of the rate hikes has slowed, but the Fed has yet to pivot away from its current hawkish stance. That’s why bond valuations have been mostly contained in 2023.

That said, TLT is holding a lot better than it did in 2022, when it dropped by more than 30%. As of now, TLT is trading almost exactly where it started the year—around $101/share.

TLT started 2023 on strong footing, but much like the Bloomberg U.S. Aggregate Bond Index, it lost steam in Q2.

Looking at the broader bond ETF universe, many of the 2023 outperformers hail from the same niches that were highlighted in the list of best bond managers—investment grade, high yield and emerging market.

Listed below are the top-performing bond ETFs so far in 2023 (as of July 26):

- First Trust Emerging Markets Local Currency Bond ETF (FEMB), +14.9%

- iShares Convertible Bond ETF (ICVT), +12.4%

- WisdomTree Emerging Markets Local Debt Fund (ELD), +12.0%

- SPDR Bloomberg Convertible Securities ETF (CWB), +11.7%

- BondBloxx CCC-Rated USD High Yield Corporate Bond ETF (XCCC), +10.7%

- iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (TLTW), +10.0%

- VanEck J. P. Morgan EM Local Currency Bond ETF (EMLC), +9.8%

- Janus Henderson B-BBB CLO ETF (JBBB), 9.7%

- Franklin Senior Loan ETF (FLBL), 9.5%

- Invesco Emerging Markets Sovereign Debt ETF (PCY), +9.5%

- BondBloxx USD High Yield Bond Consumer Cyclicals Sector ETF (XHYC), +8.6%

- KraneShares Quadratic Deflation ETF (BNDD), 8.5%

- Xtrackers Municipal Infrastructure Revenue Bond ETF (RVNU), +8.4%

- iShares J.P. Morgan EM Local Currency Bond ETF (LEMB), +8.4%

- iShares International High Yield Bond ETF (HYXU), +8.2%

Going forward, interest rate decisions taken by the Federal Reserve, as well as the overarching philosophy of the central bank (i.e. dovish, neutral, or hawkish), will heavily influence the direction of bond prices in H2 2023.

To learn more about trading bond-focused ETFs, check out this installment of Market Measures on the tastylive financial network. To follow everything moving the markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.