Insiders Aren’t Buying Ark’s Hype

Fund manager Cathie Wood says her portfolio will produce a 40% compound annual growth rate over the next five years. Market history and executive insiders suggest otherwise.

After 12 years as chief investment officer of global thematic strategies at investment giant AllianceBernstein, Wood founded ARK (Active Research Knowledge) Funds in 2014. Its thematic investment funds target disruptive and innovative high-growth companies, the technological forces altering economies and consumer behavior.

The flagship ARK Innovation ETF (exchange-traded fund) invests in next-generation technology like videoconferencing, telemedicine, energy storage, digital streaming and the metaverse. Wood’s team has capitalized on investors’ fear of missing out (FOMO) on big trends and bigger gains.

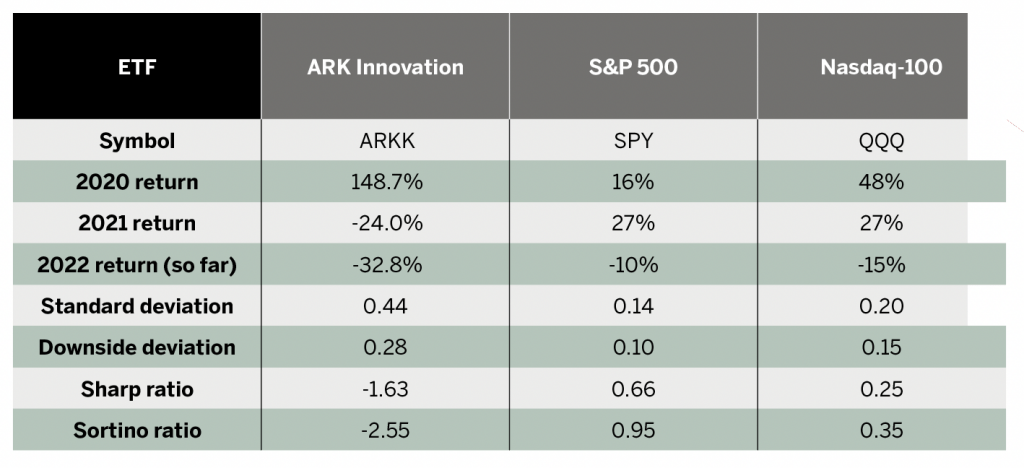

In 2020, five of ARK’s seven ETFs achieved an average return of 141%.

A gushing media cheered Wood’s success. Financhill, a company that offers a suite of financial tools, called her “the most underrated investor in the game.” Barron’s said she “disrupted” investment management. In a New York Times profile titled God, Money, YOLO: How Cathie Wood Found Her Flock, the authors highlighted the bold Tesla price prediction Wood made while debating (or besting) Kevin O’Leary, Shark Tank’s Mr. Wonderful.

But times have changed. With recent market conditions working against tech stocks, the flagship fund and other ARK ETFs face new pressures. For months, investors have dumped growth stocks on speculation that the Federal Reserve would accelerate its timeline on interest rate hikes to tame inflation and concerns about high valuations.

Longtime critics have argued that ARK Funds, like the tech-heavy Nasdaq-100, benefited from the Federal Reserve’s decade of low interest rates and the cheap money policies that have prevailed since the fund’s inception. Add on massive amounts of Congressional stimulus in 2020 and 2021—plus a new wave of speculators—and the market capitalization of stocks trading at a price-to-sales above 20 surpassed the nosebleed valuations during the dot-com bubble. (See “The Cost of Growth,” at the end of the article.)

With new headwinds and capital rotating from growth stocks to value stocks, Wood hasn’t wavered despite rampant selling in 2022. (The flagship ETF fell 33.5% YTD by Feb. 18).

“Our strategy is our strategy,” Wood told Bloomberg in December before issuing an eye-popping outlook. “The opportunity in our strategy is huge right now. We expect a compound annual growth rate (CAGR) of roughly over 40% over the next five years.”

Critics are scrutinizing this incredible projection and Wood’s recent argument that ARK now qualifies as a “deep value” fund. It was noted in thetycoonist.com blog, for example, that just one in 15 stocks on the S&P 500 have generated annualized returns of 40% over the last five years. This suggests that picking just one stock with 40% annual returns has a 6.6% probability.

Therefore, based on joint probability, the odds of having a three-stock portfolio in which all stocks hit an annualized return of 40% over five years is one in 38,000. When the portfolio had 43 stocks in December, thetycoonist.com said that for the fund “to quintuple in five years, every single stock would need to increase by a factor of more than twelve.”

Such returns are technically possible but highly unlikely.

So, what does Wood see that so many others don’t? If her preferred stocks trade at deep value and could deliver such incredible returns, why would a group of investors with an exceptional track record of exploiting share price value fail to share her conviction?

A warning to growth investors

Wood offered a statement in February that redefined ARK’s thematic innovation fund. “Give us five years,” she said, “we’re running a deep value portfolio.”

Let’s unpack both parts of that sentence.

First: “Give us five years.”

According to ARK’s website, its thematic analysts ask four key questions about investment opportunities:

• Where’s the next big disruptive innovation?

• What’s the size of the total market?

• Which industries will be disrupted?

• What companies will emerge as the winners?

After answering those questions, ARK’s thematic analysts speculate and invest in much the same way someone might bet on sports futures markets for the Kentucky Derby.

But ARK Funds is also betting on the weather, track conditions, jockeys, trainers—and even the breeding of horses that occurred years ahead of multiple Kentucky Derby events. Then ARK Funds changes its bets dozens of times along the way at different odds.

Look at the fund’s Top 10 holdings in mid-February: Tesla (TSLA), Teladoc (TDOC), Coinbase (COIN), EXACT Sciences (EXAS), UiPath (PATH), Roku (ROKU), Zoom Video Communications (ZM), Block (SQ), Unity Software (U) and Intellia Therapeutics (NTLA).

Based on the weight of ARK’s current investments, one might ask whether those top 10 companies represent the “best in breed” at their current value relative to their perceived future value.

Can anyone reasonably hypothesize future disruption for videoconferencing giant Zoom Video Communications? The stock is now down from all-time highs of $568.34 in October 2020 to less than $127 per share in February 2022. What trends would push it back to all-time highs, as Wood suggests, in the next five years?

Basic business analysis indicates low barriers to entry in the videoconferencing business. Plus, companies new to the sector have been gaining market share, thanks to the COVID-19 work-from-home trend.

On the micro level, one wonders if Zoom’s best years are ahead in a world that’s adopting digital whiteboards, employing artificial intelligence and embracing the metaverse. Or will Americans want to take part in what Vox describes as a “dystopian hellscape of working in the metaverse?” Imagine workers joining the avatars of colleagues while strapped inside a VR headset at home. Will another competitor take market share? Before allocating capital, ARK should ponder all of this and then ask its fourth question: “Which companies will emerge as the winners?”

Another ARK Innovation favorite, Teladoc, could succeed in telemedicine, but nothing has stopped virtual medicine from thriving across competitive, independent health networks. Is the metaverse the future of virtual surgery support, and will that drive radical disruption and incredible profits for Teladoc investors? Or will it lose part of its 13% market share to competitors that include Sharecare (SHCR), Amwell (AMWL) and other telehealth competitors?

Tesla has grown incredibly but in the years ahead may concede market share in the EV business to legacy automakers like Volkswagen, which will become the global leader in EV production next year. Tesla trades at 18.6 times sales, and shares are off about 31.8% from all-time highs. Its price-to-earnings sit at an incredible 178 times, signaling that the price justifies the return by the year 2190. (Note: Tesla has proven valuation ideologues wrong before).

Tech may be disruptive, but projecting the future market leader can be a fool’s errand. Take the example of Motorola Solutions. It was once the world’s largest cell phone manufacturer and thus a leader in a disruptive technology that changed the global landscape. But Motorola fell out of favor when Apple and Samsung unleashed even more disruption. Motorola Solutions stock cratered after Apple unveiled the iPhone.

Microeconomic questions prompted the Morningstar investment research firm to issue a “neutral” rating in 2021 for the ARK. (See Falling Star). Analyst Robby Greenwald worried last year that ARK’s nine analysts lacked deep industry experience and that the fund struggled to develop and retain talent.

The fund also seemed to operate on Wood’s instinct instead of thematic analysis, he wrote.

“ARK’s untested analysts, go-with-your-gut risk management approach and bloated asset base raise doubts about whether this fund’s outstanding historical results can continue,” Greenwald maintained.

His report emerged one month after ARK Innovation hit its all-time high of $159.70. By Feb. 18, 2022, shares traded at $64.80.

Turnover trouble

ARK Innovation ETF is an active fund, meaning that Wood can jump in and out of stocks and other investors can follow based on daily reporting. However, the exchange-end fund enables Wood to force investors to remain locked in—a very liquid strategy.

Traditionally, a five-year fund would set several positions, maintain low turnover and act with conviction on a specific portfolio. In finance, a portfolio turnover ratio is the percentage change of the stocks bought and sold over 12 months.

ARK Innovation reports a turnover ratio of 70%. The fund with a five-year outlook has made many impulsive moves with investor capital, even if it maintains an “active” strategy.

For example, ARK dumped shares of Twitter in January 2022. Logic suggests, given an active strategy, that Wood needed cash for more attractive buying opportunities.

“I’ve never seen innovation on sale like it is today.” Wood said in January.

On Jan. 7, Wood’s fund purchased a sizable stake of 261,211 shares of Roblox (RBLX) as shares traded above $84. Wood had previously generated large gains in November 2021 in its ARK Next Generation Internet ETF portfolio after a 42% jump in shares after earnings.

But Roblox’s innovation got cheaper in February.

One month later, ARK Innovation bought another 729,695 Roblox shares on a day the stock closed at $63.06. Then, after another small purchase the following day of 42,982 shares, the fund found another sale—buying another 337,552 shares after share prices collapsed after earnings.

Shares then lost another 8.3% on Feb. 18. and traded under $50 per share.

So, does ARK still believe in Roblox, even with its -25.8% margins, the price-to-sales ratio of 13.4, and other weak fundamentals in the middle of a dramatic sell-off? As tech stocks continue to drop, as the Fed hikes rates and as growth stocks continue a brutal round of price discovery, Wood is asking for incredible patience despite her previous winning track record.

What insiders say

Now to the second—and more important—part of Wood’s proclamation about ARK ETF: “We’re running a deep-value portfolio.”

The phrase “deep value” is associated with Benjamin Graham, the famed value investor and author of the Wall Street tome The Intelligent Investor.

Wood appears to be redefining value by linking the ratio of a stock’s current price to a future that “we cannot even imagine right now.” Or as she recently described it, she’s tying investment to the disruptive force of the metaverse.

It’s a restructuring of valuation logic. It’s the soft rebranding of ARK Funds. And it’s a hard sell.

At its core, “value” is a market anomaly, one that’s “prominent in short, specific periods,” according to finance professors Soosung Hwang of Sungkyunkwan University in South Korea and Alexandre Rubesam of Cass Business School in the United Kingdom.

Value is a common subject in academic studies of how certain investors exploit it for gains and how it relates to other anomalies.

Corporate insider buying and selling trends are the most important signals when building conviction for a trade or spotting value, according to a 2018 study called Do Insiders Exploit Anomalies? by Deniz Anginer, Gerard Hoberg and H. Nejat Seyhun.

That study finds that insider executive purchases exploit price anomalies and allow buyers to extract value between their buy price and when knowledge of their trades becomes public. As legendary money manager Peter Lynch once said, “Insiders might sell their shares for any number of reasons, but they buy them for only one: They think the price will rise.”

Insider buying can be a sign of confidence when a stock has fallen and executives believe it’s undervalued. Conversely, insider selling, especially among several executives in a process known as cluster selling, can signal a collective belief that the stock may be expensive.

Analysis of this trend suggests a diligence failure in ARK Innovation ETF’s portfolio construction.

Tracking AARK insiders

The U.S. Securities and Exchange Commission (SEC) requires corporate insiders to submit a Form 4 when they buy or sell stock in their companies or execute company stock options.

Consider what that form indicates about ARK Innovation ETF.

The fund’s share price peaked at $159.70 in February 2021 and began declining. Over the 12 months from that peak, insiders at ARK’s top 10 company holdings sold more than $27.92 billion in shares, according to secform4.com. Less Tesla and Elon Musk, the other nine represented about $11 billion in sales.

These sales represented an exit of existing shares and pushed the insider buying signal on all 10 stocks into negative territory.

Now, guess how much stock those insiders purchased directly over those same 12 months, according to the same source. The answer: Zero.

Suppose ARK has assembled a superior collection of holdings that will trade at Wood’s definition of deep value and thus possesses significant financial potential in the years ahead. These are the companies that Wood believes will be the winners in the race toward disruption.

If that’s true, why aren’t executive insiders—a predictive class of investors—buying stock in her preferred disruptive companies? They’re not directly buying their own stocks hand-over-fist, even though Wood is staking her reputation on their companies.

Executives do receive options and stock incentives, but SEC documents show that no insiders at the top 10 ARK holdings purchased shares directly over the previous 12 months.

In many cases, corporate officers executed options and took stock. In one example, Tesla CEO Elon Musk executed billions in stock for “tax purposes” in September 2021, only to turn around and sell shares for cash.

Analysis of the entire ARK portfolio of 37 stocks shows that as of Feb. 18, not many insiders have made direct purchases of their stocks in the previous 12 months. Insiders at eight companies triggered only 13 direct cash purchases since February 2021.

At just 0.5% of the ETF’s weight, digital education firm 2U (TWOU) is the holding with the largest number of insider trades. Four executives bought stock between Feb. 14 and Feb. 16 in a range of $9.43 to $10.07 per share.

At $9.43, that price sits at roughly 81% off from the company’s 52-week high.

Direct insider buying isn’t a perfect indicator of future prices, but it is a sign that in terms of value very few executives at the companies Wood touts believe now is the time to buy shares.

Warning signs

Don’t think of this as a eulogy. Consider it a warning. Many managers have believed their strategies could weather any headwind but promptly failed.

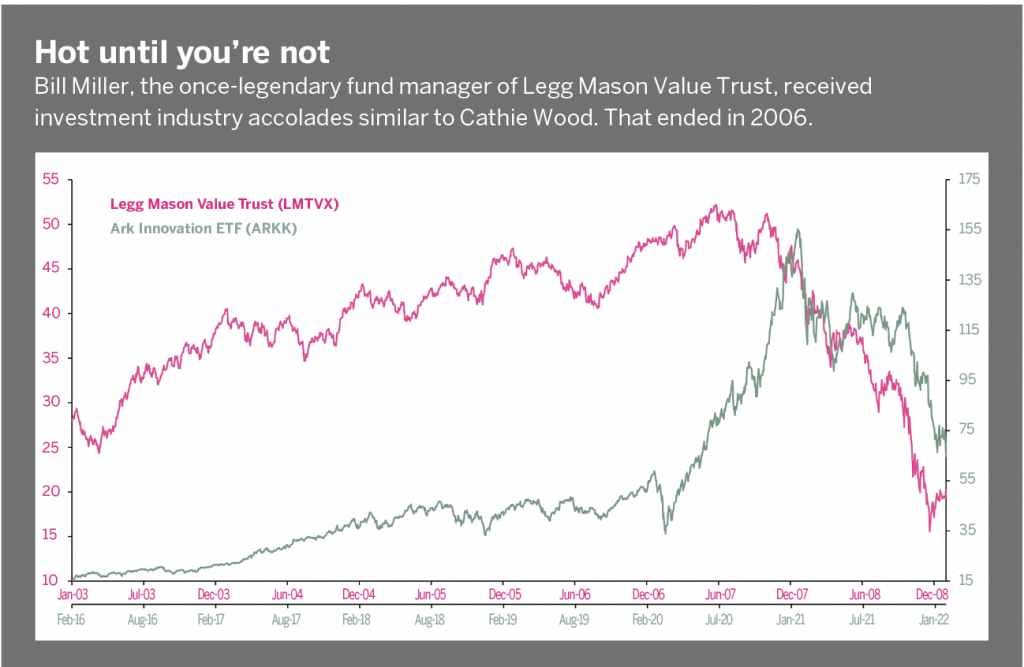

Esteemed manager Bill Miller, whose Legg Mason Value Trust beat the S&P 500 for 15 straight years, doubled down on “value” in Bear Stearns and other fading financial stars during the 2008 crisis. The event was dramatized in the book and film The Big Short.

In what Pershing Square Capital founder Bill Ackman called “one very big mistake,” he held onto Valeant Pharmaceuticals (VRX) as shares cratered during an activist effort. As a result, he endured a brutal two-year stretch of losses.

Both managers bounced back and have delivered remarkable returns in recent years. But other names have disappeared from the headlines.

Financial manager Garrett Van Wagoner had the “golden touch” on tech stocks when he launched a fund in January 1997. His Emerging Growth Fund had annual gains of 66% in the first three years, including 291% gains in 1999. Then, the dot-com bubble deflated. So when Van Wagoner closed his fund in 2008, it had an annualized loss of 7.8% from inception.

Nobel Laureate economist Paul Krugman wrote a eulogy for Tiger Management in April 2000. In his classic New York Times op-ed, Reckonings: A Hedge Fund Pruned, Krugman noted that fund manager Julian Robertson placed failed bets against the Japanese economy.

“Each time the market wonders what happened” when a famed manager loses touch, Krugman wrote. “And each time, one possible answer is that he never had that touch to begin with.”

In many cases, the failed fund becomes more memorable than the forgotten manager: Think of Archegos Capital, Everest Capital, Greensill Capital and Woodford Investment Management.

The future

No one should arbitrarily root against Wood—except investors in the Tuttle Capital Short Innovation ETF (SARK), an actively managed fund that aims to generate -1x the return, for a single day, of the ARK Innovation ETF (ARKK).

This fund, which uses swaps that Wood has called “ridiculous,” generated a 61.3% return from its Nov. 12, 2021 inception through Feb. 18, 2022.

Meanwhile, Wood remains convinced that rotating capital from growth stocks to value has been a mistake. In a January 2022 report, ARK Funds’ managers wrote: “In our view, the real bubble could be building in such so-called “value” stocks with much higher valuations in the context of a five-year investment time horizon, as opposed to last year.”

Let’s be fair. The acolytes of a famed value investor and author Benjamin Graham aren’t worried because banks and manufacturing stocks have increased in price-to-tangible book value from 0.8x to 1.0x in three months and remain near liquidation value.

But maybe Wood will be right and everyone else will be wrong, even the corporate insiders.

Or perhaps Wood will make a strategic shift that anchors the portfolio to S&P 500 benchmark stocks like Amazon and Apple while riding out the storm fueled by broad price discovery. Or maybe ARK Funds’ tech stocks will continue to fall and thus attract takeover bids that generate merger arbitrage opportunities.

Or, in five years, traders may look back and raise a glass to St. Cathie after she walks away with an estimated net worth of $250 million.

In this era of unforgiving investors and media blowhards, one should—at the very least—salute Wood for having the bravery, resilience and confidence to fight the history books and attempt to make valuations bend to her will.

The Cost of Growth

How costly is a stock that trades at a multiple of 10 times revenue (or a P/S of 10)? In April 2002, former Sun Microsystems CEO Scott McNealy said the following to Business Week:

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends,” he said. “That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is hard with 39,000 employees.”

Achieving those seemingly impossible returns would also require that the company paid no corporate or dividend taxes and spent nothing on research and development for a decade, McNealy said.

“Now, having done that, would any of you like to buy my stock at [the 2000 high of] $64?” he asked rhetorically. “Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

Yes, what were investors thinking in 2000?

Apparently, they believed that 10-times-sales doesn’t matter. That a company may disrupt an industry’s legacy players. That the rest of the investment world—including the valuation snobs—were wrong.

They were thinking like the architects of the ARK Innovation exchange-traded fund. Even after the dramatic tech selloff from November 2021, the average P/S ratio of its top 10 holdings is 11.5 times revenue.

Falling Star

“Wood’s reliance on her instincts to construct the portfolio is a liability. This is a high-risk, benchmark-agnostic portfolio that invests across technology platforms the team thinks will revolutionize how sectors across the globe operate.

“The firm often favors companies that are unprofitable, highly volatile and could plummet in tandem. The fund lacks well-defined risk controls, which are now more important than ever. As its asset base has swelled, the

fund has become less liquid and more vulnerable to severe losses. As an exchange-traded fund it can’t close to investors.

“ARK’s untested analysts, go-with-your-gut risk management approach and bloated asset base raise doubts about whether this fund’s outstanding historical results can continue.” – Robby Greenwald, Morningstar, March 30, 2021