After 55% Correction, Hindenburg is Still Shorting Icahn Enterprises (IEP)

Hindenburg Research releases report on May 2 arguing Icahn Enterprises (IEP) was overvalued and now the dividend has been cut in half.

- On May 2, Hindenburg Research released a short report against Icahn Enterprises (IEP) suggesting Icahn Enterprises is overvalued and that the company’s dividend was unsustainable.

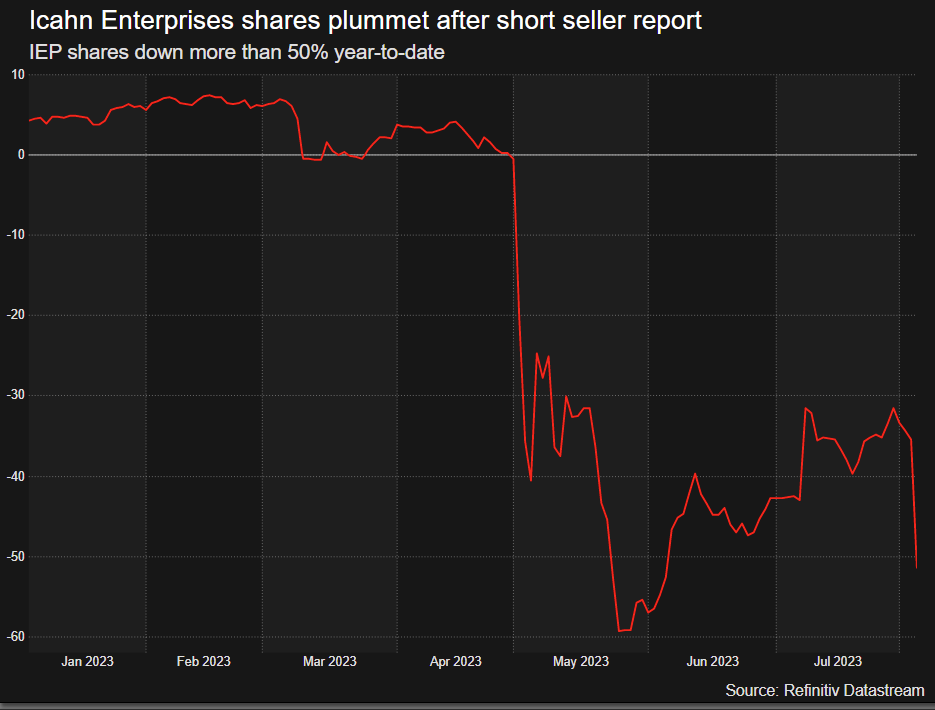

- In the wake of that report, IEP units are down roughly 55% on the year, and the dividend has been cut in half.

- IEP units started the year around $51/unit, but are now trading roughly $23.50/unit. Hindenburg’s report implies that the fair value of IEP units could be as low as $12.50/unit.

As a longtime shareholder activist, Carl Icahn is well-known for uncovering inefficiencies on Wall Street and exploiting them. But in 2023, the tables have turned, as Icahn’s own company—Icahn Enterprises (IEP)—has fallen under the microscope.

And so far, the findings haven’t been too favorable—at least not for Icahn and unitholders of Icahn Enterprises. Shares (technically referred to as units in this case) in IEP are down 55% on the year, which includes a 23% slide on Aug. 4, after the company announced it was cutting its dividend in half.

Early in his career, Icahn gained notoriety when he executed a variety of hostile takeovers—most notably his leveraged buyout of Trans World Airlines in 1988. More recently, however, Icahn had been known for leading activist shareholder campaigns against well-known companies such as RJR Nabisco, Clorox (CLX), Motorola and many others.

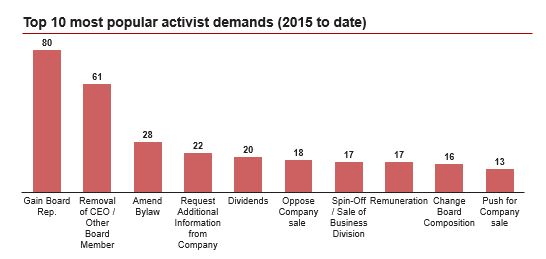

Icahn’s typical playbook is to quietly acquire a large stake in the target company, and then use that position as leverage to call for reforms that he believes will unlock additional value in the stock. This process usually involves placing himself or his allies on the board of directors at the target company—a common approach for activist shareholders, as illustrated below.

Source: Latham & Watkins

In many instances, Icahn’s strategy buoyed the prices of his investments, and created a profit for himself and his partners/investors. Icahn is even credited with the mainstream popularization of this approach, as evidenced by National Public Radio’s (NPR) 2008 characterization of Icahn as “the nation’s most famous activist investor.”

Considering that history, it’s somewhat ironic that Icahn has found himself the target of similar tactics in 2023.

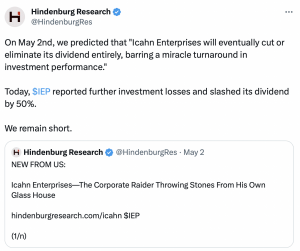

On May 2, Hindenburg Research launched a short investment thesis against Icahn Enterprises, arguing that the company was overvalued and that the company’s dividend was unsustainable.

Since that time, the market capitalization of Icahn Enterprises has dropped by more than $9 billion, and the company’s dividend has been cut in half. Considering those developments, it appears (at least for now) that Hindenburg’s thesis was correct.

Hindenburg publicized its case against Icahn Enterprises in a May 2 paper titled “Icahn Enterprises: The Corporate Raider Throwing Stones From His Own Glass House.”

In that piece, Hindenburg highlighted that “IEP trades at a 218% premium to its last reported net asset value (NAV), [which is] vastly higher than all comparables.”

Hindenburg further noted that “most closed-end holding companies trade around or at a discount to their NAVs,” highlighting that similar vehicles run by star managers such as Dan Loeb (Third Point) and Bill Ackman (Pershing Square) trade at discounts to NAV of 14% and 35%, respectively.

That comes in sharp contrast to the sky-high premium with which Icahn Enterprises was trading in relation to NAV—more than 200% above NAV (at least it was, before the Hindenburg report).

Hindenburg’s research also highlighted how IEP’s dividend yield was much higher than other large-cap companies, and how Icahn Enterprises had essentially been supporting the dividend with cash on hand, as opposed to investment income, which Hindenburg argued wasn’t sustainable.

Complicating matters further, Icahn—who owns 85% of Icahn Enterprises—had apparently pledged 60% of his stake in IEP toward personal loans, and hadn’t fully disclosed the details of those arrangements to unitholders of Icahn Enterprises.

Last month, Icahn—apparently caving to pressure stemming from Hindenburg’s report—announced that he had renegotiated the structure of his loans and purportedly untied them from the trading price of Icahn Enterprises. IEP rallied on that news, but wasn’t able to sustain the positive momentum.

On Au. 4, Icahn Enterprises announced a surprise cut to the dividend (from $2/unit to $1/unit)—further validating the Hindenburg investment thesis. IEP shares were down as much as 37% in the wake of that announcement, but ultimately closed the day above their worst levels.

Why Hindenburg is Still Shorting Icahn Enterprises (IEP)

Year-to-date, IEP is now down 55%. But despite that huge reversal, Hindenburg tweeted on Aug. 4 that they are sticking with their short position in IEP—at least for the time being.

Hindenburg may have been emboldened to maintain its short due to the recent earnings report released by Icahn Enterprises. During Q2 of this year, Icahn Enterprises lost another $269 million.

Moreover, it should be noted that Hindenburg’s original short thesis against Icahn Enterprises highlighted how the company’s investment portfolio was down roughly 53% since 2014, and how IEP had burnt through nearly $5 billion in cash over that same period.

Hindenburg also revealed that its own internal research suggested that IEP was trading “at a 310% premium to NAV.” That’s because Hindenburg assigned an in-house NAV of $4.4 billion to Icahn Enterprises, which was 22% lower than the company’s reported year-end indicative NAV of $5.6 billion.

At the end of last year, IEP units were trading in the market for roughly $51/unit. However, using Hindenburg’s estimate that the units were overvalued by 310%, that implies the fair value of IEP units could theoretically be as low as $12.50/unit—assuming one agrees with Hindenburg’s thesis and conclusions.

As a reminder, Hindenburg noted that many of IEP’s comparables trade at a discount to NAV—meaning that if IEP units were trading in-line with their competitors, they would actually trade below $12.50/unit.

As of Aug. 8, shares in IEP are trading at roughly $23.50/unit, which may help explain why Hindenburg—based on its own in-house research and bearish outlook—continues to short IEP. Hindenburg clearly believes that even after correcting by 55% (illustrated below), IEP units haven’t bottomed.

Source: Reuters

Over the coming weeks and months it should become increasingly clear whether or not the market agrees with Hindenburg’s uber bearish outlook.

Of course, the underlying performance of Icahn Enterprises’ investment portfolio will also be a big factor going forward, as well.

To learn more about how shorting works in the financial markets, readers can check out this episode of The Leap From Options to Futureson the tastylive financial network. To follow everything moving the markets, readers can also tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.