Macy’s: Rejected Takeover Provides New Opportunity for Options Sellers

Macy’s recent takeover bid for $21/share makes the stock more attractive for options-focused opportunities

- In early December, Macy’s (M) received an unsolicited takeout bid for $21/share, valuing the company at close to $6 billion, but they rejected it saying it “lacked compelling value.”

- The investor group targeting Macy’s plans to reassess the situation and potentially submit another bid with a higher price tag.

- As a result of the takeover attempt and implied support in the company’s shares, options-focused opportunities look attractive heading into the company’s Q4 earnings report in late February (exact date, TBD).

The prospect of investing in a traditional brick and mortar department store in 2023 is in many ways akin to investing in horse-drawn wagons after the invention of the automobile.

There’s certainly still a place for department stores in the U.S. economy, but their influence in the retail sales sector is vastly diminished. Twenty years ago, department stores accounted for more than 8% of the country’s total advance retail sales on an annual basis. Today, that figure has dropped to roughly 2.20%.

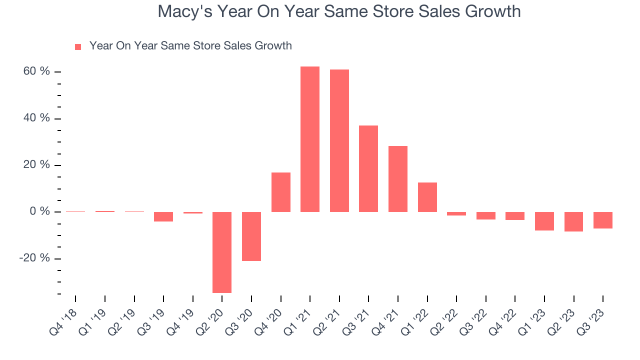

That said, much like crocodiles, Macy’s (M) has found a way to survive, and has even flourished. After a disappointing year in 2020 due to the COVID-19 pandemic, Macy’s posted impressive revenues, earnings and gross margins in 2021 and 2022. In those two years, Macy’s produced roughly $24 billion in revenues alongside $1.2-1.4 billion in profit and operating margins of nearly 40%.

Macy’s is still profitable

As highlighted above, 2023 wasn’t quite as good as the two years prior, but when the final numbers are tallied, Macy’s is still expected to post a net profit for calendar year 2023. Macy’s is scheduled to announce its Q4 and full-year 2023 earnings data at the end of February (exact date, TBD).

In addition to its competent management team, Macy’s has a couple other big things going for it. One of those is the company’s impressive real estate holdings, which have been valued at $8-$9 billion by outside analysts. That figure includes the famous Herald Square location in New York City, which has been appraised for nearly $3 billion on its own.

On top of its attractive real estate portfolio, the company received a takeout offer in early December 2023 that valued the company at nearly $6 billion, which represents about $21/share. That’s especially interesting because Macy’s stock was trading as low as $11/share last November.

In the immediate wake of the takeover bid, Macy’s shares climbed all the way above $20/share. But in interim, the stock has retraced slightly, and is currently trading around $18.50/share.

Takeout offer

On Jan. 21 of this year, Macy’s officially rejected the takeover offer, indicating the proposal “lacked compelling value.” As is often the case in these situations, many outside observers now believe the Arkhouse/Brigade investor group will likely submit a revised proposal in the near future, featuring a higher bid.

To wit, The Wall Street Journal reported that the Arkhouse/Brigade group “has indicated that it would be willing to raise its offer subject to due diligence.” There’s certainly no guarantee the group will increase its current offer, but there’s no reason to believe they will rescind it, either.

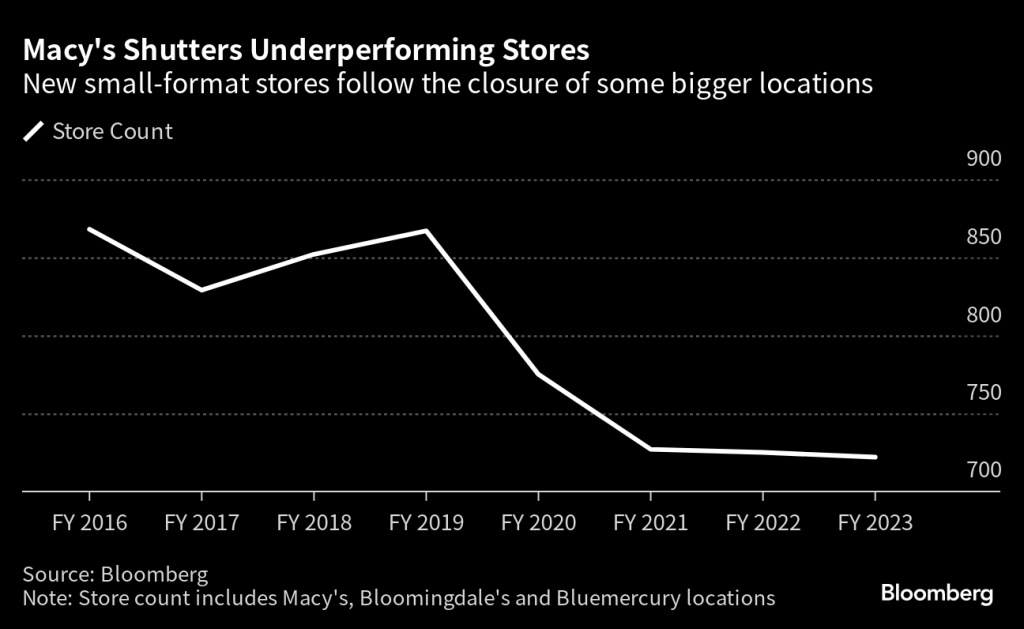

Looking at the overall enterprise, Macy’s consists of about 500 stores that operate under the flagship brand, as well as 30 Bloomingdale’s locations and some discount locations that operate under those two brands. Macy’s also operates 160 Bluemercury stores, after acquiring that brand back in 2015. In recent years, the total number of locations under the Macy’s umbrella has been shrinking.

With the bid, Arkhouse Management and Brigade Capital Management are attempting to merge their respective areas of expertise to drive more value (and earnings) from this well-known brand. Arkhouse has a long history in the real estate industry, whereas Brigade’s focus has traditionally been the consumer and retail sectors. In the past, Brigade has invested in companies such as JCPenney, Sears and Neiman Marcus.

At this time, Macy’s presents investors and traders—particularly those active in the options universe—with some compelling opportunities. In the financial world, analysts can quibble endlessly about valuations, but the reality is that the best approximation of value for an asset is the amount someone is willing to pay for it.

Right now, the aforementioned investor group is willing to pay $5.8 billion to acquire the Macy’s enterprise. As of Jan. 24, Macy’s trades in the market with a capitalization of roughly $5 billion. That divergence arguably represents an opportunity, and one that could become even more attractive if shares of Macy’s continue to fall.

Why options strategies are well-suited to takeover

What’s currently known is that an investor group is currently willing to purchase Macy’s for nearly $6 billion. From an options trading perspective, that’s extremely meaningful.

For one, that suggests that Macy’s stock not only has somewhat of a ceiling at this time, but it also arguably has a floor. On the upper end of the range, Macy’s could trade at or above $21/share if the existing takeover bid is accepted, or even higher if another takeout bid materializes.

Another potential bidder probably wouldn’t look to pay a huge premium over what Arkhouse and Brigade have already offered. If Arkhouse/Brigade raised their offer by 20%—which would be a significant amount—that would imply a price of $25.20/share.

Floor on the stock

On the other hand, the existing bid also puts a sort of floor in the stock. Assuming Macy’s Q4 earnings clock in as expected, it’s hard to see Macy’s shares cratering after earnings, especially with a potential suitor waiting in the wings. The only caveat to that outlook would be if the U.S. entered a recession, and Macy’s was forced to dramatically lower its 2024 earnings guidance.

Under that scenario, the Arkhouse/Brigade group might be viewed as less likely to try and acquire Macy’s. It could also remove the prospect of a second, higher bid.

Regardless, the most important consideration for options traders at this time is that Macy’s is far less susceptible to a sharp correction, due to the existence of the takeover bid. And that benefit should provide added support to the stock for the next several months, if not longer.

From a strategic standpoint, that means options traders might look favorably upon short options trades in Macy’s at this time. For example, an existing stockholder might decide to sell a covered call using a strike price that’s above the level of the takeover offer price. To be on the safe side, an investor or trader might opt to sell a $25-strike call, which provides a cushion in the event that Arkhouse/Brigade raised its bid, or if a second bid were to materialize.

Sell a put

On the other hand, investors and traders bullish on Macy’s shares might even elect to sell a put. This approach might also be of interest to existing shareholders, or those market participants who are considering new positions in Macy’s.

With naked short puts, the primary risk is that the underlying stock sells off. In that case, the put seller (put writer) can be assigned on the short puts, forcing the investor to buy the stock at the strike price. However, in the case of Macy’s that may not be the worst outcome. Especially for investors and traders that are bullish on Macy’s over the longer-term, or those that believe Macy’s will ultimately accept a takeover bid.

For example, the $15-strike put for the February monthly expiration cycle is currently trading for about $0.30. Imagine that a trader sold one $15-strike put for $0.30. As long as Macy’s shares remain above $14.70/share by the expiration date (Feb. 16, 2024), the trader at minimum breaks even on the position. If Macy’s stock is trading at or above $15/share at expiration, the trader gets to keep the entire credit from the put sale.

In that case, the credit would be $30.00 (1 contract x $0.30/contract x 100 contract multiplier = $30), which represents the maximum potential profit from the trade. However, if the investor or trader instead sold 100 contracts, that would represent a potential maximum profit of $3,000 (100 contracts x $0.30/contract x 100 contract multiplier = $3,000).

At the other end of the spectrum, if Macy’s stock were to drop to $14/share by the expiration date, the naked short put seller would be forced to buy 100 shares of Macy’s stock for $15/share. However, due to the $0.30 credit from the put sale, the effective purchase price would actually be $14.70/share.

Either way, one can see how this wouldn’t necessarily be the worst outcome for an investor/ trader that’s bullish on Macy’s future. Especially if that person firmly believes the stock is worth closer to $21/share. Considering that the Arkhouse/Brigade group is willing to pay $21/share for the company right now, it’s easy to see why some market participants might view Macy’s shares as attractively priced at $14-15/share.

The unexpected

The market isn’t riskless. Something unexpected could occur and push the shares below $15/share. For example, if Arkhouse/Brigade were to officially rescind their bid. That’s something that prospective options traders—in any stock or ETF—need to keep in mind.

But with an acquisition offer of $21/share in hand, the risks to selling options in Macy’s are arguably reduced as compared to a scenario in which Macy’s didn’t receive a bid at all. Investors and traders should note that covered calls are generally less risky than naked short puts because of the covered nature of the call position. With a covered call, the long stock component of the trade provides a degree of protection as compared to a naked short put.

That said, for investors and traders that are looking to purchase Macy’s shares at lower levels, and have the capital and risk tolerance to do so, naked short puts may represent an attractive proposition. Another choice would be to simply purchase additional shares of Macy’s if the stock drops in price. But that strategy isn’t riskless, either.

To learn more about trading covered calls and short puts, check out this installment of Market Measures on the tastylive network. And to follow everything moving the markets in 2024, including the options markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.