Retail Sales Are Slowing, But Not at Walmart (WMT)

Shares in Walmart (WMT) offer a compelling opportunity at this time due to the company’s revamped digital strategy and its ability to increase sales during economic downturns

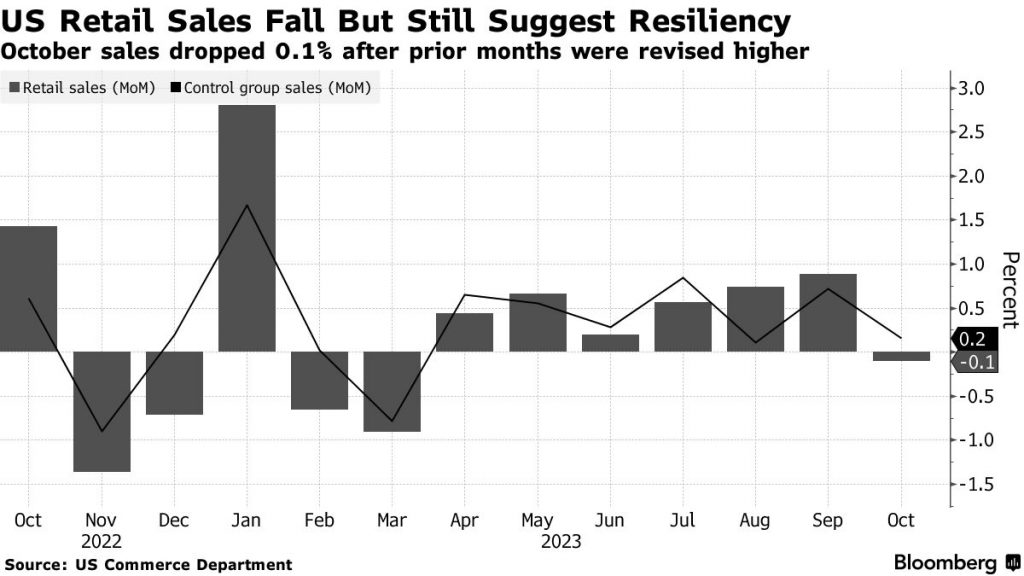

- Retail sales in the United States recently dropped for the first time in seven months.

- Despite those headwinds, Walmart (WMT) posted impressive Q3 sales growth, including a 24% increase in online sales.

- Walmart’s revamped digital strategy, alongside the company’s demonstrated ability to increase sales during economic downturns, make the stock especially attractive at this time.

Consumption-related personal spending accounts for roughly 68% of the U.S. economy, so the U.S. economy is highly dependent on the strength of the U.S. consumer.

Not long ago, U.S. Treasury Secretar Janet Yellen credited robust consumer spending as one of the primary reasons that the U.S. economy has held up better than expected in 2023.

However, recent data suggests that American consumers may finally be feeling the pinch of higher interest rates. In the month of October, retail sales moved into negative territory for the first time since March, as illustrated below.

On top of the above decline in retail spending, recent data also shows that American consumers have been forced to rely more heavily on credit to maintain current spending levels.

In Q3, consumer credit card balances in the U.S. spiked above $1 trillion for the first time in history. Overall, credit card balances are now $154 billion higher than they were a year ago, which represents the largest increase (over a 12-month period) since 1999.

Rising credit card balances may help explain why retail sales dropped last month, and why consumer spending could drop further in the coming months. According to Howard Dvorkin, chairman of Debt.com, consumers are now “maintaining and supporting their lifestyles using credit card debt.”

The next update on retail sales is scheduled to be released in mid-December, and that report will provide further details on the ongoing state of the American consumer.

In the meantime, investors and traders can also track the retail sector of the stock market for further insight into consumer spending and the health of the underlying economy.

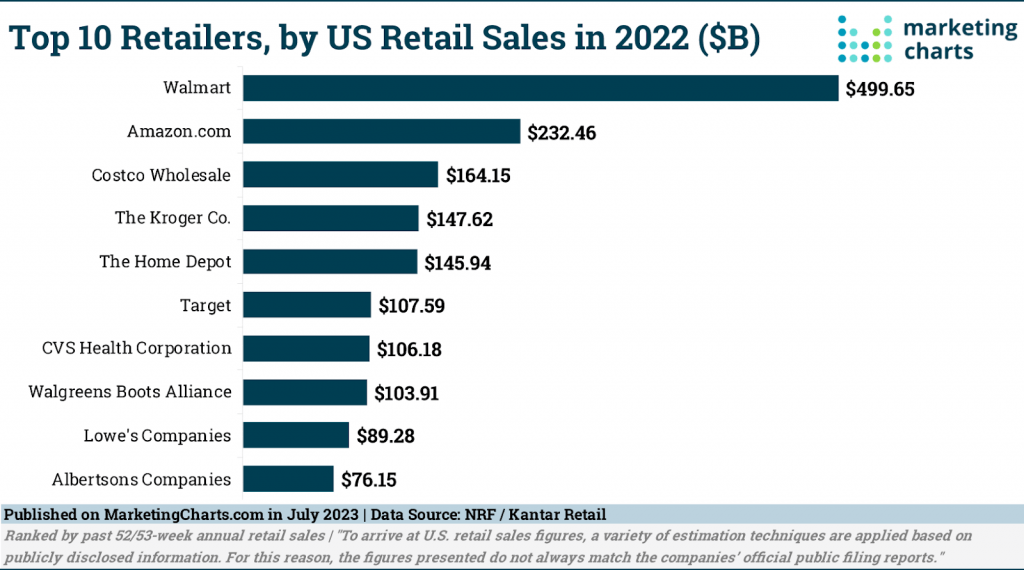

The graphic below highlights some of the largest retailers in the United States by annual sales volume.

2023 Performance in the Retail Sector

So far in 2023, the retail sector of the stock market is trading in positive territory, but it is well behind the returns observed in the broader S&P 500.

Year-to-date, the SPDR S&P Retail ETF (XRT) is up close to 7%, while the S&P 500 as a whole has returned closer to 20%.

In general, online-focused retailers have seen better performance than traditional retailers, at least in terms of stock performance. For example, the Amplify Online Retail ETF (IBUY) is up more than 24% year-to-date, which is far superior to the 7% return in XRT.

Looking at the country’s largest retailers, one can see further evidence of this trend. The list below highlights year-to-date performance in the 13 of the 15 largest retailers in the U.S. Two of the largest 15 retailers, Aldi and Publix, are not included in the list because they are not publicly traded.

- Amazon (AMZN) +71%

- Apple (AAPL) +52%

- Costco Wholesale (COST) +31%

- Walmart (WMT) +10%

- Albertsons Companies (ACI) +4%

- Ahold Delhaize (ADRNY) +1%

- Lowe’s Companies (LOW) 0%

- Kroger (KR) 0%

- The Home Depot (HD) -2%

- Target (TGT) -13%

- Best Buy (BBY) -14%

- CVS Health (CVS) -26%

- Walgreens (WBA) -46%

Amazon (AMZN) and Apple (AAPL) have been two of the stronger performers in the retail sector this year, but one can’t overlook the fact that these two stocks are crossovers from the technology sector. In 2023, tech stocks have been red-hot, with the Nasdaq 100 climbing by 47% year-to-date.

Online retailers have outperformed traditional retailers in 2023. However, Walmart (WMT) also stands out in 2023, and not just because shares of Walmart hit a fresh all-time high this year, but the company has also been working to expand its digital footprint.

Walmart is the country’s largest retailer by a mile, but its e-commerce business has consistently lagged well behind Amazon’s. However, Walmart has deployed a new approach to its online business, and the early results suggest the company may be poised to benefit from a new source of growth.

Walmart’s New E-Commerce Approach

In order to bulk up its e-commerce business, Walmart has been focusing on improvements to its digital shopping experience and working to expand its online offerings, in terms of sellers and available products.

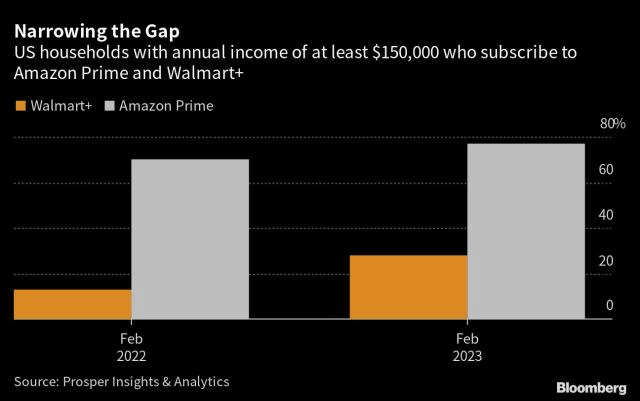

In order to achieve those goals, Walmart redesigned its website and shopping app to be more customer-centric. The company also optimized and invested in its Walmart Plus (aka Walmart+) shopping/shipping program, which is Walmart’s answer to Amazon Prime.

Using Walmart Plus, customers receive free unlimited deliveries from Walmart stores (minimum order $35) and free shipping on items from Walmart.com (no minimum required). Much like Amazon Prime, Walmart Plus also offers early access to sales promotions, video streaming through Paramount Plus, and an innovative “return from home” service.

Walmart has also moved aggressively to try and attract new sellers on the company’s third-party marketplace. The company is hoping to add “hundreds of thousands” of new independent sellers, and has offered free storage during the holiday season as one method of attracting them. The early returns suggest that these e-commerce investments have been paying off.

During the first two quarters of the year, Walmart’s online sales rose at a more rapid pace than last year. That trend is even more impressive when one considers that online sales at companies like Macy’s (M) and Target (TGT) were moving in the opposite direction over that same period.

In its most recent Q3 earnings report, Walmart revealed that the company’s online sales were up 24% as compared to the same period last year. For the online niche of the company’s business, this represented the best quarterly growth (year-over-year) since Q1 of 2021—the latter of which was during the heart of the COVID-19 pandemic when many shoppers were minimizing in-person visits.

Walmart’s fresh approach to e-commerce could also benefit from a potential downturn in the U.S. economy. Unlike most companies, Walmart has actually experienced increased sales during previous economic downturns because a larger percentage of American shoppers tend to visit discount retailers during recessions.

Amid the Great Recession, revenues at Walmart actually grew by 9% from 2007 to 2008, and 7% from 2008 to 2009. So if the U.S. economy falls into recession at some point in 2024, that could actually serve to boost sales at Walmart. And if that comes to pass, Walmart’s recent investments into its e-commerce business could prove especially valuable.

Investment Takeaways and Recommendation

Recent data suggests that American consumers are relying more heavily on debt-fueled spending, which appears to have taken a toll in October when retail sales in the U.S. declined for the first time since March.

Despite those headwinds, Walmart recently reported that its quarterly revenues grew by 5% during Q3 of 2023, rising to roughly $161 billion. Last year, Walmart posted Q3 revenues of closer to $153 billion.

For many companies, the threat of an economic downturn is generally bad for their financial projections. But in the case of Walmart, the company has actually experienced a boost in revenues during previous economic downturns.

Not surprisingly, Walmart’s stock has also outperformed the broader market during such periods. During the heart of the 2008-2009 Financial Crisis, shares in Walmart actually appreciated by 10% during calendar year 2008, in comparison to a 38% decline in the S&P 500.

In that regard, Walmart represents somewhat of a unique opportunity at this time. If the U.S. economy does enter a recession in the next three to six months, Walmart would be relatively more attractive than many other stocks because its revenues and earnings could actually rise during a recession.

On the other hand, if the U.S. economy avoids recession, and continues to grow, Walmart is also poised to benefit. Walmart has steadily improved its e-commerce footprint, and is seeing increased online sales as a result of these new investments. Going forward, that means Walmart could start pecking away at Amazon’s dominant online market share in the coming quarters.

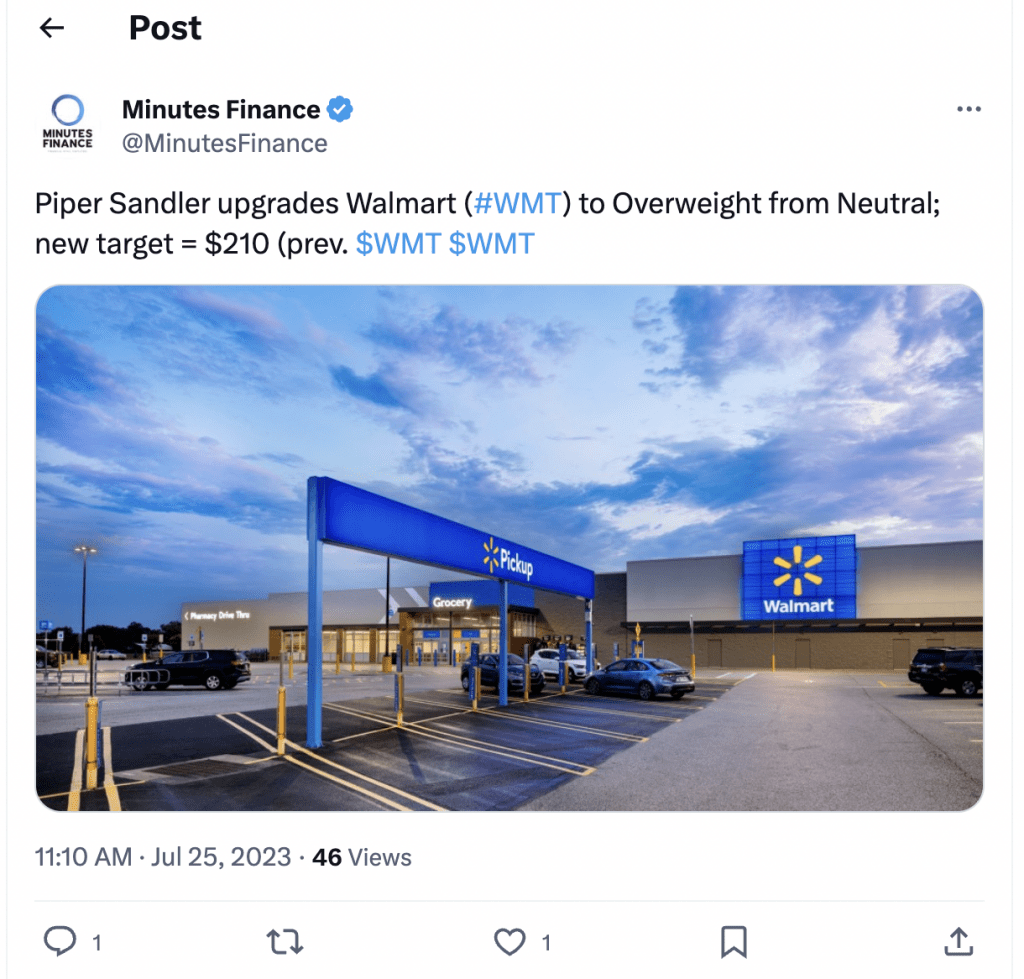

Moreover, of the 30 analysts that currently cover Walmart, 25 of them rate the stock a “buy,” while 5 rate it a “hold.” None of those 30 analysts currently rate the stock a “sell.”

The average analyst price target for shares of Walmart is currently about $180/share, which is 14% higher than where the shares trade today, at $158/share. Interestingly, the analyst price targets collectively range between $163/share and $210/share, which means that Walmart’s stock currently trades below the lowest analyst price target.

Considering all of the above, Walmart’s shares appear to be a “strong buy” at this time, which is not coincidentally the same rating this stock receives from TipRanks.

To follow everything moving the markets, including the options markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.