Indian Rupee Sinks to Record Low Against the U.S. Dollar

U.S. dollar strength has been a major market theme in 2023—a reality that was underscored recently when the Indian rupee set a fresh all-time low against the dollar

- Despite red-hot economic growth in India, the Indian rupee recently fell to a record low against the U.S. dollar.

- The Japanese yen and Chinese yuan are also trading at the lower end of their recent historical ranges against the dollar.

- The Russian ruble has also depreciated significantly against the dollar in 2023, but recently staged a small reversal.

The Indian economy has been one of the hottest in the world in 2023, but despite that reality, the Indian rupee continues to lose ground against the U.S. dollar.

During the last five years, the rupee has depreciated by nearly 20% against the dollar.

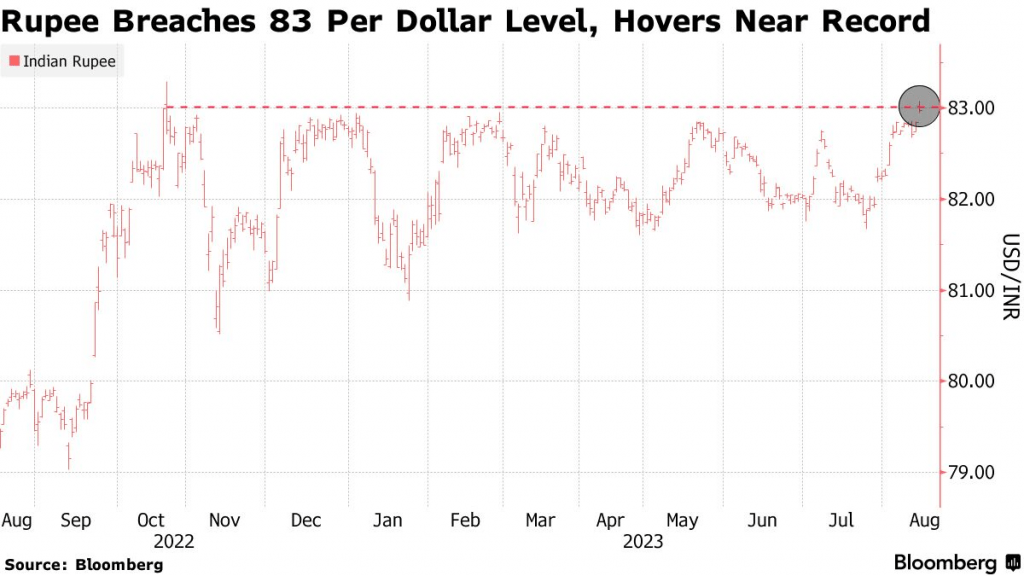

And at the start of November, the rupee dropped to a fresh all-time low against the dollar, at roughly 83.30, as illustrated below.

Five years ago, only about 70 rupees were required to purchase a single dollar, whereas today, that figure has risen above 83.

As a reminder, exchange rates are quoted using the format “ABC/DEF,” and are interpreted to mean that the first currency listed is a single unit, while the exchange rate itself represents the amount of the second currency that is required to purchase a single unit of the first currency.

For example, the USD/INR currency pair reports how many Indian rupees are required to purchase a single dollar. And today, that figure is 83.22. This is referred to as the “exchange rate” between the dollar and rupee.

Importantly, the rupee hasn’t been the only big loser against the dollar in 2023. For example, both the Japanese yen and the Chinese yuan have also steadily depreciated against the dollar in recent months.

Currently, more than 150 yen and about 7.25 yuan are required to buy a single U.S. dollar. Both of those figures represent depressed valuations for the yen and yuan relative to the dollar, much like with the rupee.

One of the biggest factors moving currency markets in 2023 has been rising U.S. interest rates, which has driven increased demand for the dollar.

In 2023, India’s economy is expected to be the fastest-growing in the G-20, which includes China. During the first three quarters of this year, India’s GDP grew by roughly 6.1%. In comparison, China’s economy has grown at a rate of 4.5% over the first three quarters of the year.

However, strength in the Indian economy hasn’t spilled over into its currency markets, likely because the U.S. central bank has been more hawkish on interest rates as compared to the Reserve Bank of India.

On the other hand, India’s emerging economic strength has benefited the country in many other ways. The Indian stock market, for example, is now trading near all-time highs. Moreover, India attracted around $85 billion in fresh foreign direct investment (FDI) last year, which represented a new all-time record.

Cross border trade has also picked up between India and the United States, as ties between the two countries have strengthened in the wake of the pandemic. India’s top two trading partners are now the United States and China, in that order.

India has undoubtedly been a direct beneficiary of the U.S. trade war with China, as some international companies have expanded their manufacturing footprints in India to circumvent the stiff tariffs that the U.S. has levied against Chinese exports.

Additional Updates From the FX Universe

In addition to the rupee, two of Asia’s other major currencies—the Chinese yuan and the Japanese yen—are also trading near multiyear lows against the dollar. Together, China, India and Japan constitute the three largest economies in Asia.

Currently, over 150 yen and about 7.25 yuan are required to buy a single U.S. dollar. The yen hasn’t been this weak against the dollar since the early 1990s. And for its part, the yuan hasn’t sunk to such lows against the dollar since early 2007.

The fact that the dollar is dominating all three currencies shows that the current foreign exchange (FX) trends are more about strength in the dollar, as opposed to specific weaknesses in the currencies of those three countries.

Looking at some of the world’s other major economies, the U.S. dollar has also exhibited strength against currencies like the Canadian dollar, euro, British pound and Russian ruble. In all four cases, the dollar is trading at a favorable level as compared to their respective historical ranges.

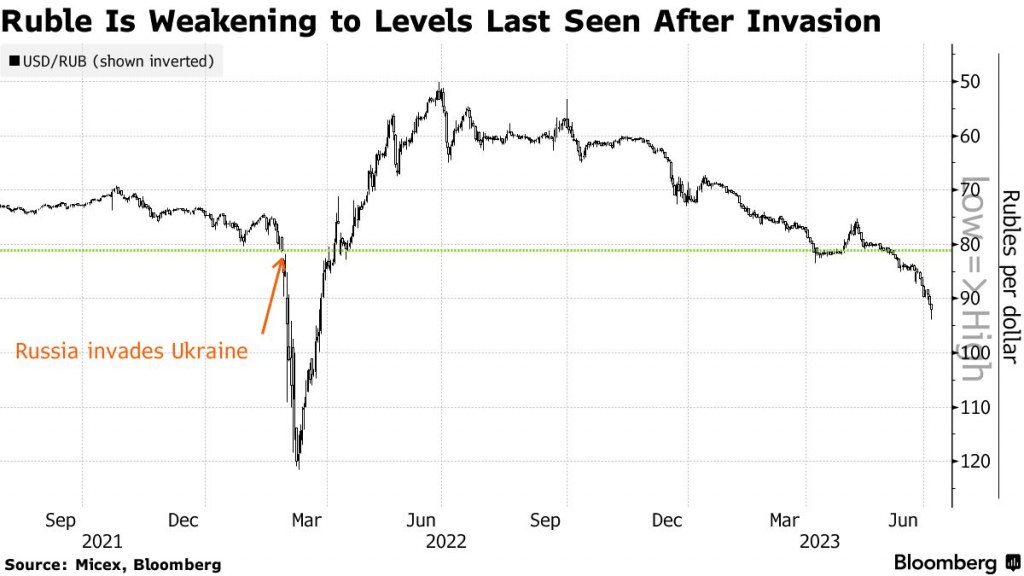

However, in the case of the first three currencies, the dollar has been trading in a fairly stable range against each of them over the last month. At the other end of the spectrum is the Russian ruble, which has swung like a pendulum against the greenback since the country expanded its war against Ukraine in early 2022.

Since the start of 2022, the USD/RUB exchange rate has ranged between roughly 57 and 134. And the transition between those levels has often felt like a rollercoaster. At the outset of the war in 2022, the ruble depreciated sharply in value against the dollar, crashing to roughly 134.

Then, the ruble executed a huge reversal, and clawed back to the levels observed before the conflict began. However, in 2023, the wheels have once again fallen off the ruble, with the USD/RUB exchange rate trending back toward 100 during the first 10 months of the year.

During the last two weeks, the ruble has staged a small rally, with the USD/RUB exchange rate currently hovering around 90.

That rally appears attributable to an emergency action adopted by the Russian government in mid-October. At that time, the country’s longtime President—Vladimir Putin—decreed that all Russian companies holding foreign currencies were to immediately convert those reserves into rubles.

Ruble rebounds

This process essentially served to synthetically boost demand for the ruble, which has rebounded in value over the last two weeks.

The currency may also have received a boost from a recent report that Russian oil has been selling at levels well above the $60-per-barrel price cap imposed by the G7. According to The Moscow Times, Russian oil has been selling about $20 above the price cap, of late.

However, that relief may be short-lived, because oil prices have been slumping, and are now down roughly 20% since the end of September. And on November 16, oil prices dropped by another 4% in a single trading session.

Aside from trading individual currency pairs, investors and traders active in the FX markets can also track and trade performance in the dollar using the U.S. Dollar Index (DX-Y.NYB). The “DXY” is one of the most-followed gauges of the dollar’s ongoing value, in basket terms.

The DXY measures the value of the U.S. dollar relative to the currencies of some of its closest trading partners, including the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc.

To learn more about trading foreign currencies, readers can utilize the extensive library of resources available at ig.com/us. To follow everything moving the markets, including the FX markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.