Inflation Has Cooled, But Interest Rates Markets are Projecting Another Rate Hike

The June 2023 inflation report indicated that price inflation continues to cool, however, the Fed is expected to raise benchmark interest rates another quarter percentage point

The U.S. government released a key inflation report on July 12 and the headline numbers were mildly encouraging.

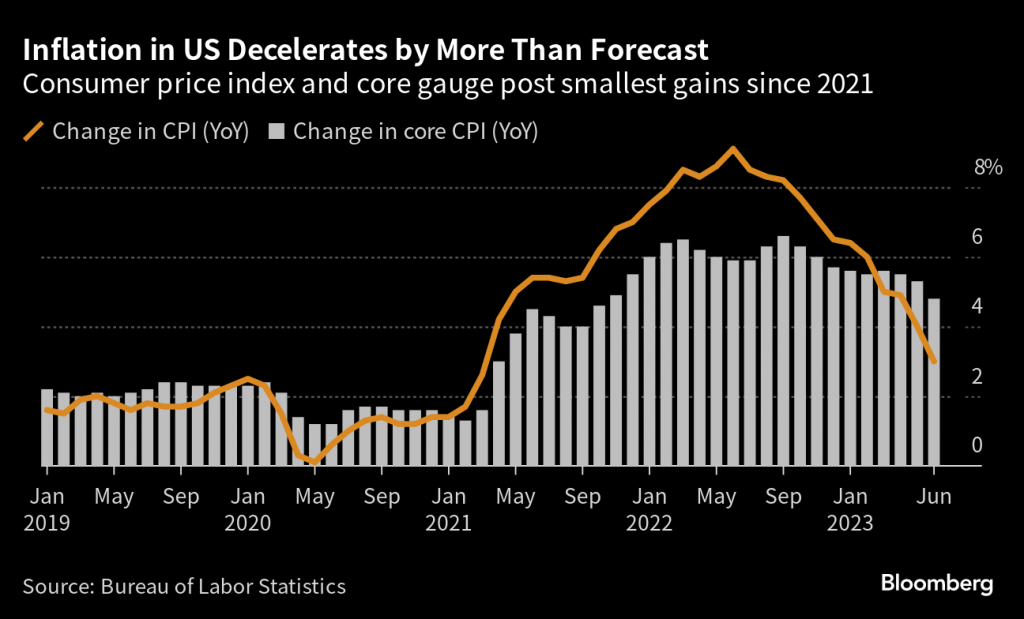

The Labor Department announced that consumer prices rose 0.2% from May to June, and that the June 2023 figures were about 3% higher than those observed 12 months ago.

While that’s not necessarily ideal, 3% is much closer to the Fed’s inflation target of 2%—especially compared with the inflation figures from last year. In summer of 2022, inflation was running as high as 9%.

Inflation is cooling, but unfortunately, the headline figures don’t tell the full story.

For starters, core inflation—which excludes the prices of food and energy—was 4.8% in June of 2023, which is considerably higher than the headline number of 3%.

As a result, it’s widely expected that leaders at the Federal Reserve will raise benchmark interest rates by another quarter percentage point at their upcoming meetings on July 25-26.

At present, the challenge is that prices in some corners of the U.S. economy are cooling, while others remain stubbornly high.

On a positive side, energy prices have declined substantially since last summer. According to AAA, the national average price for a gallon of regular gas is about $3.50, which is down roughly 25% from last year.

Along those lines, the price of natural gas—which is often used to heat residences and businesses—has dropped precipitously since the record highs observed in 2022. Today, natural gas is trading for roughly $2.65/MMBtu, which represents a decline of about 70% from the heights observed in August 2022.

Declines like these help explain why the inflation figures have fallen so dramatically in recent months.

However, there are pockets of the economy where prices remain persistently high, and that’s why the Fed is expected to raise rates in or beyond July.

Unfortunately, the U.S. Labor Department’s figures revealed that housing rents in June were 8.3% higher than a year ago, and 0.5% higher than the month prior. That’s still far too high for the Fed, not to mention for the consumers that are paying those sky-high prices.

For example, the Wall Street Journal interviewed Ali Salim, a resident of Seattle who reported that his landlord had increased his rent by 24% in 2022, and another 10% in 2023.

Examples like these help illustrate how housing costs are currently eating up a much larger percentage of people’s budget than they did leading up to the pandemic.

Jonathan Miller, the president of Miller Samuel—a real estate appraisal and consulting firm—estimates that, “rents remain 20% to 25% above pre-pandemic levels in many markets, so it would take a price correction to meaningfully reduce the pressure.”

The good news is that price inflation has slowed, but the prices for many goods and services in the economy remain high. And this current bout of inflation can’t truly be resolved until prices start reversing course, as observed in the energy market.

Investors and traders appear to agree with that line of thinking, because recent activity in the interest rate futures market indicates the vast majority of market participants are betting on another rate increase at the Fed’s July 25-26 meetings.

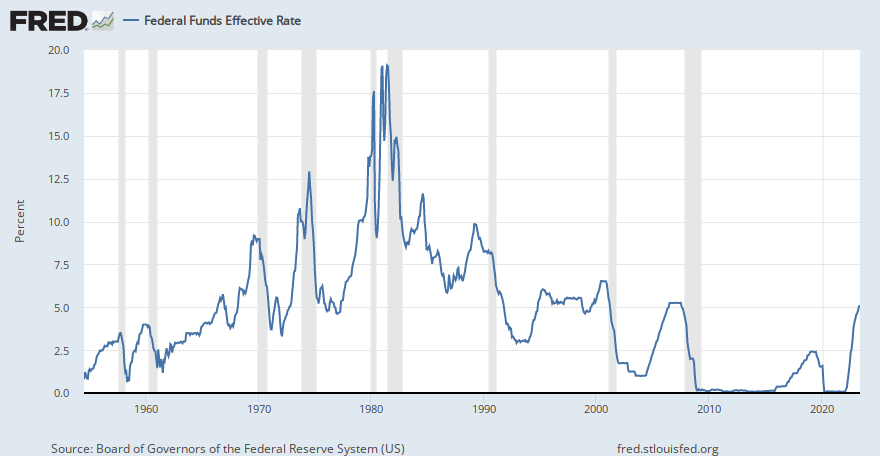

Currently, the rates market is implying a 97% chance that the Fed will raise the federal funds by another quarter percent on July 26, from the current target range of 5%-5.25% to a new target range of 5.25%-5.50%.

That said, the number of traders expecting two rate hikes before the end of November did decline slightly after the June inflation report. Before the June inflation report was released, the market implied there was a 36% the Fed would hike rates two more times before the end of November, but now that figure has dropped to 27%.

Those figures suggest the Fed could pause again after the July meeting and “wait and see” how things develop before possibly hiking rates again at the end of 2023, or in early 2024.

That outlook is drastically different from what was observed earlier in the year, when interest rates markets suggested there was a strong likelihood the Fed would cut rates at some point in 2023. Today, the likelihood of a rate cut in 2023 looks fairly miniscule.

Along those lines, Vanguard—a registered investment advisor with more than $7 trillion in assets under management—recently indicated that its own internal economic modeling projected the first rate cut would arrive at some point in H1 2024 at the earliest.

The Vanguard outlook appears to closely match the expectations of the market. According to Charlie Bilello, chief market strategist at Creative Planning, the interest rates market is currently projecting the first rate cut will occur in May of 2024.

To learn more about trading interest rates, check out this installment of Today’s Assignment on the tastylive financial network. To follow everything moving the markets this summer, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.