Robusta Coffee Beans Are Trading At Multi-Decade Highs

Reduced supplies of coffee have contributed to higher prices, with the price of Robusta coffee beans recently climbing to multi-decade highs

- Poor growing conditions have resulted in weaker than expected coffee harvests in recent years.

- Reduced supplies of coffee have contributed to higher prices, with the price of Robusta coffee beans recently climbing to multi-decade highs.

- Improving fundamentals have made coffee-focused futures and stocks increasingly attractive, such as Farmer Brothers Coffee (FARM), which recently reported better than expected quarterly earnings.

Coffee prices continue to be one of the hottest commodities in the world. With prices remaining stubbornly high, coffee will undoubtedly play a continuing role in the ongoing inflation narrative, alongside the rising price of eggs and other consumer goods.

Last year, coffee producers were able to increase their total production versus the year prior. During the 2022/2203 growing season, total coffee production crested to 171 million 60 kilogram bags. That was about 2% higher than the 168 million bags produced during the 2021/2022 growing season.

However, both of these figures are lower than what was produced during the 2020/2021 growing season, when the total harvest was closer to 175 million bags.

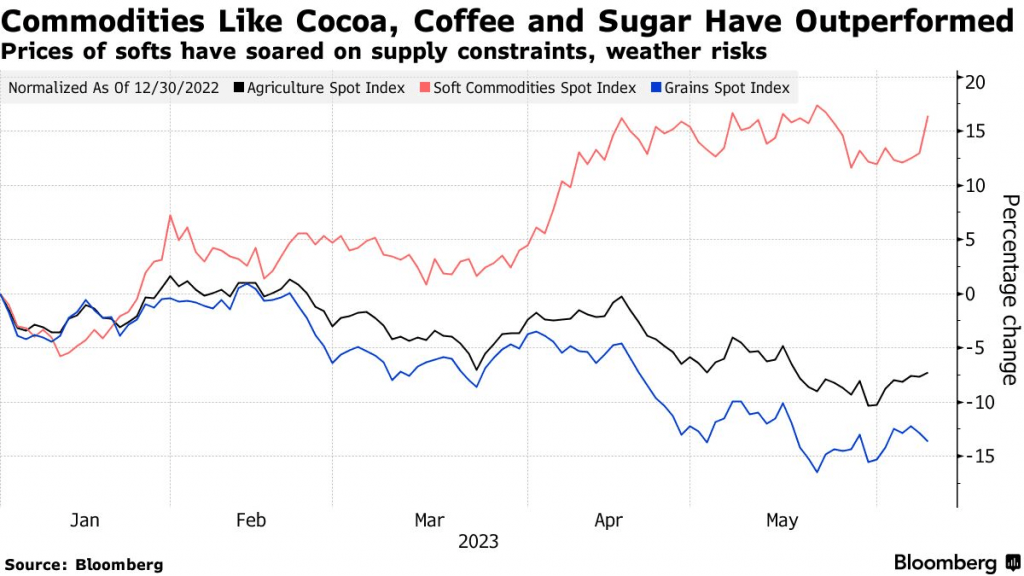

The slowdown in coffee production during the last couple of years—largely due to poor growing conditions—has contributed to higher prices.

In 2022, the price of Arabica coffee—considered the premium bean in the coffee world—surged to a five-year high of roughly $6.20/kilogram. That rise in prices was primarily attributable to a poor coffee harvest.

However, this development also served to shift the dynamic within the broader coffee industry.

In response to skyrocketing prices of Arabica coffee beans, many coffee makers started buying a larger percentage of Robusta coffee beans, which are traditionally a lot cheaper than Arabica beans. Arabica tends to be preferred by most coffee drinkers, but the cost of Arabica beans is considerably higher than that of Robusta beans—sometimes as much as double the price.

As a result of this market dynamic, Arabica beans have actually been falling in price, while Robusta beans have been rising.

Since peaking above $6/kilogram in 2022, Arabica beans have retraced back to about $4.50/kilogram, where they trade today.

In contrast, the price of Robusta coffee has been rising. At the end of last year, Robusta prices surged toward $3/kilogram, and have since crested to a 29-year high at roughly $3.25/kilogram. That’s 100% higher than where Robusta beans were trading three years ago.

In the case of Robusta, both rising demand and limited supply have boosted the fortunes of Robusta beans. Contrary to its namesake, Robusta beans are far less plentiful than Arabica beans. That means increased demand for a commodity that’s in relatively short supply has pushed prices steadily higher. And in the process eaten into the premium that Arabica traditionally enjoys vis-a-vis Robusta.

In the most recent 2022/2023 growing season roughly 57% of total global coffee production was Arabica beans, while 43% was Robusta. That equates to about 98 million bags of Arabica and about 73 million bags of Robusta.

Unfortunately, the primary growing regions for Robusta, which include Indonesia and Vietnam in southeast Asia, have experienced subpar growing conditions of late, and that’s expected to continue in 2024.

Growing conditions for Arabica beans haven’t been great, either. Brazil and Colombia are the world’s top two producers of Arabica coffee, and both of those countries have faced rolling droughts during the last couple of years, which has impaired overall coffee production.

All together, four countries—Brazil, Colombia, Indonesia and Vietnam—account for more than 70% of the world’s annual coffee bean production. But Brazil is by far the largest, generating about 40% of the world’s annual coffee production, while Vietnam is second with 20% of the world’s total production.

While Brazil and Colombia have been battling droughts, Vietnam and Indonesia—the primary Robusta producers—have been battling torrential rainfall associated with the El Niño weather phenomenon. The inability of Robusta producers to significantly increase supplies is one key reason why Robusta beans have continued to rise in price.

All told, these trends suggest that coffee prices will remain firm for the foreseeable future. And that Robusta beans in particular could continue to increase in value during 2024.

Moreover, any additional weather-related shocks/disasters in South America or southeast Asia could unleash a fresh wave of bullish sentiment in the global coffee market.

Coffee-focused futures and stocks looking more attractive

When it comes to playing further upside in the coffee markets, many investors and traders may elect to deploy a bullish coffee futures position, or a long call futures option.

However, market participants bullish in the coffee space may also elect to purchase shares of a coffee-focused stock, such as Farmer Brothers Coffee (FARM). Shares in FARM are already up 24% year-to-date, and appear poised to rally further on the heels of several positive developments. One big positive for Farmer Brothers Coffee was its most recent quarterly earnings report.

Last quarter, Farmer Brothers was expected to lose $0.73 per share, but instead posted a surprise profit of $0.13 per share. What’s even more impressive about that number is that Farmer Brothers produced that profit on revenues that were only slightly higher than the same quarter last year.

In the most recent quarter, Farm Brothers produced revenues of $89.5 million, which was $600,000 more than the same quarter last year.

In addition to the top-line beat on earnings, Farmer Brothers reported that EBITDA for the most recent quarter was positive $2.30 million as compared to a negative EBITDA figure of $2.20 million last year. This boost appears to stem from the fact that the company was able to reign in spending, trimming its operating expenses drop by about $2.6 million.

All told, these operating efficiencies resulted in significantly higher gross margins, as well—40% as compared to 35% in the same quarter last year. Management at Farmer Brothers has been on a mission to run a more efficient and leaner enterprise, and the most recent quarterly results illustrate that they have found success on this path.

As part of this initiative, the company has streamlined its procurement, production and sales operations, eliminated redundancies in its operations, and focused more on its highest profitability items and key customer relationships.

On top of the recent earnings surprise, Farmer Brothers Coffee also appears to be benefiting from optimism that the company could be the focus of a potential acquisition attempt at some point in the future.

While speculative at this point, several of the larger shareholder groups at Farmer Brothers banded together recently and some analysts believe that activist group may ultimately push management at Farmer Brothers to consider strategic alternatives, including a potential sale of the company.

The aforementioned activist shareholder group is comprised of 22NW LP and JCP Investments, which together own about 15% of the company’s outstanding stock. Previously, 22NW and JCP had pushed for Farmer Brothers to accept one of their candidates for the board of directors.

That effort was ultimately a success, as prominent hedge fund manager Bradley Raadoff was appointed an independent board member at Farmer Brothers back in 2022.

Taken all together, it appears that Farmer Brothers is well positioned to continue to outperform in 2024. The company is operating at a high level of efficiency, has improved its earnings potential, and has seen upward momentum in its underlying shares.

Moreover, the fundamentals in the broader coffee industry appear strong, which could ultimately make Farmer Brothers an attractive buyout candidate for a larger player seeking to expand their footprint in the sector.

Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.